Suzuki 2007 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2007 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUZUKI MOTOR CORPORATION

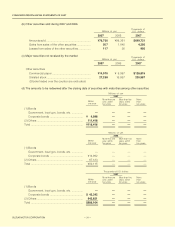

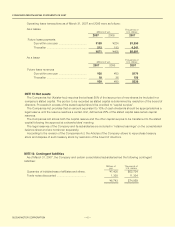

NOTE 9: Income taxes

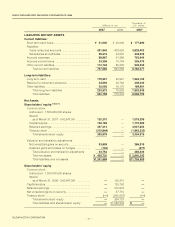

Breakdown of deferred tax assets and deferred tax liabilities by their main occurrence causes were as follows.

Thousands of

Millions of yen U.S. dollars

2007 2006 2007

Deferred tax assets

Excess-depreciation ................................................. ¥ 56,526 ¥ 42,663 $ 478,837

Various reserves ....................................................... 44,344 37,012 375,638

Unrealized gross profits elimination.......................... 26,022 23,565 220,432

Others ....................................................................... 98,940 92,905 838,121

Deferred tax assets total ........................................... ¥225,833 ¥196,146 $1,913,029

Deferred tax liabilities

Net unrealized gains on security .............................. ¥ (23,050) ¥ (25,196) $ (195,257)

Variance from the complete market value method

of newly consolidated subsidiaries ......................... (7,984) (7,636) (67,640)

Reserve for fixed assets advanced depreciation ..... (2,499) (2,519) (21,171)

Others ....................................................................... (960) (539) (8,138)

Deferred tax liabilities total........................................ ¥ (34,495) ¥ (35,891) $ (292,208)

Net amounts of deferred tax assets .......................... ¥191,337 ¥160,255 $1,620,821

CONSOLIDATED FINANCIAL STATEMENTS OF 2007

43

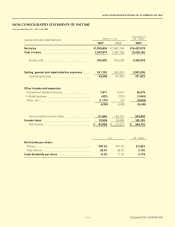

The differences between the statutory tax rate and the effective tax rate were summarized as follows.

2007 2006

Statutory tax rate ........................................................... 39.8% 39.8%

Tax credit .................................................................. (5.3%) (4.1%)

Equity in earnings of affiliates ................................... (0.6%) (1.3%)

Others ....................................................................... (1.9%) (1.7%)

Effective tax rate ........................................................... 32.0% 32.7%

Thousands of

Millions of yen U.S. dollars

2007 2006 2007

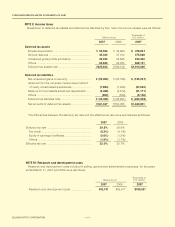

Research and development costs ............................ ¥92,141 ¥89,917 $780,531

NOTE 10: Research and development costs

Research and development costs included in selling, general and administrative expenses, for the years

ended March 31, 2007 and 2006 were as follows: