Tesco 2005 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2005 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

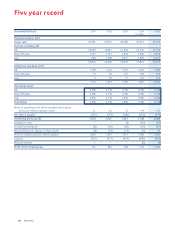

Tesco PLC 59

Note 27 Pensions continued

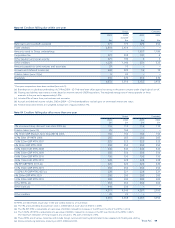

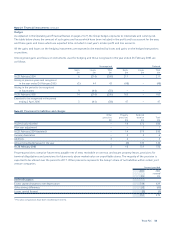

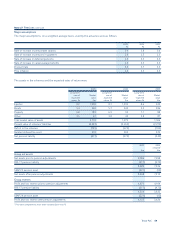

Major assumptions

The major assumptions, on a weighted average basis, used by the actuaries were as follows:

2005 2004 2003

%%%

Rate of increase in pensionable salaries 3.9 3.8 3.6

Rate of increase in pensions in payment 2.6 2.5 2.3

Rate of increase in deferred pensions 2.6 2.5 2.3

Rate of increase in career average benefits 2.6 2.5 2.3

Discount rate 5.4 5.7 5.5

Price inflation 2.6 2.5 2.3

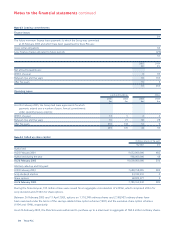

The assets in the schemes and the expected rates of return were:

2005 2004 2003

Long-term Long-term Long-term

rate of Market rate of Market rate of Market

expected value expected value expected value

return % £m return % £m return % £m

Equities 8.2 1,908 8.1 1,399 8.6 945

Bonds 5.4 560 5.7 445 5.5 386

Property 6.8 183 6.9 92 7.1 88

Other 3.5 67 3.8 43 3.8 87

Total market value of assets 2,718 1,979 1,506

Present value of schemes’ liabilities (3,453) (2,653) (2,275)

Deficit in the schemes (735) (674) (769)

Related deferred tax asset 218 202 229

Net pension liability (517) (472) (540)

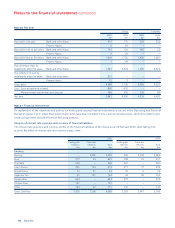

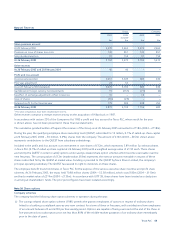

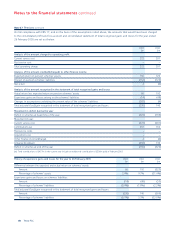

2005 2004

restated†

£m £m

Group net assets

Net assets prior to pension adjustments 9,006 7,998

FRS 17 pension liability (517) (472)

8,489 7,526

SSAP 24 pension asset (221) (12)

Net assets after pension adjustments 8,268 7,514

Group reserves

Profit and loss reserve prior to pension adjustments 4,873 4,104

FRS 17 pension liability (517) (472)

4,356 3,632

SSAP 24 pension asset (221) (12)

Profit and loss reserve after pension adjustments 4,135 3,620

†Prior year comparatives have been restated (see note 1).