Shutterfly 2009 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2009 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SHUTTERFLY, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

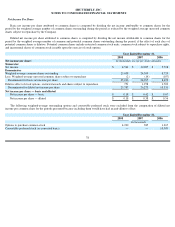

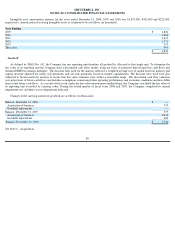

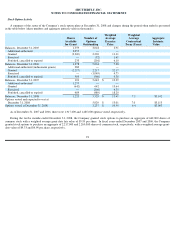

Accrued Liabilities

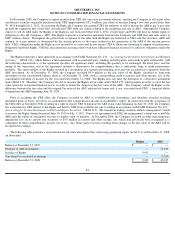

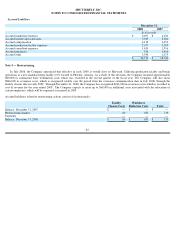

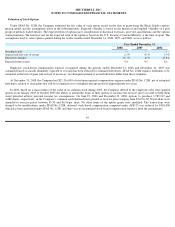

Note 5 — Restructuring

In July 2008, the Company announced that effective in early 2009, it would close its Hayward, California production facility and begin

operations at a new manufacturing facility to be located in Phoenix, Arizona. As a result of this decision, the Company incurred approximately

$80,000 in contractual lease termination costs which was recorded in the second quarter of the fiscal year. The Company will also incur

$846,000 in severance costs, which is recognized ratably over the period from the severance communication date in July 2008, through the

facility closure date in early 2009. Through December 31, 2008, the Company has recognized $633,000 in severance costs which is recorded in

cost of revenue for the year ended 2008. The Company expects to incur up to $60,000 in additional costs associated with the relocation of

certain employees, which will be expensed as incurred in 2009.

Accrued liabilities related to restructuring actions consist of (in thousands):

December 31,

2008

2007

In thousands

Accrued marketing expenses

$

6,697

$

4,101

Accrued income and sales taxes

5,923

3,682

Accrued compensation

4,110

3,053

Accrued production facility expenses

2,677

3,283

Accrued consultant expenses

1,439

1,516

Accrued purchases

526

1,414

Accrued other

3,340

1,675

$

24,712

$

18,724

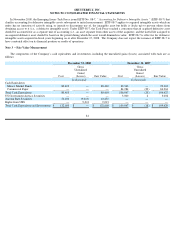

Facility

Closure Costs

Workforce

Reduction Costs

Total

Balance, December 31, 2007

$

—

$

—

$

—

Restructuring charges

80

633

713

Payments

—

—

—

Balance, December 31, 2008

$

80

$

633

$

713

87