Tesco 2003 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2003 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2TESCO PLC

This operating and financial review analyses the performance of the Tesco Group

in the financial year ended 22 February 2003. It also explains other aspects of

the Group’s results and operations, including strategy and risk management.

operating and financial review

99 00 01 0302

GROUP PERFORMANCE £m

28,613

25,654

22,773

20,358

18,546

23,40723,407

21,68521,685

19,88419,884

18,33418,334

17,09117,091

GROUP SALES

UK SALES

99 00 01 0302

CAPITAL EXPENDITURE £m

2,134

2,027

1,944

1,488

1,067

1,2281,228

1,2761,276

1,2061,206

989989

848848

GROUP

UK

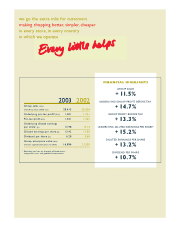

GROUP PERFORMANCE Group sales including VAT

increased by 11.5% to £28,613m (2002 – £25,654m).

Group underlying profit on ordinary activities

before tax (excluding net loss on disposal of fixed

assets, integration costs and goodwill amortisation)

increased by 14.7% to £1,401m. In the year, we

acquired the T&S and HIT businesses.The impact

was to increase underlying profit by a net £1m.

Group capital expenditure was £2,134m

(2002 – £2,027m). UK capital expenditure was

£1,228m, including £558m on new stores and

£335m on extensions and refits.Total international

capital expenditure was £906m, £527m in Asia

and £379m in Europe. In the year ahead, we forecast

Group capital expenditure to be around £2.2bn.

The Group continued to generate strong

operating cash flows. Net cash inflow from

operating activities increased by 17% to £2,375m

(2002 – £2,038m).

Group net debt in the year increased by

£1,177m to £4,737m (2002 – £3,560m), including

the additional debt used for the purchase of HIT

(£391m) and acquired T&S debt (£155m). Gearing

increased to 73% (2002 – 64%).

GROUP INTEREST AND TAXATION Net interest

payable was £180m (2002 – £153m), of which

£10m relates to the additional debt taken on for

the T&S and HIT acquisitions.

Ta x has been charged at an effective rate of

30.5% (2002 – 30.9%). Prior to accounting for the

net loss on disposal of fixed assets, integration costs

and goodwill amortisation, our underlying tax rate

was 29.6% (2002 – 30.4%).

SHAREHOLDER RETURNS AND DIVIDENDS

Underlying diluted earnings per share (excluding

net loss on disposal of fixed assets, integration costs

and goodwill amortisation) increased by 15.2% to

13.98p (2002 – 12.14p).

GROUP SUMMARY

2003 2002 Change

£m £m %

Group sales

(including value added tax) 28,613 25,654 11.5

Underlying profit on

ordinary activities

before tax†1,401 1,221 14.7

Profit on ordinary activities

before taxation 1,361 1,201 13.3

Underlying diluted

earnings per share†13.98p 12.14p 15.2

Dividend per share 6.20p 5.60p 10.7

UK PERFORMANCE

2003 2002 Change

£m £m %

Sales

(including value added tax) 23,407 21,685 7.9

Underlying operating profit†1,297 1,213 6.9

REST OF EUROPE PERFORMANCE

2003 2002 Change

£m £m %

Sales

(including value added tax) 3,032 2,475 22.5

Underlying operating profit†141 90 56.7

ASIA PERFORMANCE

2003 2002 Change

£m £m %

Sales

(including value added tax) 2,174 1,494 45.5

Underlying operating profit†71 29 144.8

†Excluding net loss on disposal of fixed assets, integration costs

and goodwill amortisation.

GROUP STRATEGY Our strategy is simple and

the four key elements remain the same: strong UK

core business; non-food growth; retailing services

and international.

This customer focused strategy has again

delivered strong results by bringing value, choice and

convenience to millions of customers every week.