Red Lobster 2008 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2008 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DARDEN RESTAURANTS, INC. 35

Management’s Discussion and Analysis of Financial Condition

and Results of Operations

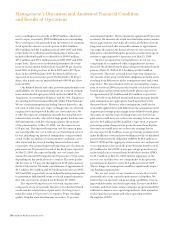

funds rate plus 0.500 percent). Assuming a “BBB” equivalent

credit rating level, the applicable margin under the New Revolving

Credit Agreement will be 0.350 percent. We may also request

that loans under the New Revolving Credit Agreement be made

at interest rates offered by one or more of the Revolving Credit

Lenders, which may vary from the LIBOR or base rate, for up

to $100.0 million of borrowings. The New Revolving Credit

Agreement requires that we pay a facility fee on the total amount

of such facility (ranging from 0.070 percent to 0.175 percent,

based on our credit ratings) and, in the event that the outstand-

ing amounts under the applicable New Revolving Credit

Agreement exceeds 50 percent of such New Revolving Credit

Agreement, a utilization fee on the total amount outstanding

under such facility (ranging from 0.050 percent to 0.150 percent,

based on our credit ratings). As of May 25, 2008, $130.0 million

was outstanding under the New Revolving Credit Agreement.

In addition, $48.4 million of commercial paper was outstanding

as of May 25, 2008, which is backed by this facility.

On October 11, 2007, we issued $350.0 million of unsecured

5.625 percent senior notes due October 2012, $500.0 million

of unsecured 6.200 percent senior notes due October 2017

and $300.0 million of unsecured 6.800 percent senior notes

due October 2037 (collectively, the New Senior Notes) under

a registration statement filed with the Securities and Exchange

Commission (SEC) on October 9, 2007. Discount and issuance

costs, which were $4.3 million and $11.7 million, respectively,

are being amortized over the terms of the New Senior Notes

using the straight-line method, the results of which approxi-

mate the effective interest method. The interest rate payable

on each series of the New Senior Notes will be subject to

adjustment from time to time if the debt rating assigned to

such series of the New Senior Notes is downgraded below a

certain rating level (or subsequently upgraded). The maxi-

mum adjustment is 2.000 percent above the initial interest

rate and the interest rate cannot be reduced below the initial

interest rate. As of May 25, 2008, no such adjustments to the

interest rates had been made. We may redeem any series of the

New Senior Notes at any time in whole or from time to time in

part, at the principal amount plus a make-whole premium. If

we experience a change of control triggering event, we may be

required to purchase the New Senior Notes from the holders.

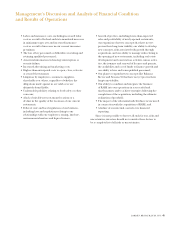

During the second quarter of fiscal 2008, we entered into

treasury-lock derivative instruments with $550.0 million of

notional value to hedge a portion of the risk of changes in

the benchmark interest rate prior to the issuance of the New

Senior Notes, as changes in the benchmark interest rate would

cause variability in our forecasted interest payments. These

instruments were all settled at the issuance of the New Senior

Notes for a cumulative gain of $6.2 million. This amount was

recorded in accumulated other comprehensive income (loss)

and will be reclassified into earnings as an adjustment to

interest expense as interest on the New Senior Notes or similar

debt is incurred. A gain of $0.5 million was recognized in earn-

ings during fiscal 2008 as an adjustment to interest expense.

During the fourth quarter of fiscal 2008, we also entered

into treasury-lock derivative instruments with $100.0 million

of notional value to hedge a portion of the risk of changes

in the benchmark interest rate associated with the expected

issuance of the long-term debt to refinance our existing

long-term debt due to mature in fiscal 2011, as changes in the

benchmark interest rate will cause variability in our forecasted

interest payments. The fair value of these outstanding treasury-

lock derivative instruments was a net gain of $2.3 million at

May 25, 2008 and is included, net of tax of $0.9 million, in

accumulated other comprehensive income (loss).

On August 12, 2005, we issued $150.0 million of unsecured

4.875 percent senior notes due in August 2010 and $150.0 mil-

lion of unsecured 6.000 percent senior notes due in August

2035 under our prior shelf registration statement on file with

the SEC. The net proceeds of $295.4 million from the issuance

of these senior notes were used to repay at maturity our $150.0

million of 8.375 percent senior notes on September 15, 2005

and our $150.0 million of 6.375 percent notes on February 1,

2006. In March 2007, we repaid, at maturity our $150.0 mil-

lion unsecured 5.750 percent medium-term notes with cash

from operations and short-term borrowings.

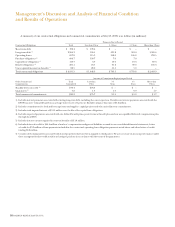

At May 25, 2008, our long-term debt consisted principally of:

• $150.0 million of unsecured 4.875 percent senior notes

due in August 2010;

• $75.0 million of unsecured 7.450 percent medium-term

notes due in April 2011;

• $350.0 million of unsecured 5.625 percent senior notes

due in October 2012;

• $100.0 million of unsecured 7.125 percent debentures

due in February 2016;

• $500.0 million of unsecured 6.200 percent senior notes

due in October 2017;

• $150.0 million of unsecured 6.000 percent senior notes

due in August 2035;

• $300.0 million of unsecured 6.800 percent senior notes

due in October 2037; and

• An unsecured, variable rate $15.5 million commercial

bank loan due in December 2018 that is used to sup-

port two loans from us to the Employee Stock Owner-

ship Plan portion of the Darden Savings Plan.

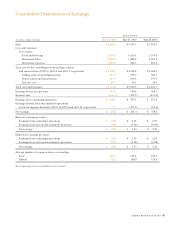

Through our shelf registration statement on file with the

SEC, we may issue an indeterminate amount of unsecured

debt securities from time to time in one or more series,

which may consist of notes, debentures or other evidences of

indebtedness in one or more offerings.