Tesco 2005 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2005 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56 Tesco PLC

Notes to the financial statements continued

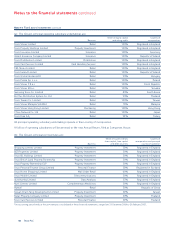

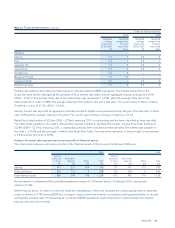

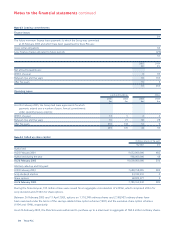

Note 26 Share options continued

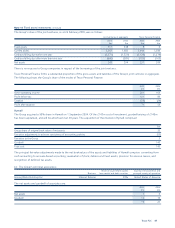

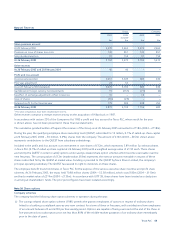

(ii) The Irish savings-related share option scheme (2000) permits the grant to Tesco Ireland employees of options in respect of

ordinary shares linked to a building society/bank save-as-you-earn contract for a term of three or five years with contributions

from employees of an amount between €12 and €320 per four-weekly period. Options are capable of being exercised at the

end of the three or five-year period at a subscription price not less than 75% of the middle-market quotation of an ordinary

share immediately prior to the date of grant.

(iii) The executive share option scheme (1984) permitted the grant of options in respect of ordinary shares to selected executives.

The scheme expired after ten years on 9 November 1994 and during the year all outstanding options under the scheme

were exercised.

(iv) The executive share option scheme (1994) permitted the grant of options in respect of ordinary shares to selected executives.

The scheme expired after ten years on 17 October 2004. Options were generally exercisable between three and ten years from

the date of grant, at a subscription price not less than the average of the middle-market quotations of an ordinary share for

the three dealing days immediately preceding the date of grant. The exercise of options will normally be conditional upon the

achievement of a specified performance target related to the annual percentage growth in earnings per share over a three-

year period. There were no discounted options granted under this scheme.

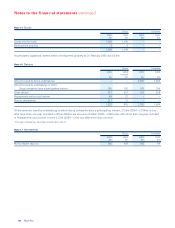

(v) The unapproved executive share option scheme (1996) was adopted on 7 June 1996. This scheme was introduced following

legislative changes which limited the number of options which could be granted under the previous scheme. As with the

previous scheme, the exercise of options will normally be conditional upon the achievement of a specified performance target

related to the annual percentage growth in earnings per share over any three-year period. There will be no discounted options

granted under this scheme.

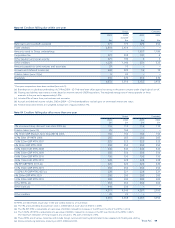

(vi) The international executive share option scheme (1994) permitted the grant of options in respect of ordinary shares to

selected non-UK executives on substantially the same basis as their UK counterparts. The scheme expired after ten years on

20 May 2004. Options were normally exercisable between three and ten years from their grant at a price of not less than the

average of the middle-market quotations for the ordinary shares for the three dealing days immediately preceding their grant.

The exercise of options will normally be conditional on the achievement of a specified performance target related to the

annual percentage growth in earnings per share over a three-year period. There were no discounted options granted

under this scheme.

(vii) The performance share plan (2004) was adopted on 4 July 2004. This scheme permits the grant of options in respect of

ordinary shares to selected executives. Options are normally exercisable between four and ten years from the date of grant for

nil consideration. The exercise of opions will normally be conditional on the achievement of specified performance targets

determined by the Remuneration Committee when the options are granted.

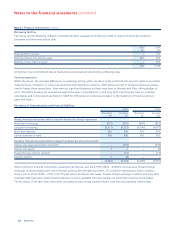

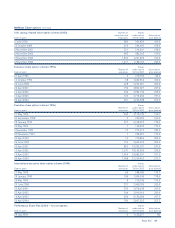

Tesco PLC has taken advantage of the exemptions applicable to Inland Revenue-approved SAYE share option schemes and

equivalent overseas schemes under Urgent Issues Task Force Abstract 17 (revised 2003), ‘Employee Share Schemes’. In schemes

where options are granted at nil discount, there is no charge to the profit and loss account.

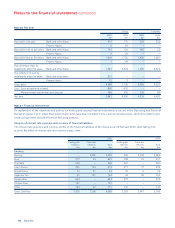

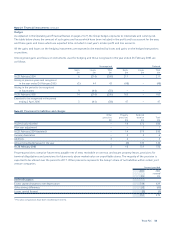

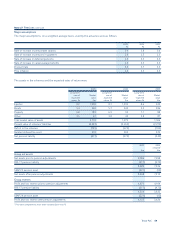

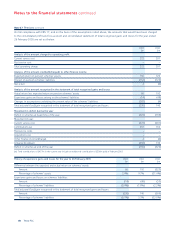

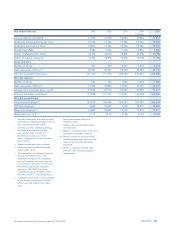

The company has granted outstanding options in connection with the six open schemes as follows:

Savings-related share option scheme (1981) Number of Shares

executives and under option Subscription

Date of grant employees 26 Feb 2005 price (pence)

28 October 1999 1,489 1,912,412 151.0

26 October 2000 15,547 17,350,526 198.0

8 November 2001 20,591 21,123,441 198.0

8 November 2002 52,215 51,464,183 159.0

6 November 2003 58,332 46,066,547 195.0

4 November 2004 68,985 48,105,391 232.0