Shutterfly 2009 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2009 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SHUTTERFLY, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

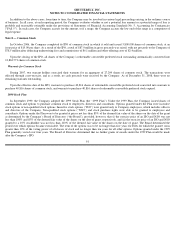

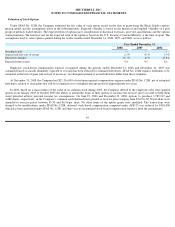

Inducement Awards

Included in the stock option and restricted stock unit activity above, the Company granted inducement stock option awards and restricted stock

units to two executives. These inducement grants were approved by the Company’

s Board of Directors and were not issued under a shareholder

approved plan. A total of 129,000 options to purchase common stock and 7,000 restricted stock units were granted under this nonqualified

agreement. These grants have a 10 year term, and vest over a four year period from the initial date of hire of the respective executives, in a

manner consistent with awards granted under the 2006 Plan.

Also included in the stock option activity are 50,000 previously issued inducement stock option awards which have been forfeited pursuant to

the termination of an executive.

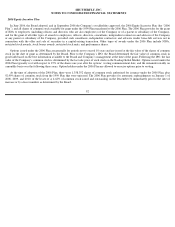

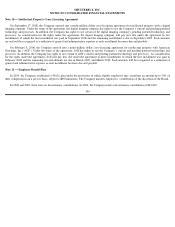

Note 9 — Income Taxes

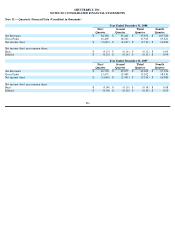

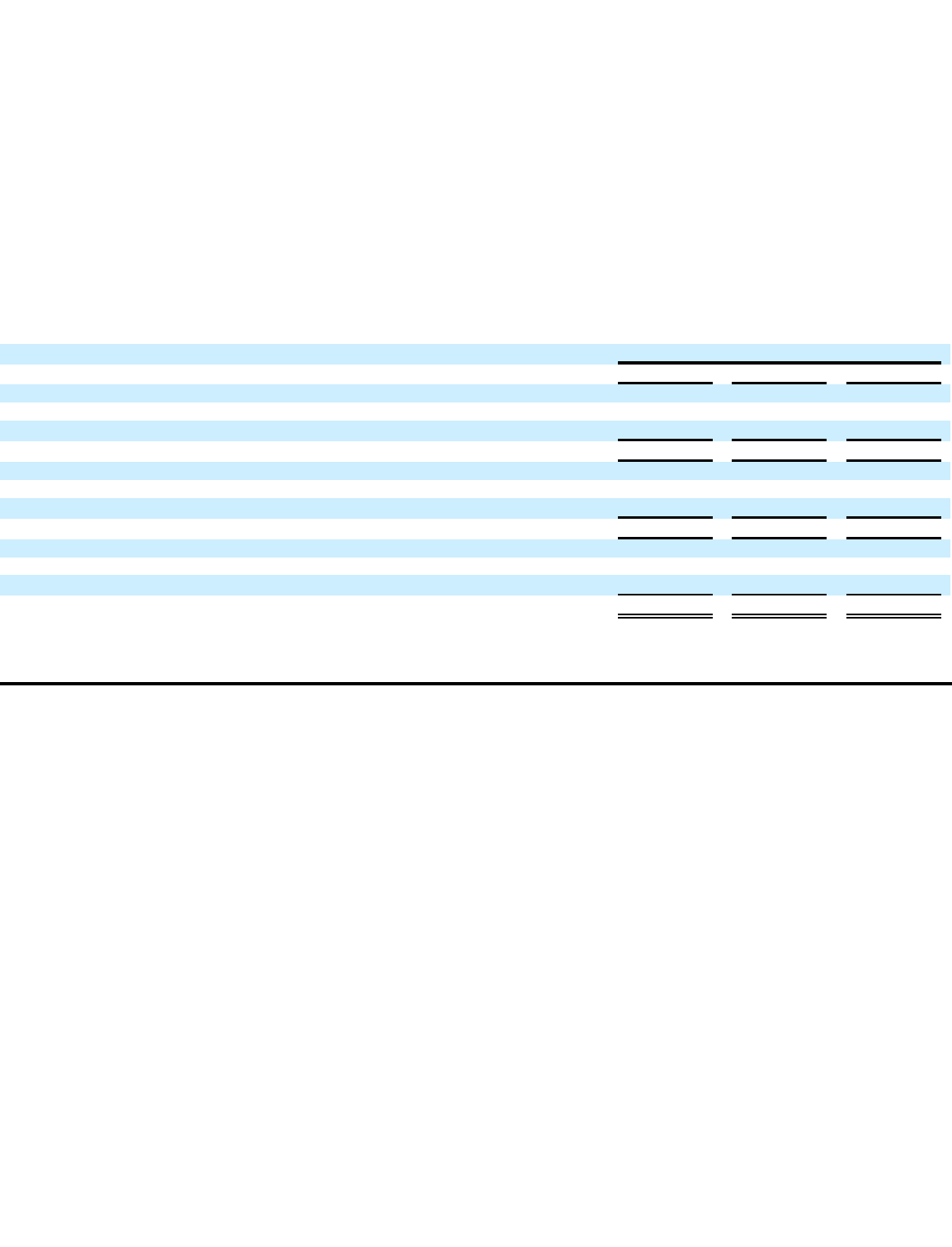

The components of the provision for income taxes is as follows (in thousands):

December 31,

2008

2007

2006

Federal:

Current

$

727

$

206

$

610

Deferred

1,108

5,146

2,809

$

1,835

$

5,352

$

3,419

State:

Current

$

1,156

$

216

$

133

Deferred

(1,199)

734

390

$

(43)

$

950

$

523

Total income tax expense (benefit):

Current

$

1,883

$

422

$

743

Deferred

(91)

5,880

3,199

$

1,792

$

6,302

$

3,942

97