Sallie Mae 2001 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2001 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

8

Dear Fellow Shareholders: We begin this letter by paying tribute to our employees. They met

the challenge to effect 2001’s enormous changes and turned out a record performance. In the wake

of our mid-year 2000 purchase of USA Group, we expected 2001 to begin a period of stronger

growth and new direction for Sallie Mae. Those expectations proved accurate—2001 was indeed a

very good year. Our 6,000-plus employees stepped up to make it happen.

For starters, we passed a major milestone: $10 billion of preferred channel loan originations, 40 percent

above 2000. Our expanding sales force, armed with the best array of financial aid products, success-

fully added many new schools and enhanced our business with existing school customers.

We are particularly proud of our operations teams. They processed $14.5 billion of loan acquisitions

(preferred channel plus $5 billion of additional loan purchases) and implemented most of our complex

integration activities. They executed flawlessly through peak season. Their “can-do” approach kept

our spirits high during that critical period.

Our late summer peak season proved even stronger than anticipated. Confronted with record applica-

tion and disbursement activity, we blinked and decided to put customer satisfaction ahead of meeting

every self-imposed integration deadline. Our productivity goals were postponed, our cost-reduction

goals were not met—but not canceled—and we expect to deliver further efficiencies again in 2002.

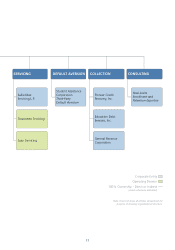

Effective Integration. Sallie Mae’s successes of 2001 resulted in large part from the value inherent

in the 2000 USA Group transaction and effective integration of their activities. We believe we have

blended the talent and dedication of our new workforce. Our customers report that we passed the

most important test: They did not even notice we integrated. The merger put us into the guarantor

services and loan collection businesses—with growth potential that fits our capabilities and produces

fee income using very little balance sheet and capital. We grew USA Funds guarantees 8 percent in

2001, up from just 6 percent in 2000. We expect to step up that performance significantly in 2002.

We like the student loan collection business and will aggressively pursue market share. This business

can cut taxpayer cost dramatically. We see a challenge in reducing the more than $30 billion of stu-

dent loan paper that remains uncollected. Today, we manage only $6 billion of that total. Already

in 2002, we have strengthened ourselves for this task with the acquisitions of Pioneer Credit and

General Revenue Corporation, two highly successful student loan collection experts.

Last year, our corporate finance group effectively solidified the right side of our balance sheet. They

used 2001’s benign interest rate environment to provide lower and more stable borrowing costs for

Letter from the CEO

and President

“We expected 2001 to begin a

period of stronger growth and

new direction for Sallie Mae.

Those expectations proved

accurate—2001 was indeed

a very good year.”