Tesco 2003 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2003 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32 TESCO PLC

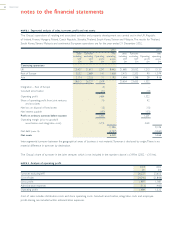

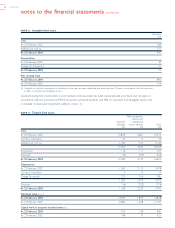

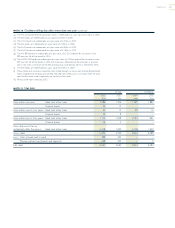

NOTE 7 Net interest payable

2003 2002

£m £m £m £m

Interest receivable and similar income on money market

investments and deposits 65 66

Less interest payable on:

Short-term bank loans and overdrafts repayable within five years (104) (101)

Finance charges payable on finance leases (5) (4)

4% unsecured deep discount loan stock 2006 (a) (10) (9)

4% RPI bonds 2016 (b) (12) (15)

3.322% LPI bonds 2025 (c) (10) (4)

103⁄8% bonds 2002 – (19)

83⁄4% bonds 2003 (17) (17)

6% bonds 2006 (9) (8)

71⁄2% bonds 2007 (24) (24)

6% bonds 2008 (15) (9)

51⁄8% bonds 2009 (18) (18)

65⁄8% bonds 2010 (10) (10)

6% bonds 2029 (12) (12)

0.7% Yen bonds 2006 (d) (13) (8)

51⁄4% Euro bonds 2008 (13) –

43⁄4% Euro bonds 2010 (4) –

51⁄2% bonds 2033 (2) –

51⁄2% bonds 2019 (4) –

Other bonds (d) (7) (7)

Interest capitalised 62 63

Share of interest of joint ventures and associates (18) (17)

(245) (219)

(180) (153)

(a) Interest payable on the 4% unsecured deep discount loan stock 2006 includes £5m (2002 – £5m) of discount amortisation.

(b) Interest payable on the RPI bonds includes £2m (2002 – £7m) of RPI related amortisation.

(c) Interest payable on the LPI bonds 2025 includes £1m (2002 – £2m) of RPI related amortisation.

(d) 2002 comparative has been separated out in line with detailed disclosure this year.

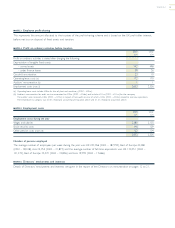

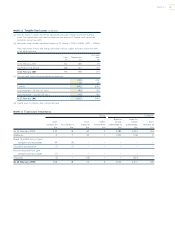

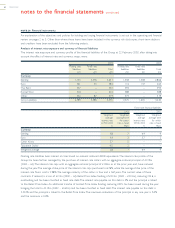

NOTE 8 Taxation

2003 2002

(a) Analysis of charge in year £m £m

Current tax:

UK corporation tax at 30.0% (2002 – 30.0%) 382 348

Prior year items (56) (29)

Overseas taxation 88

Share of joint ventures and associates 19 9

353 336

Deferred tax: (note 21)

Origination and reversal of timing differences (i) 54 35

Prior year items 10 –

Share of joint ventures and associates (2) –

62 35

Tax on profit on ordinary activities 415 371

(i) The total charge for the year of £54m includes a £2m (2002 – £3m) debit to fixed assets.

notes to the financial statements continued