Red Lobster 2008 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2008 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

DARDEN RESTAURANTS, INC. 63

NOTE 12

FINANCIAL INSTRUMENTS

The fair values of cash equivalents, accounts receivable, accounts

payable and short-term debt approximate their carrying amounts

due to their short duration.

The carrying value and fair value of long-term debt at

May 25, 2008 was $1.63 billion and $1.62 billion, respectively.

The carrying value and fair value of long-term debt at May 27,

2007 was $491.6 million and $496.3 million, respectively. The

fair value of long-term debt is determined based on market

prices or, if market prices are not available, the present value

of the underlying cash flows discounted at our incremental

borrowing rates.

NOTE 13

STOCKHOLDERS’ EQUITY

TREASURY STOCK

On June 16, 2006, our Board of Directors authorized an

additional share repurchase authorization totaling 25.0 million

shares in addition to the previous authorization of 137.4 million

shares, bringing our total authorizations to 162.4 million.

In fiscal 2008, 2007 and 2006, we purchased treasury stock

totaling $159.4 million, $371.2 million and $434.2 million,

respectively. At May 25, 2008, a total of 147.0 million shares

had been repurchased under the authorizations. The

repurchased common stock is reflected as a reduction of

stockholders’ equity.

STOCK PURCHASE/LOAN PROGRAM

We have share ownership guidelines for our officers. To assist

them in meeting these guidelines, we implemented the 1998

Stock Purchase/Option Award Loan Program (Loan Program)

in conjunction with our Stock Option and Long-Term Incentive

Plan of 1995. The Loan Program provided loans to our officers

and awarded two options for every new share purchased, up to

a maximum total share value equal to a designated percentage

of the officer’s base compensation. Loans are full recourse

and interest bearing, with a maximum principal amount of

75 percent of the value of the stock purchased. The stock

purchased is held on deposit with us until the loan is repaid.

The interest rate for loans under the Loan Program is fixed

and is equal to the applicable federal rate for mid-term loans

with semi-annual compounding for the month in which the

loan originates. Interest is payable on a weekly basis. Loan

principal is payable in installments with 25 percent, 25 percent

and 50 percent of the total loan due at the end of the fifth,

sixth and seventh years of the loan, respectively. Effective

July 30, 2002, and in compliance with the Sarbanes-Oxley

Act of 2002, we no longer issue new loans under the Loan

Program. We account for outstanding officer notes receivable

as a reduction of stockholders’ equity.

STOCKHOLDERS’ RIGHTS PLAN

Under our Rights Agreement dated May 16, 2005, each share

of our common stock has associated with it one right to

purchase one-thousandth of a share of our Series A Participating

Cumulative Preferred Stock at a purchase price of $120 per

share, subject to adjustment under certain circumstances to

prevent dilution. The rights are exercisable when, and are not

transferable apart from our common stock until, a person or

group has acquired 15 percent or more, or makes a tender

offer for 15 percent or more, of our common stock. If the

specified percentage of our common stock is then acquired,

each right will entitle the holder (other than the acquiring

company) to receive, upon exercise, common stock of either

us or the acquiring company having a value equal to two times

the exercise price of the right. The rights are redeemable

by our Board of Directors under certain circumstances and

expire on May 25, 2015.

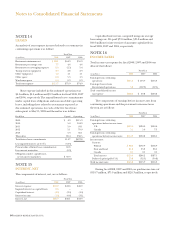

ACCUMULATED OTHER

COMPREHENSIVE INCOME (LOSS)

The components of accumulated other comprehensive

income (loss) are as follows:

May 25, May 27,

(in millions)

2008 2007

Foreign currency translation adjustment $ (1.0) $ (4.3)

Unrealized gains (losses) on derivatives, net of tax 4.5 3.8

SFAS No. 158 benefit plan funding position,

net of tax (24.2) (32.3)

Total accumulated other comprehensive

income (loss) $(20.7) $(32.8)

Reclassification adjustments associated with pre-tax net

derivative gains (losses) realized in net earnings for fiscal 2008,

2007 and 2006 amounted to ($1.8) million, ($1.3) million and

$5.0 million, respectively. The amortization of the unrecognized

net actuarial loss component of our fiscal 2009 net periodic

benefit cost for the defined benefit plans and postretirement

benefit plan is expected to be approximately $0.4 million and

$0.6 million, respectively.