Tesco 2005 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2005 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Tesco PLC 47

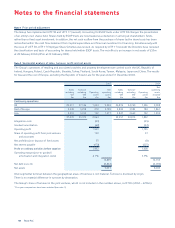

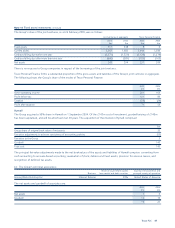

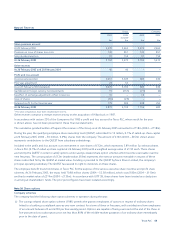

Note 14 Fixed asset investments continued

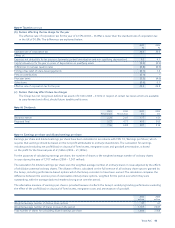

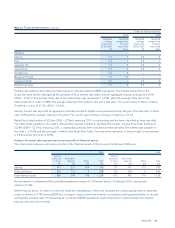

The Group’s share of the joint ventures, as at 26 February 2005, was as follows:

Joint ventures in aggregate Tesco Personal Finance

2005 2004 2005 2004

£m £m £m £m

Fixed assets 717 348 8 6

Current assets 3,563 1,658 3,446 1,580

Creditors falling due within one year (3,371) (1,323) (3,120) (1,274)

Creditors falling due after more than one year (666) (389) (103) (103)

Net assets 243 294 231 209

There is no recourse to Group companies in respect of the borrowings of the joint ventures.

Tesco Personal Finance forms a substantial proportion of the gross assets and liabilities of the Group’s joint ventures in aggregate.

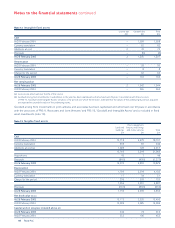

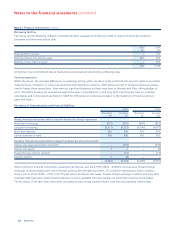

The following shows the Group’s share of the results of Tesco Personal Finance:

2005 2004

£m £m

Other operating income 201 166

Profit before tax 101 80

Taxation (30) (24)

Profit after taxation 71 56

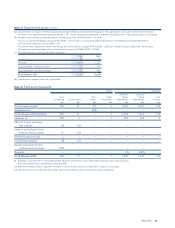

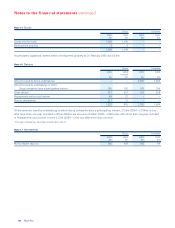

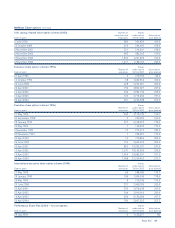

Hymall

The Group acquired a 50% share in Hymall on 1 September 2004. Of the £145m cost of investment, goodwill arising of £140m

has been capitalised, and will be amortised over 20 years. The acquisition of the interest in Hymall comprised:

£m

Group share of original book value of net assets 20

Fair value adjustments to achieve consistency of accounting policies (15)

Fair value to the Group 5

Goodwill 140

Total cost 145

The principal fair value adjustments made to the net bookvalues of the assets and liabilities of Hymall comprise: converting from

cash accounting to accruals-based accounting; revaluation of stock; debtors and fixed assets; provision for onerous leases, and

recognition of deferred tax assets.

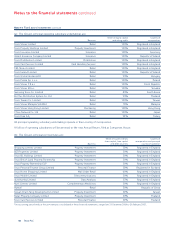

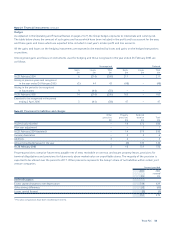

(c) The Group’s principal associate is:

Share of issued share capital, Country of incorporation and

Business loan capital and debt securities principal country of operation

GroceryWorks Holdings Inc. Internet Retailer 39% United States of America

The net assets and goodwill of associates are:

2005 2004

£m £m

Net assets 76

Goodwill 12 15

19 21