Suzuki 2007 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2007 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUZUKI MOTOR CORPORATION

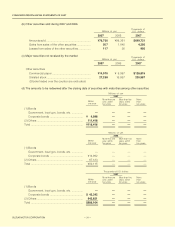

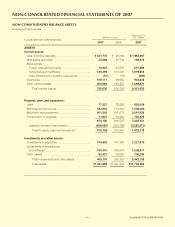

Short-term bank loans

Secured ................................................................... ¥ 734 ¥ 200 $ 6,223

Unsecured ............................................................... 166,501 125,915 1,410,433

¥167,236 ¥126,115 $1,416,657

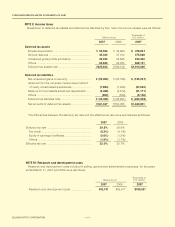

NOTE 6: Short-term bank loans and long-term debt

Short-term bank loans as of March 31, 2007 and 2006 consisted of the following. The annual interest rates of

short-term bank loans as of March 31, 2007 were 0.42 percent to 13.35 percent.

2007 2006 2007

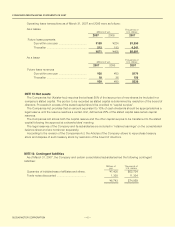

“The zero coupon convertible bonds” are convertible into common stock at the options of holders at the

conversion price of ¥2,000 per share.

“The zero coupon convertible bonds with 130% call option” are convertible into common stock at the options of

holders at the conversion price of ¥3,054 per share.

If the outstanding convertible bonds were fully converted as of March 31, 2007, 64,076,413 additional shares of

common stock would be issued.

As is customary in Japan, both short-term and long-term bank loans are subject to general agreements which

provide that the banks may, under certain circumstances, request additional security for those loans, and may

treat any security furnished to the banks, as well as cash deposited with them, as security for all present and

future indebtedness.

Long-term debt as of March 31, 2007 and 2006 consisted of:

Loans maturing through 2013

Secured ................................................................ ———

Unsecured ............................................................ ¥ 58,387 ¥40,535 $ 494,597

Unsecured zero coupon convertible bonds with

130% call option in yen due 2013 ........................ 150,000 —1,270,648

Unsecured zero coupon convertible bonds in

yen due 2010........................................................ 29,921 29,991 253,460

Secured 9.00 percent Indian Rs. bonds due 2007 etc.

1,088 1,869 9,216

¥239,396 ¥72,395 $2,027,922

Less portion due within one year ............................. (1,088) (801) (9,216)

¥238,308 ¥71,594 $2,018,706

2007 2006 2007

Thousands of

U.S. dollars

Millions of yen

Thousands of

U.S. dollars

Millions of yen

CONSOLIDATED FINANCIAL STATEMENTS OF 2007

40