Shutterfly 2009 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2009 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SHUTTERFLY, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

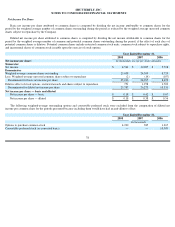

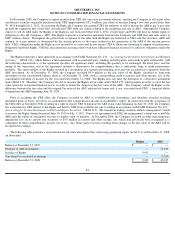

Comprehensive Income (Loss)

FASB Statement No. 130, Reporting Comprehensive Income, establishes standards for reporting and displaying comprehensive

income and comprehensive loss and its

components in the consolidated financial statements. Comprehensive income is defined as the change in

equity of a business enterprise during a period from transactions and other events and circumstances from non-

owner sources. Comprehensive

income (loss) is composed of net income (loss) and unrealized gains and losses on marketable securities, which are disclosed in the

accompanying consolidated statements of comprehensive income. Unrealized income (loss) on investments for the year ended December 31,

2008, 2007 and 2006 are net of tax benefit of $3,148,000, $13,000 and $919,000 respectively.

In November 2008, the Company accepted an offer (the "Rights") from UBS AG ("UBS"), one of its investment providers, entitling

the Company to sell at par value its auction-

rate securities ("ARS") originally purchased from UBS (approximately $52.3 million, par value) at

anytime during a two-

year period from June 30 2010 through July 2, 2012. In connection with the acceptance, the Company transferred its ARS

from available-for-

sale to trading securities in accordance with SFAS 115. The transfer to trading securities reflects mangement's intent to

exercise the Rights during the period June 30, 2010 to July 2, 2012. Prior to its agreement with UBS, management's intent was to hold the ARS

until the earlier of anticipated recovery in market value or maturity At the time the agreement was signed, the unrealized loss on its ARS was

$9.0 million, $5.9 million was included in other comprehensive income net of tax of $3.1 million. At December 31, 2008 the Company recorded

a reclassification adjustment to recognize an other than temporary impairment loss of $9.0 million in interest and other income, net, which had

previously been recognized as a component of other comprehensive income, net of tax.

Segment Reporting

The Company operates in one industry segment —

digital photofinishing services. The Company operates in one geographic area, the

United States of America.

FASB Statement No. 131, Disclosures about Segments of an Enterprise and Related Information

, establishes standards for reporting

information about operating segments. Operating segments are defined as components of an enterprise about which separate financial

information is available that is evaluated regularly by the chief operating decision maker, or decision making group, in deciding how to allocate

resources and in assessing performance. The Company’s chief operating decision maker is its Chief Executive Officer. The Company’

s Chief

Executive Officer reviews financial information presented on a consolidated basis for purposes of allocating resources and evaluating financial

performance. The Company has one business activity and there are no segment managers who are held accountable for operations, operating

results and plans for products or components below the consolidated unit level. Accordingly, the Company reports as a single operating segment.

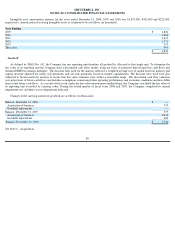

Recent Accounting Pronouncements

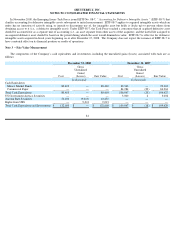

Effective January 1, 2008, the Company adopted SFAS No. 157, “Fair Value Measurements” (“FAS 157”).

In February 2008, the Financial

Accounting Standards Board ("FASB") issued a staff position which provides a one year deferral of the effective date of SFAS 157 for all

nonfinancial assets and liabilities except for those that were recognized or disclosed in the financial statements at fair value at least annually.

Therefore, the Company has adopted the provision of FAS 157 only with respect to its financial assets and liabilities. FAS 157 defines fair value,

establishes a framework for measuring fair value and expands disclosures about fair value measurements. Fair value is defined under FAS 157 as

the exchange price that would be received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market

for the asset or liability in an orderly transaction between market participants on the measure date. Valuation techniques used to measure fair

value under FAS 157 must maximize the use of observable inputs and minimize the use of unobservable inputs. The standard describes a fair

value hierarchy based on three input levels, of which the first two are considered observable and the last unobservable, as follows:

79