Shutterfly 2009 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2009 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SHUTTERFLY, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

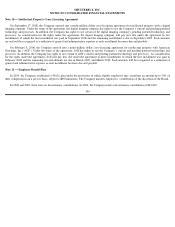

2006 Equity Incentive Plan

In June 2006, the Board adopted, and in September 2006 the Company’s stockholders approved, the 2006 Equity Incentive Plan (the “

2006

Plan”),

and all shares of common stock available for grant under the 1999 Plan transferred to the 2006 Plan. The 2006 Plan provides for the grant

of ISOs to employees (including officers and directors who are also employees) of the Company or of a parent or subsidiary of the Company,

and for the grant of all other types of awards to employees, officers, directors, consultants, independent contractors and advisors of the Company

or any parent or subsidiary of the Company, provided such consultants, independent contractors and advisors render bona-

fide services not in

connection with the offer and sale of securities in a capital-

raising transaction. Other types of awards under the 2006 Plan include NSOs,

restricted stock awards, stock bonus awards, restricted stock units, and performance shares.

Options issued under the 2006 Plan are generally for periods not to exceed 10 years and are issued at the fair value of the shares of common

stock on the date of grant as determined by the Board. Prior to the Company’

s IPO, the Board determined the fair value of common stock in

good faith based on the best information available to the Board and Company’

s management at the time of the grant. Following the IPO, the fair

value of the Company’

s common stock is determined by the last sale price of such stock on the Nasdaq Global Market. Options issued under the

2006 Plan typically vest with respect to 25% of the shares one year after the options’

vesting commencement date, and the remainder ratably on

a monthly basis over the following three years. Option holders under the 2006 Plan are allowed to exercise options prior to vesting.

At the time of adoption of the 2006 Plan, there were 1,358,352 shares of common stock authorized for issuance under the 2006 Plan, plus

92,999 shares of common stock from the 1999 Plan that were unissued. The 2006 Plan provides for automatic replenishments on January 1 of

2008, 2009, and 2010, of the lesser of a) 4.62% of common stock issued and outstanding on the December 31 immediately prior to the date of

increase or b) a lesser number as determined by the Board.

92