Sallie Mae 2001 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2001 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

9

several years. We grew capital, yet maintained an active share repurchase program. These and other

financial successes led us to accelerate our planned GSE exit to September 30, 2006, two years earlier

than originally scheduled.

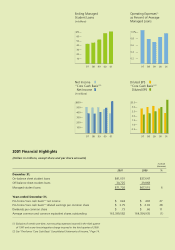

Yes, we had a good year in 2001. We achieved “core cash basis” diluted earnings per share of $3.75, a

28 percent increase over 2000 and well beyond our 15 percent, long-term earnings target. We are in an

enviable position; we can see meeting our growth targets well into the future in businesses we know.

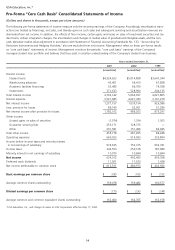

Financial Integrity. Few 2001 annual reports will be issued without some commentary about

financial integrity. You probably already know that Sallie Mae reports earnings on both GAAP and

“core cash basis.” The operating results of each approach are presented in this report, and we hope

you find the extra information more useful than confusing. The “core cash basis” results are critical for

us to judge our own financial performance accurately. Sadly, today’s GAAP distorts the economics of

several of our asset/liability funding mechanisms and creates misleading earnings volatility. The inher-

ent conservatism of the core cash methodology will lead to lower reported earnings over time than

will GAAP, though short-term fluctuations in either direction can be very material.

Giving Back. In 2001, Sallie Mae demonstrated a commitment to serving the communities where

our customers and our employees live and work. Our philanthropic arm, The Sallie Mae Fund, under-

took the launch of “First in My Family,” an effort designed to encourage young Hispanic-Americans to

be first in their family to go to college. Also, we created the Sallie Mae 911 Education Fund shortly

after the terrorist attacks to relieve affected families of their student loan debt and provide scholarship

funds. We are pleased that numerous families have participated in this program, and we expect to see

many more as days pass. Like you, we were horrified by the events of September 11, and we hope

our efforts are meaningful to the victims of these atrocities.

The next several years present dramatic market opportunities for Sallie Mae. We will take advantage

of each chance we see to enhance our scale, build markets for our key services, grow student loan

share and diversify our funding sources. We expect an exciting 2002.

Strategic Priorities. Immediate strategic priorities are the Higher Education Act Reauthorization

process and our accelerated transition from GSE status to a fully private-sector corporation. We see

these as opportunities to strengthen the nation’s student loan delivery system and Sallie Mae. Sallie

Mae is very proud of its role in delivering the FFELP which is, in our opinion, a tremendous bargain for

the American taxpayer. Taxpayers pay less today to make and maintain FFELP loans than they did 10

years ago. Better collection practices can lower that cost even further. We believe Congress and the

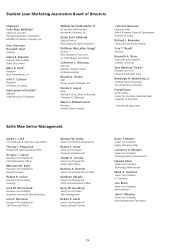

Albert L. Lord Thomas J. Fitzpatrick