Suzuki 2007 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2007 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUZUKI MOTOR CORPORATION

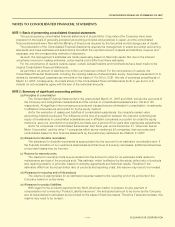

NOTE 3: Accounting Changes

(Accounting standard for presentation of Net Assets in the Balance Sheet)

Effective from the fiscal year ending March 31, 2007, the Company and its subsidiaries adopted new accounting

standards “Accounting Standard for Presentation of Net Assets in the Balance Sheet (Accounting Standards Board of

Japan; ASBJ Statement No.5 issued on December 9, 2005)” and the “Implementation Guidance on Accounting

Standard for Presentation of Net Assets in the Balance Sheet (Accounting Standards Board of Japan; ASBJ

Guidance No.8 issued on December 9, 2005).”

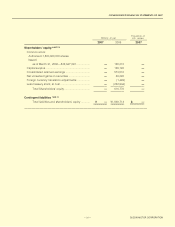

The amount corresponding to the conventional shareholders’ equity in the balance sheet is 741,673 million yen. Net

assets in the Consolidated balance sheets for the fiscal year is presented according to the revised “Regulation

Concerning the Terminology, Forms and Preparation Methods of Interim Consolidated Financial Statements.”

(Accounting standard for Business Combinations, etc.)

Effective from the fiscal year ending March 31, 2007, the Company and its subsidiaries adopted new accounting

standards “Accounting Standard for Business Combinations (the Business Accounting Council; issued on October

31, 2003)”, “Accounting Standard for Business Divestitures and the related Implementation Guidance (Accounting

Standards Board of Japan; ASBJ Guidance No.7 issued on December 27, 2005)”, and the “Accounting Standard for

Business Combinations and Accounting Standard for Business Divestitures (Accounting Standards Board of Japan;

ASBJ Guidance No.10 last updated on December 22, 2006).”

(Accounting Standard for Directors’ Bonus)

Effective from the fiscal year ending March 31, 2007, the Company and its subsidiaries adopted new accounting

standards “Accounting Standard for Directors’ Bonus (Accounting Standards Board of Japan; ASBJ Guidance No.4

issued on November 29, 2005).”

As a result of this change, “Selling, general and administrative expenses” increased by 468 million yen and

“operating income” and “Income before income taxes” decreased by 468 million yen respectively compared with

what would have been under the previous accounting policy.

(Accrued bonuses for directors and corporate auditors)

In order to defray bonuses for directors and corporate auditors, estimated amount which is accrued for this fiscal

year is appropriated.

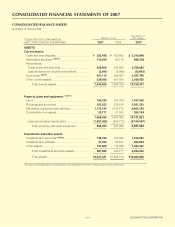

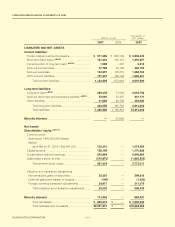

CONSOLIDATED FINANCIAL STATEMENTS OF 2007

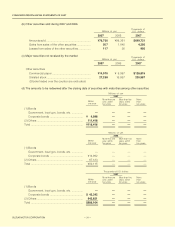

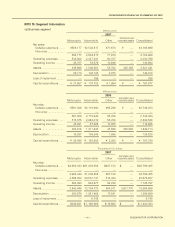

Finished products .................................................... ¥323,314 ¥290,945 $2,738,788

Work in process ....................................................... 24,816 19,483 210,223

Raw materials and others ........................................ 52,979 44,257 448,787

¥401,110 ¥354,687 $3,397,799

NOTE 4: Inventories

Inventories as of March 31, 2007 and 2006 were as follows:

2007 2006 2007

Thousands of

U.S. dollars

Millions of yen

37