Shutterfly 2009 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2009 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SHUTTERFLY, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

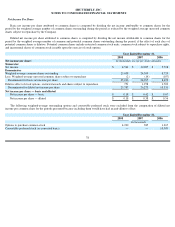

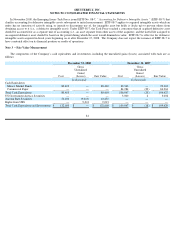

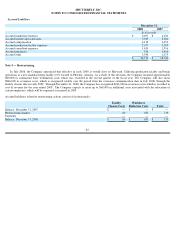

In accordance with FAS 157, the following table represents the Company’s fair value hierarchy for its financial assets (cash equivalents and

long term investments) as of December 31, 2008 (in thousands):

The Company’s financial assets subject to fair value measurement are comprised of money market funds, auction rate securities (“ARS”

)

and an asset ("Rights") which was recorded as a result of signing an agreement with one of its investment advisors ("UBS") entitling UBS to

repurchase the ARS at a future date. The ARS investments and Rights are the only financial instruments valued under the Level 3

hierarchy. ARS investments are long-term variable rate bonds tied to short-

term interest rates. After the initial issuance of the securities, the

interest rate on the securities is reset periodically, at intervals established at the time of issuance (primarily every twenty eight days), based on

market demand for a reset period. Auction rate securities are bought and sold in the marketplace through a competitive bidding process often

referred to as a “Dutch auction.”

If there is insufficient interest in the securities at the time of an auction, the auction may not be completed and

the rates may be reset to predetermined “penalty” or “maximum” rates.

From the inception of these investments in ARS in January 2008 through February 2009, due to the recent uncertainties in the credit

markets, all scheduled auctions have failed. Consequently, the investments are not currently liquid and the Company will not be able to access

these funds until a future auction of these investments is successful, the securities are called by the issuer or a buyer is found outside of the

auction process. As a result, the Company has classified the entire balance of ARS as non-

current investments on its consolidated balance

sheet. At the time of the initial investment and through the date of this report, all of these auction rate securities remain AAA rated. The assets

underlying each security are student loans and 90% of the principal amounts are guaranteed by the Federal Family Education Loan Program

(“FFELP”).

Typically, the fair value of ARS investments approximates par value due to the frequent resets through the auction process. While the

Company continues to earn interest on its ARS investments at the contractual rate, these investments are not currently trading and therefore do

not have a readily determinable market value. Accordingly, the estimated fair value of the ARS investments no longer approximates par value.

At December 31, 2008, the Company utilized a discounted cash flow approach to determine the Level 3 valuation for the ARS investments.

This analysis indicated a fair value of $43.3 million. The assumptions used in preparing the discounted cash flow model include estimates for

interest rates, timing and amount of cash flows, credit and liquidity premiums, and expected holding periods of the ARS. These assumptions are

volatile and subject to change as the underlying sources of these assumptions and market conditions change. They represent the Company’

s

estimates given available data as of December 31, 2008. Based on this assessment of fair value, as of December 31, 2008 the Company

determined there was a decline in fair value of its ARS investments of $9.0 million.

December 31, 2008

Fair Value

Level 1

Level 2

Level 3

Cash equivalents:

Money market funds

$

80,410

$

80,410

$

—

$

—

Long

-

term investments:

Auction rate securities

43,237

—

—

43,237

Rights from UBS

9,013

—

—

9,013

Total financial assets

$

132,660

$

80,410

$

—

$

52,250

82