Shutterfly 2009 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2009 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SHUTTERFLY, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Investments

The Company evaluates declines in fair value of marketable securities in accordance with SFAS No. 115, Accounting for Certain

Investments in Debt and Equity Securities , and related guidance issued by the FASB and SEC in order to determine the classification of the

decline in fair value as “temporary” or “other-than-temporary.”

A temporary decline in fair value results in an unrealized loss being recorded in

the other comprehensive income (loss) component of stockholders equity. Such an unrealized loss does not affect net income (loss) for the

applicable accounting period. An other-than–

temporary decline in fair value is recorded as a realized loss in the consolidated statement of

operations and reduces net income (loss) for the applicable accounting period. The differentiating factors between these classifications include

the length of time and extent to which the market value has been less than cost, the financial condition of the issuer, and the ability and intent of

the Company to retain its investment in the issuer for a period of time sufficient to allow for any anticipated recovery in market value.

During the fourth quarter of fiscal 2008, the Company reclassified its auction rate securities from available-for-

sale to trading securities.

Investments that the Company designates as trading assets are reported at fair value, with gains or losses resulting from changes in fair value

recognized in earnings. See Note 3-Fair Value Measurement.

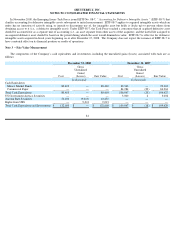

Fair Value

Effective January 1, 2008, the Company adopted SFAS No. 157, “Fair Value Measurements” (“FAS 157”).

In February 2008, the FASB

issued a staff position which provides a one year deferral of the effective date of SFAS 157 for all nonfinancial assets and liabilities except for

those that were recognized or disclosed in the financial statements at fair value at least annually. Therefore, the Company has adopted the

provision of FAS 157 only with respect to its financial assets and liabilities. FAS 157 defines fair value, establishes a framework for measuring

fair value and expands disclosures about fair value measurements. Fair value is defined under FAS 157 as the exchange price that would be

received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an

orderly transaction between market participants on the measure date. Valuation techniques used to measure fair value under FAS 157 must

maximize the use of observable inputs and minimize the use of unobservable inputs. The standard describes a fair value hierarchy based on three

input levels, of which the first two are considered observable and the last unobservable, as follows:

Level 1 – Quoted prices in active markets for identical assets or liabilities

Level 2 – Inputs other than Level 1 that are observable, either directly or indirectly, such as quoted prices for similar assets or liabilities;

quoted prices in markets that are not active; or other inputs that are observable or can be corroborated by observable market data for

substantially the full term of the assets or liabilities.

Level 3 – Unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the assets or

liabilities.

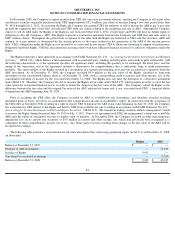

The Company utilized a discounted cash flow approach to determine the Level 3 valuation for its auction rate securities. The assumptions

used in preparing the discounted cash flow model include estimates for interest rates, timing and amount of cash flows, credit and liquidity

premiums, and expected holding periods of the ARS. These assumptions are volatile and subject to change as the underlying sources of these

assumptions and market conditions change. They represent the Company's estimates given available data as of December 31, 2008.

73