Tesco 2003 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2003 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TESCO PLC 55

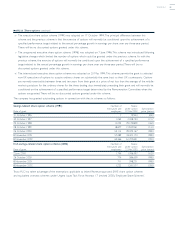

five year record continued

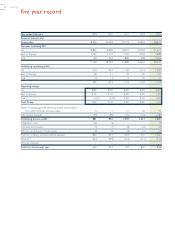

Year ended February 1999 2000 2001 2002 2003

Group enterprise value 413,528 13,591 21,590 21,290 16,896

Underlying diluted earnings per share 2/3 9.37p 10.18p 10.66p 12.14p 13.98p

Underlying earnings per share 2/3 9.59p 10.36p 10.87p 12.33p 14.10p

Dividend per share 4.12p 4.48p 4.98p 5.60p 6.20p

Return on shareholders’ funds 3/5 21.3% 20.9% 22.7% 23.2% 23.3%

Return on capital employed 3/6 17.2% 16.1% 16.6% 16.1% 15.3%

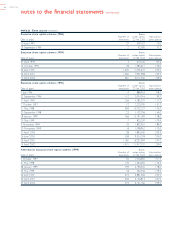

Group statistics

Number of stores 821 845 907 979 2,291

Total sales area – 000 sq ft 21,353 24,039 28,362 32,491 39,944

Full-time equivalent employees 126,914 134,896 152,210 171,794 188,182

UK retail statistics

Number of stores 639 659 692 729 1,982

Total sales area – 000 sq ft 715,975 16,895 17,965 18,822 21,829

Average store size (sales area – sq ft) 825,627 26,641 27,636 28,576 29,455

Full-time equivalent employees 9104,772 108,409 113,998 121,272 133,051

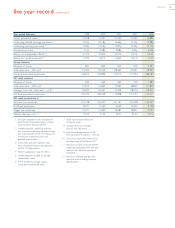

UK retail productivity £ 10

Turnover per employee 11 151,138 156,427 161,161 165,348 162,457

Profit per employee 11 8,771 9,160 9,649 10,002 9,748

Wages per employee 11 15,271 15,600 16,087 16,821 17,020

Weekly sales per sq ft 7/12 21.05 21.43 22.01 22.33 22.16

1 Excludes integration costs and goodwill

amortisation. Operating margin is based

upon turnover exclusive of VAT.

2 Underlying profit, underlying earnings

per share and underlying diluted earnings

per share exclude net loss on disposal of

fixed assets, integration costs and

goodwill amortisation.

3 2003, 2002 and 2001 statistics have

been calculated based on the adoption

of FRS 19 ‘Deferred Tax’.

4 Market capitalisation plus net debt.

5 Underlying profit divided by average

shareholders’ funds.

6 Profit divided by average capital

employed excluding net debt.

7 Store sizes exclude lobby and

restaurant areas.

8 Average store size excludes

Express and T&S stores.

9 Based on average number of full-

time equivalent employees in the UK.

10 2003 ratios have been impacted by

the acquisition of T&S Stores PLC.

11 Based on turnover exclusive of VAT,

underlying operating profit and total

staff cost per full-time equivalent

employee.

12 Based on weighted average sales

area and sales excluding property

development.