Shutterfly 2009 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2009 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Historically we have financed our operations and capital expenditures through operations, private sales of preferred stock, our initial public

offering, lease financing and the use of bank and related-

party loans. As a result of our initial public offering in September 2006, we raised

approximately $78.5 million of proceeds, net of underwriters’

discount and fees, which we received on October 4, 2006. At December 31, 2008,

we had $88.2 million of cash and cash equivalents. Cash equivalents are comprised of money market funds.

At December 31, 2008, $52.3 million par value of our marketable securities portfolio was invested in AAA rated investments in auction-

rate

debt securities ("ARS"). ARS investments are long-term variable rate bonds tied to short-

term interest rates. After the initial issuance of the

securities, the interest rate on the securities is reset periodically, at intervals established at the time of issuance (primarily every twenty eight

days), based on market demand for a reset period. Auction rate securities are bought and sold in the marketplace through a competitive bidding

process often referred to as a “Dutch auction.”

If there is insufficient interest in the securities at the time of an auction, the auction may not be

completed and the rates may be reset to predetermined “penalty” or “maximum” rates.

From the inception of these investments in ARS in January 2008 through February 2009, due to the recent uncertainties in the credit

markets, all scheduled auctions have failed. Consequently, the investments are not currently liquid and we will not be able to access these funds

until a future auction of these investments is successful, the securities are called by the issuer or a buyer is found outside of the auction process.

As a result, we have classified the entire balance of ARS as non-

current investments on our consolidated balance sheet. At the time of the initial

investment and through the date of this report, all of these auction rate securities remain AAA rated. The assets underlying each security are

student loans and 90% of the principal amounts are guaranteed by the Federal Family Education Loan Program (“FFELP”).

Typically, the fair value of ARS investments approximates par value due to the frequent resets through the auction process. While we

continue to earn interest on our ARS investments at the contractual rate, these investments are not currently trading and therefore do not have a

readily determinable market value. Accordingly, the estimated fair value of the ARS investments no longer approximates par value.

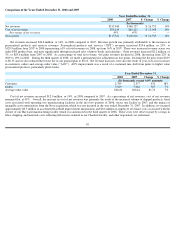

At December 31, 2008, we utilized a discounted cash flow approach to determine the Level 3 valuation for the ARS investments. This

analysis indicated a fair value of $43.3 million. The assumptions used in preparing the discounted cash flow model include estimates for interest

rates, timing and amount of cash flows, credit and liquidity premiums, and expected holding periods of the ARS. These assumptions are volatile

and subject to change as the underlying sources of these assumptions and market conditions change. They represent our estimates given available

data as of December 31, 2008. Based on this assessment of fair value, as of December 31, 2008 we determined there was a decline in fair value

of our ARS investments of $9.0 million.

In November 2008, we accepted an offer from UBS AG (“UBS”), one of our investment advisors, entitling us to sell at par value auction-

rate securities originally purchased from UBS (approximately $52.3 million, par value) at anytime during a two-

year period from June 30, 2010

through July 2, 2012 (the "Rights"). In accepting the Rights, we also granted UBS the authority to sell or auction the ARS at par at any time up

until the expiration date of the offer and released UBS from any claims relating to the marketing and sale of ARS. Although we expect to

sell our ARS under the Rights, if the Rights is not exercised before July 2, 2012, it will expire and UBS will have no further rights or obligation

to buy our ARS. The Rights represent a contractual agreement between us and UBS that will rank senior to UBS' ordinary shares. Throughout

the period from acceptance of the offer until the Rights are redeemed or UBS sells the securities, ARS will continue to accrue interest as

determined by the auction process or the terms outlined in the prospectus of the ARS if the auction process fails. UBS’

s obligations under the

Rights are not secured by its assets and do not require UBS to obtain any financing to support its performance obligations under the

Rights. UBS has disclaimed any assurance that it will have sufficient financial resources to satisfy its obligations under the Rights .

57