Tesco 2005 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2005 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Tesco PLC 17

Directors’ remuneration report For the year ended 26 February 2005

Remuneration Committee

The Remuneration Committee (the ‘Committee’) is governed

by formal Terms of Reference, which were reviewed and

updated by the Board this year.

Composition of the Committee

The Committee is now composed entirely of independent

Non-executive Directors. The members of the Committee are

Mr C L Allen (Chairman of the Committee), Mr E M Davies

(appointed to the Committee in October 2004), Dr H Einsmann,

and Mr R F Chase. During the year Mr G F Pimlott resigned

from the Committee, prior to retiring from the Board. No

member of the Remuneration Committee has any personal

financial interest in the matters being decided, other than as

a shareholder, and no day-to-day involvement in running the

business of Tesco.

Ms L Neville-Rolfe is Secretary to the Committee and attends

meetings. Mr D E Reid, Non-executive Chairman, and Sir Terry

Leahy, Chief Executive of the Group, both attend the meetings

at the invitation of the Committee except when their own

remuneration is being discussed. The Committee is supported

by Mrs C M Chapman, Personnel Director of Tesco Stores Ltd

and has continued to use the services of Deloitte & Touche LLP

as an external, independent advisor. Deloitte & Touche LLP

also provided advisory services in respect of corporate tax

planning, share schemes, pensions and international taxation

to the Group during the year. Members’ attendance at

committee meetings is listed in the Directors’ Corporate

Governance report on page 13.

The role of the Committee

The Remuneration Committee’s key objectives are to:

• determine and recommend to the Board the remuneration

policy for the Chairman and Executive Directors;

• monitor the level and structure of remuneration for senior

management, and

• ensure the level and structure of remuneration is designed

to attract, retain, and motivate the Executive Directors

needed to run the company.

Activities of the Committee:

The Committee normally meets four times a year and circulates

minutes of its meetings to the Board. The rolling schedule

for the Committee includes: a review of overall remuneration

arrangements; an overview of best practice; Executive and

Non-executive Directors’ salary benchmarking; consideration

of the relationship of reward between Executive Directors and

senior managers; determining the level of awards and grants

to be made under the Company’s incentive plans; agreeing

targets for next year; considering feedback from shareholders,

and an annual review of its own effectiveness. In addition to

the routine business this year, the Committee also started a

review of pension provisions and share options in the light

of recent legislative developments and accounting changes.

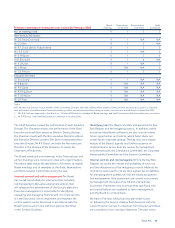

Executive Directors’ remuneration policy We have a

long-standing policy of rewarding achievement, talent and

experience. We also seek to provide incentives for delivering

high growth and high returns for shareholders. The Committee

believes that a significant proportion of total remuneration

should be performance-related and at risk of forfeiture. In

addition, performance-related reward should be delivered

largely in shares to closely align the interests of shareholders

and all Executive Directors. In determining the balance

between the fixed and variable elements of the Executive

Directors’ remuneration packages, the Committee has

regard to policy and also market practice. Our policy is for

performance related elements to form a major part of the total

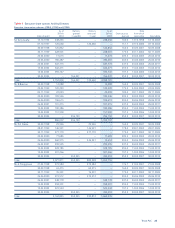

remuneration opportunity for all Executive Directors. The table

below shows the current balance of fixed and performance

related elements, for levels of performance, on target and

above target.

Fixed elementFixed element

(approximately 20%-40%)(approximately 20%-40%)

Performance related elementsPerformance related elements

(approximately 60%-80%)(approximately 60%-80%)

Base salary

Deferred

share bonus

Performance

share plan

Cash bonus Share options

Short-term performance Long-term performance