Tesco 2005 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2005 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

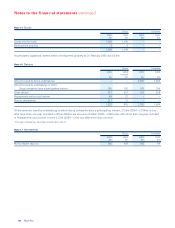

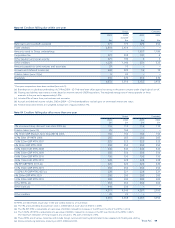

Notes to the financial statements continued

Note 21 Financial instruments continued

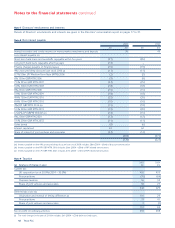

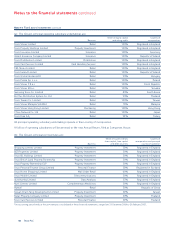

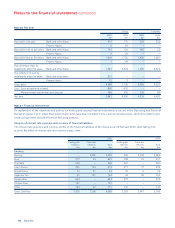

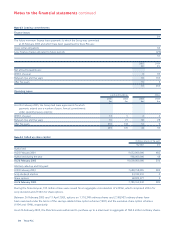

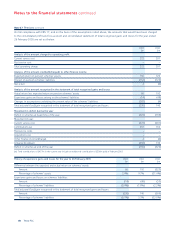

Borrowing facilities

The Group has the following undrawn committed facilities available at 26 February 2005 in respect of which all conditions

precedent had been met at that date:

2005 2004

£m £m

Expiring within one year – 133

Expiring between one and two years 561 920

Expiring in more than two years – 305

561 1,358

All facilities incur commitment fees at market rates and would provide funding at floating rates.

Currency exposures

Within the Group, the principal differences on exchange arising, which are taken to the profit and loss account, relate to purchases

made by Group companies in currencies other than their reporting currencies. After taking account of forward currency purchases

used to hedge these transactions, there were no significant balances on these exposures at the year end. Also, rolling hedges of

up to 18 months duration are maintained against the value of investments in, and long-term intercompany loans to, overseas

subsidiaries and, to the extent permitted in SSAP 20, differences on exchange are taken to the statement of total recognised

gains and losses.

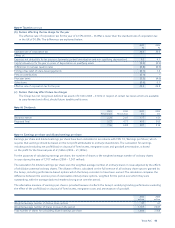

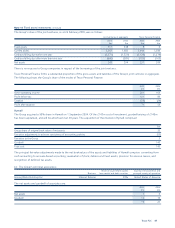

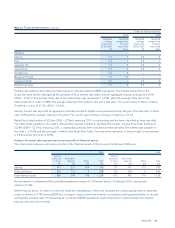

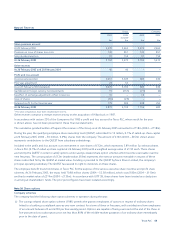

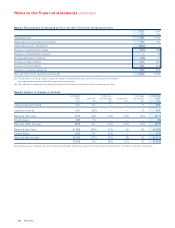

Fair values of financial assets and financial liabilities

2005 2004

Book value Fair value Book value Fair value

£m £m £m £m

Primary financial instruments held or issued to finance the Group’s operations:

Short-term borrowings (477) (475) (844) (852)

Long-term borrowings (4,511) (4,721) (4,346) (4,407)

Short-term deposits 346 346 430 430

Cash at bank and in hand 800 800 670 670

Derivative financial instruments held to manage the interest rate and currency profile:

Interest rate swaps and similar instruments – (181) – (192)

Interest rate options 4 2 – (3)

Forward foreign currency contracts – (15) – (13)

Currency options 2 (6) – –

(3,836) (4,250) (4,090) (4,367)

Other significant financial instruments outstanding at the year end are £479m (2004 – £240m) nominal value forward foreign

exchange contracts hedging the cost of foreign currency denominated purchases. On a mark-to-market basis, these contracts

show a loss of £15m (2004 – £13m loss). The fair values of interest rate swaps, forward foreign exchange contracts and long-term

fixed rate debt have been determined by reference to prices available from the markets on which the instruments are traded.

The fair values of all other items have been calculated by discounting expected future cash flows at prevailing interest rates.

52 Tesco PLC