Tesco 2003 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2003 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50 TESCO PLC

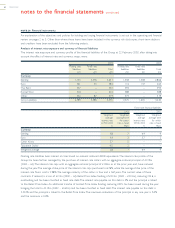

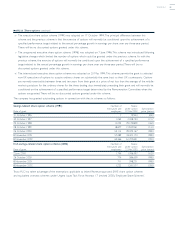

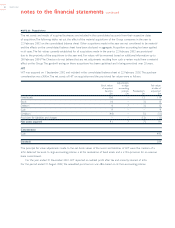

NOTE 27 Post-retirement benefits other than pensions

The company operates a scheme offering post-retirement healthcare benefits. The cost of providing these benefits has been

accounted for on a similar basis to that used for defined benefit pension schemes.

The liability as at 22 February 2003 of £6.6m, which was determined in accordance with the advice of qualified actuaries,

is being spread forward over the service lives of relevant employees. £0.5m has been charged to the profit and loss account

and £0.5m of benefits were paid. An accrual of £5.3m (2002 – £5.3m) is being carried in the balance sheet. It is expected

that payments will be tax deductible, at the company’s tax rate, when made.

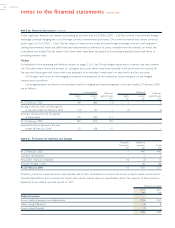

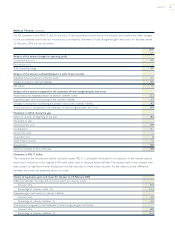

NOTE 28 Capital commitments

At 22 February 2003 there were commitments for capital expenditure contracted for, but not provided of £458m

(2002 – £674m), principally relating to the overseas store development programme.

NOTE 29 Contingent liabilities

Certain bank loans and overdraft facilities of joint ventures have been guaranteed by Tesco PLC. At 22 February 2003,

the amounts outstanding on these facilities were £12m (2002 – £12m).

The company has irrevocably guaranteed the liabilities as defined in Section 5(c) of the Republic of Ireland

(Amendment Act) 1986, of various subsidiary undertakings incorporated in the Republic of Ireland.

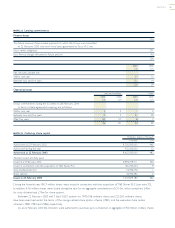

NOTE 30 Related party transactions

During the year there were no material transactions or amounts owed or owing with any of the Group’s key management

or members of their close family.

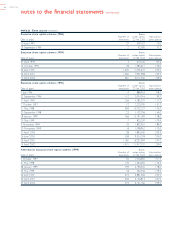

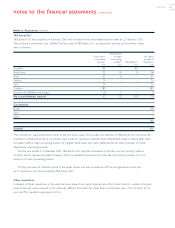

During the year, the Group traded with its joint ventures: Shopping Centres Limited, BLT Properties Limited, Tesco BL

Holdings Limited,Tesco British Land Property Partnership,Tesco Personal Finance Group Limited,Tesco Home Shopping Limited,

iVillage UK Limited, dunnhumby Limited, Nutri Centres Limited,Taiwan Charn Yang Developments Limited, Retail Property

Company Limited and Tesco Card Services Limited. During the year, the Group also traded with its five associates: Broadfields

Management Limited, Clarepharm Limited, GroceryWorks Holdings Inc., Hussmann (Hungary) Kft and Greenergy Fuels Limited.

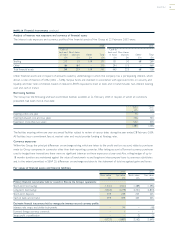

The main transactions during the year were:

i Equity funding of £4m (2002 – £26m) in joint ventures and £7m (2002 – £16m) in associates.

ii The Group made loans to joint ventures of £43m (2002 – £27m), and has been repaid loans by joint ventures of £5m

(2002 – £2m). As in the prior year no new loans have been made from joint ventures to the Group.The Group has

outstanding loan balances due from joint ventures of £107m (2002 – £68m) and outstanding loan balances due to joint

ventures of £2m (2002 – £2m) at 22 February 2003.

iii The Group made purchases of £81m (2002 – £43m) from joint ventures and associates.

iv The Group has charged joint ventures an amount totalling £42m (2002 – £26m) in respect of services, loan interest and

assets transferred, of which £8m (2002 – £3m) was outstanding at 22 February 2003.

v The Group sold a property to BLT Properties Limited for £5m.There were no transactions of this nature in the prior year.

vi Tesco Stores Limited is a member of one or more partnerships to whom the provisions of the Partnerships and Unlimited

Companies (Accounts) Regulations 1993 apply (‘Regulations’).The accounts for those partnerships have been consolidated

into these accounts pursuant to regulation 7 of the Regulations.

notes to the financial statements continued