Sallie Mae 2001 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2001 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

14

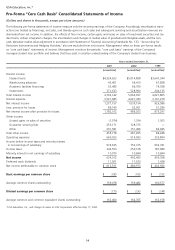

Pro-Forma “Core Cash Basis” Consolidated Statements of Income

(Dollars and shares in thousands, except per share amounts)

The following pro-forma statements of income measure only the recurring earnings of the Company. Accordingly, securitization trans-

actions are treated as financings, not sales, and thereby gains on such sales and subsequent servicing and securitization revenues are

eliminated from net income. In addition, the effects of floor income, certain gains and losses on sales of investment securities and stu-

dent loans, certain integration charges, the amortization and changes in market value of goodwill and intangible assets, and the non-

cash, derivative market value adjustment in accordance with Statement of Financial Accounting Standards No. 133, “Accounting for

Derivative Instruments and Hedging Activities,” also are excluded from net income. Management refers to these pro-forma results

as “core cash basis” statements of income. Management monitors the periodic “core cash basis” earnings of the Company’s

managed student loan portfolio and believes that they assist in a better understanding of the Company’s student loan business.

Years ended December 31,

2001 2000 1999

(unaudited) (unaudited) (unaudited)

Interest income:

Student loans $4,324,623 $5,014,858 $3,641,544

Warehousing advances 43,401 56,410 67,828

Academic facilities financings 53,485 66,709 74,358

Investments 371,633 528,960 244,135

_______________________________________ _______________________________________ _______________________________________

Total interest income 4,793,142 5,666,937 4,027,865

Interest expense 3,521,985 4,627,783 3,101,279

_______________________________________ _______________________________________ _______________________________________

Net interest income 1,271,157 1,039,154 926,586

Less: provision for losses 89,145 52,951 51,289

_______________________________________ _______________________________________ _______________________________________

Net interest income after provision for losses 1,182,012 986,203 875,297

_______________________________________ _______________________________________ _______________________________________

Other income:

(Losses) gains on sales of securities (1,574) 1,334 1,303

Guarantor servicing fees 255,171 128,375 —

Other 201,581 151,496 82,945

_______________________________________ _______________________________________ _______________________________________

Total other income 455,178 281,205 84,248

Operating expenses 660,555 514,093 355,804

_______________________________________ _______________________________________ _______________________________________

Income before income taxes and minority interest

in net earnings of subsidiary 976,635 753,315 603,741

Income taxes 342,553 250,128 187,689

Minority interest in net earnings of subsidiary 10,070 10,694 10,694

_______________________________________ _______________________________________ _______________________________________

Net income 624,012 492,493 405,358

Preferred stock dividends 11,501 11,520 1,438

_______________________________________ _______________________________________ _______________________________________

Net income attributable to common stock $ 612,511 $ 480,973 $ 403,920

_______________________________________ _______________________________________ _______________________________________

_______________________________________ _______________________________________ _______________________________________

_______________________________________ _______________________________________ _______________________________________

Basic earnings per common share $ 3.85 $ 3.02 $ 2.52

_______________________________________ _______________________________________ _______________________________________

_______________________________________ _______________________________________ _______________________________________

_______________________________________ _______________________________________ _______________________________________

Average common shares outstanding 159,078 159,482 160,577

_______________________________________ _______________________________________ _______________________________________

_______________________________________ _______________________________________ _______________________________________

_______________________________________ _______________________________________ _______________________________________

Diluted earnings per common share $ 3.75 $ 2.93 $ 2.48

_______________________________________ _______________________________________ _______________________________________

_______________________________________ _______________________________________ _______________________________________

_______________________________________ _______________________________________ _______________________________________

Average common and common equivalent shares outstanding 163,400 164,355 163,158

_______________________________________ _______________________________________ _______________________________________

_______________________________________ _______________________________________ _______________________________________

_______________________________________ _______________________________________ _______________________________________

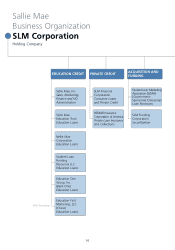

*USA Education, Inc., will change its name to SLM Corporation effective May 17, 2002.

USA Education, Inc.*