Shutterfly 2009 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2009 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SHUTTERFLY, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

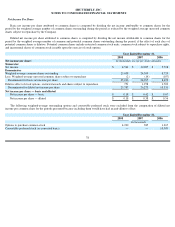

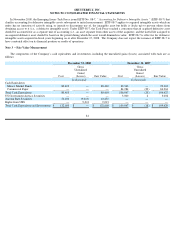

Level 1

– Quoted prices in active markets for identical assets or liabilities

Level 2

–

Inputs other than Level 1 that are observable, either directly or indirectly, such as quoted prices for similar assets or liabilities; quoted

prices in markets that are not active; or other inputs that are observable or can be corroborated by observable market data for substantially the

full term of the assets or liabilities.

Level 3

– Unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the assets or

liabilities.

The adoption of this statement did not have a material impact on the Company’s consolidated results of operations and financial

condition. The Company has elected to defer the election of this pronouncement for its nonfinancial assets and liabilities.

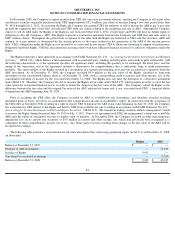

Effective January 1, 2008, the Company adopted FAS No. 159, “

The Fair Value Option for Financial Assets and Financial

Liabilities” (“FAS 159”)

which permits entities to choose to measure many financial instruments and certain other items at fair value that are not

currently required to be measured at fair value. The Company did not elect to adopt the fair value option under this Statement. The Company did

not elect the fair value option for its financial assets and liabilities existing on January 1, 2008, and did not elect the fair value option for any

financial assets and liabilities transacted during the twelve months ended December 31, 2008, except for the Rights related to its auction rate

securities that were recorded in conjunction with signing an agreement with one of its investment advisors.

In December 2007, the FASB issued FAS No. 141R, “Business Combinations” (“FAS 141R”)

which replaces FAS No. 141 and establishes

principles and requirements for how the acquirer of a business recognizes and measures in its financial statements the identifiable assets

acquired, the liabilities assumed, and any non-

controlling interest in the acquiree. FAS 141R also provides guidance for recognizing and

measuring the goodwill acquired in the business combination and determines what information to disclose to enable users of the financial

statements to evaluate the nature and financial effects of the business combination. This Statement applies prospectively to business

combinations for which the acquisition date is on or after the beginning of the first annual reporting period beginning on or after December 15,

2008. Early adoption of FAS 141R is prohibited. The Company does not expect the adoption of FAS 141R to have a material effect on its

financial position and results of operations.

In December 2007, the FASB issued SFAS No. 160, “Non-controlling Interests in Consolidated Financial Statements” (“FAS 160”)

which

amends ARB 51 to establish accounting and reporting standards for the non-

controlling interest in a subsidiary and for the deconsolidation of a

subsidiary. It clarifies that a noncontrolling interest in a subsidiary is an ownership interest in the consolidated entity that should be reported as

equity in the consolidated financial statements. In addition to the amendments to ARB 51, this Statement amends FASB Statement No. 128,

Earnings per Share; so that earnings-per-

share data will continue to be calculated the same way those data were calculated before this Statement

was issued. This Statement is effective for fiscal years, and interim periods within those fiscal years, beginning on or after December 15,

2008. The Company does not expect the adoption of FAS 160 to have a material effect on its financial position or results of operations.

In April 2008, the FASB issued FASB Staff Position ("FSP") No. 142-3, "Determination of the Useful Life of Intangible Assets". FSP 142-

3

amends the factors an entity should consider in developing renewal or extension assumptions used in determining the useful life or recognized

intangible assets under FASB Statement No. 142, "Goodwill and Other Intangible Assets". This new guidance applies prospectively to intangible

assets that are acquired individually or with a group of other assets in business combinations and asset acquisitions. FSP 142-

3 is effective for

financial statements issued for fiscal years and interim periods beginning after December 15, 2008. Early adoption is prohibited. The Company

does not expect the adoption of FSP 142-3 to have a material effect on its financial position or results of operations.

80