Tesco 2003 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2003 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TESCO PLC 29

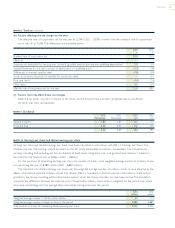

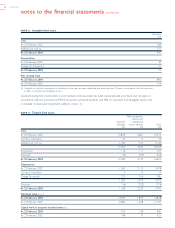

obligation to pay more or less taxation in the future. Deferred

tax assets are recognised to the extent that they are regarded

as recoverable.They are regarded as recoverable to the

extent that on the basis of all available evidence, it is regarded

as more likely than not that there will be suitable taxable

profits from which the future reversal of the underlying timing

differences can be deducted. Deferred tax is measured on a

non-discounted basis at the tax rates that are expected to

apply in the periods in which timing differences reverse, based

on tax rates and laws substantively enacted at the balance

sheet date.

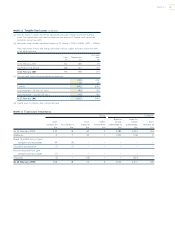

PENSIONS The expected cost of pensions in respect of

the Group’s defined benefit pension schemes is charged to

the profit and loss account over the working lifetimes of

employees in the schemes. Actuarial surpluses and deficits

are spread over the expected remaining working lifetimes

of employees.

POST-RETIREMENT BENEFITS OTHER THAN PENSIONS

The cost of providing other post-retirement benefits, which

comprise private healthcare, is charged to the profit and loss

account so as to spread the cost over the service lives of

relevant employees in accordance with the advice of qualified

actuaries. Actuarial surpluses and deficits are spread over the

expected remaining working lifetimes of relevant employees.

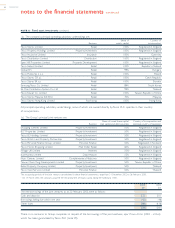

FOREIGN CURRENCIES Assets and liabilities in foreign

currencies are translated into sterling at the financial year end

exchange rates. Profits and losses of overseas subsidiaries are

translated into sterling at average rates of exchange. Gains

and losses arising on the translation of the net assets of

overseas subsidiaries, less exchange differences arising on

matched foreign currency borrowings, are taken to reserves

and disclosed in the statement of total recognised gains and

losses. Gains and losses on instruments used for hedging are

recognised in the profit and loss account when the exposure

that is being hedged is itself recognised.

FINANCIAL INSTRUMENTS Derivative instruments utilised

by the Group are interest rate swaps and caps, forward

start interest rate swaps, cross currency swaps, forward

rate agreements and forward exchange contracts and

options.Termination payments made or received in respect

of derivatives are spread over the life of the underlying

exposure in cases where the underlying exposure continues

to exist. Where the underlying exposure ceases to exist, any

termination payments are taken to the profit and loss account.

Interest differentials on derivative instruments are

recognised by adjusting net interest payable. Premia or discounts

on derivative instruments are amortised over the shorter of

the life of the instrument or the underlying exposure.

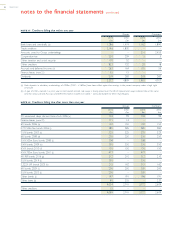

Currency swap agreements and forward exchange

contracts are valued at closing rates of exchange. Resulting

gains or losses are offset against foreign exchange gains or

losses on the related borrowings or, where the instrument is

used to hedge a committed future transaction, are deferred

until the transaction occurs or is extinguished.