Shutterfly 2009 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2009 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SHUTTERFLY, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

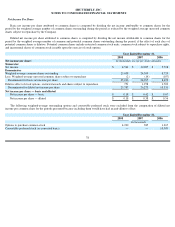

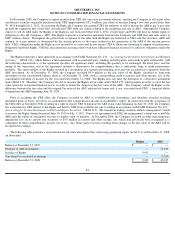

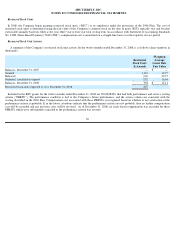

Intangible asset amortization expense for the years ended December 31, 2008, 2007 and 2006 was $1,827,000, $412,000 and $222,000,

respectively. Amortization of existing intangible assets is estimated to be as follows (in thousands):

Goodwill

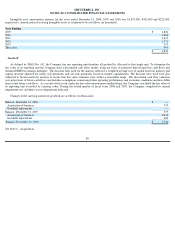

As defined by SFAS No. 142, the Company has one reporting unit therefore all goodwill is allocated to that single unit. To determine the

fair value of its reporting unit the Company used a discounted cash flows model, using ten years of projected unleveraged free cash flows and

terminal EBITDA earnings multiples. The discount rates used for the analysis reflected a weighted average cost of capital based on industry and

capital structure adjusted for equity risk premiums and size risk premiums based on market capitalization. The discount rates used were also

subjected to broad sensitivity analysis to ensure that fair value estimates were within a reasonable range. The discounted cash flow valuation

uses projections of future cash flows and includes assumptions concerning future operating performance and economic conditions and may differ

from actual future cash flows. As a result of this work, under the fair value measurement methodology, the Company concluded the fair value of

its reporting unit exceeded its carrying value. During the fourth quarter of fiscal years 2008 and 2007, the Company completed its annual

impairment test, and there was no impairment indicated.

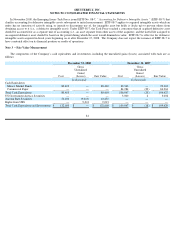

Changes in the carrying amount of goodwill are as follows (in thousands):

See Note 6 - Acquisitions.

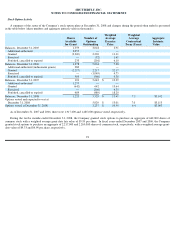

Year Ending:

2009

$

1,826

2010

1,686

2011

1,415

2012

1,271

2013

129

Thereafter

496

$

6,823

Balance, December 31, 2006

$

—

Acquisition of business

379

Goodwill adjustments

—

Balance, December 31, 2007

379

Acquisition of business

6,945

Goodwill adjustments

400

Balance, December 31, 2008

$

7,724

86