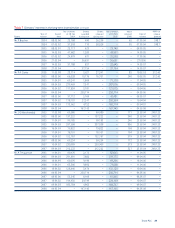

Tesco 2005 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2005 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Tesco PLC 19

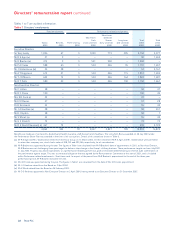

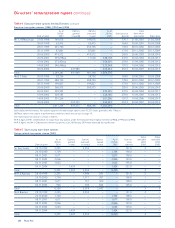

Performance Share Plan

The Performance Share Plan (PSP) provides the opportunity

to earn greater rewards for superior long-term performance.

By assuring a focus on long-term business success and helping

the Executive Directors to build up a shareholding in Tesco,

the plan further aligns the interests of shareholders and

Executive Directors.

Awards can be made up to 150% of salary. No award in

the year exceeded 75% of salary. Awards will be made

‘over’ shares and will vest, according to the achievement of the

ROCE targets. Awards will vest on a straight-line basis: 25% of

the award will vest for baseline performance with the maximum

award vesting for maximum performance. The vested shares

must then be retained for a further 12 months. The Board set

out objectives for profitable deployment of capital in a Placing

Announcement of 13 January 2004. The 2004/05 award will

vest based on the achievement of 11.5% (derived from profit

before interest less tax) at the end of the three year

performance period. This reflects the five-year objective of

raising post tax ROCE by up to 200 basis points from the base

point of 10.2% achieved in the financial year ended February

2003.

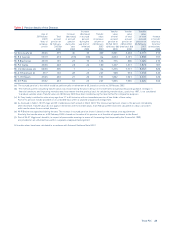

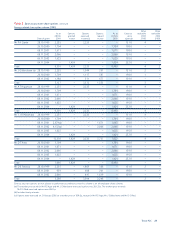

Share options

Share options with a value of up to 200% of salary are granted

to the Executive Directors under the same conditions as for

senior managers. The first 100% is subject to the achievement

of EPS growth of at least RPI plus 9% over three years, with

the balance vesting for achieving RPI plus 15% over three

years. It is practice that the value of options granted to

Executive Directors each year does not exceed 200% of salary

other than in exceptional circumstances. There is no re-testing

of performance.

Share options are an important part of the incentive

framework for hundreds of senior managers within the Group.

The Committee has considered fully the current accounting

changes and concluded that share option plans remain in

the best interests of shareholders.

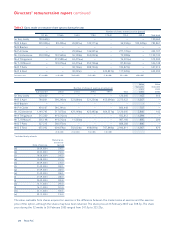

Share ownership guidelines

Executive Directors are normally expected to build and

maintain a shareholding with a value at least equal to their

base salary. New appointees will typically be allowed around

three years to establish this shareholding. Full participation

in the Performance Share Plan is conditional upon this.

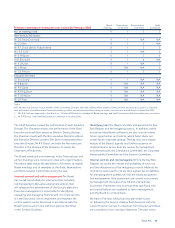

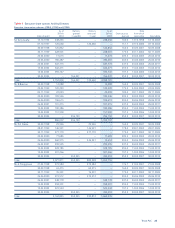

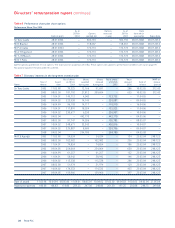

Summary of remuneration elements

All awards made to Executive Directors under the Annual

Bonus, Performance Share Plan and all options granted

under the Executive Share Option Scheme are subject to the

satisfaction of performance conditions, which are explained

above. If performance is unsatisfactory the cash bonus and

long-term incentives will reduce accordingly. The Committee

regularly reviews these performance conditions and considers

that the proposed mix of performance conditions best

supports the Group’s business strategy and provides a set of

comprehensive and robust measures of management’s effort

and success in creating shareholder value. A summary of the

elements of the package is set out in the table below.

Part of remuneration Performance measure Purpose

Base salary Individual contribution to the business success To attract and retain talented people

Annual cash bonus Earnings per share and specified Motivates year on year earnings growth

corporate objectives and delivery of business priorities

Annual deferred share element Total shareholder return, Earnings per share Generates focus on medium-term targets

and specified corporate objectives and by incentivising share price and dividend

growth ensures alignment with shareholder interests

Performance Share Plan Return on capital employed over a three Assures a focus on long-term business success

year period

Share options Earnings per share relative to retail price index Incentivises earnings growth and Executive

with more stretching performance targets for Director shareholding

the balance of awards over 100% of salary