Red Lobster 2008 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2008 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements

DARDEN RESTAURANTS, INC. 61

experience a change of control triggering event, we may be

required to purchase the New Senior Notes from the holders.

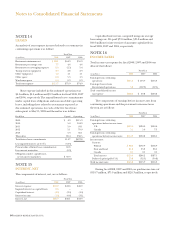

All of our long-term debt currently outstanding is expected

to be repaid entirely at maturity with interest being paid semi-

annually over the life of the debt. The aggregate maturities

of long-term debt for each of the five fiscal years subsequent

to May 25, 2008, and thereafter are $0.0 million in 2009 and

2010, $225.0 million in 2011, $0.0 million in 2012, $350.0 million

in 2013 and $1.06 billion thereafter.

NOTE 11

DERIVATIVE INSTRUMENTS AND

HEDGING ACTIVITIES

We use interest rate-related derivative instruments to manage

our exposure on debt instruments, as well as commodities

derivatives to manage our exposure to commodity price

fluctuations. We also use equity-related derivative instruments

to manage our exposure on cash compensation arrangements

indexed to the market price of our common stock. By using

these instruments, we expose ourselves, from time to time,

to credit risk and market risk. Credit risk is the failure of the

counterparty to perform under the terms of the derivative

contract. When the fair value of a derivative contract is posi-

tive, the counterparty owes us, which creates credit risk for

us. We minimize this credit risk by entering into transactions

with high quality counterparties. Market risk is the adverse

effect on the value of a financial instrument that results from

a change in interest rates, commodity prices, or the market

price of our common stock. We minimize this market risk by

establishing and monitoring parameters that limit the types

and degree of market risk that may be undertaken.

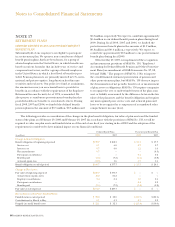

OPTION CONTRACTS AND COMMODITY SWAPS

During fiscal 2008, 2007 and 2006, we entered into option con-

tracts and commodity swaps to reduce the risk of natural gas

price fluctuations. To the extent these derivatives are effective

in offsetting the variability of the hedged cash flows, changes in

the derivatives’ fair value are not included in current earnings

but are included in accumulated other comprehensive income

(loss). These changes in fair value are subsequently reclassified

into earnings as a component of restaurant expenses when the

natural gas is purchased and used by us in our operations. Net

gains (losses) of $0.4 million, ($4.6) million and $4.3 million

related to these derivatives were reclassified to earnings during

fiscal 2008, 2007 and 2006, respectively, in connection with

the settlement of our contracts. As of May 25, 2008, we were

party to natural gas commodity swaps with aggregate notional

values of $11.3 million. The fair value of these contracts was

a net gain of $0.1 million at May 25, 2008 and is expected

to be reclassified from accumulated other comprehensive

income (loss) into restaurant expenses during fiscal 2009. To

the extent that these derivatives are no longer highly effective

in offsetting changes in cash flows related to our purchases

of natural gas, hedge accounting would be discontinued

and future changes in their fair value would be immediately

recognized in current earnings.

During fiscal 2008, we entered into commodity swaps to

reduce the risk of fluctuations in the price we pay for butter

during fiscal 2009. To the extent these derivatives are effective

in offsetting the variability of the hedged cash flows, changes

in the derivatives’ fair value are not included in current earn-

ings but are included in accumulated other comprehensive

income (loss). These changes in fair value will subsequently be

reclassified into earnings as a component of food and beverage

expenses when the butter is purchased and used by us in our

operations. As of May 25, 2008, we were party to butter com-

modity swaps with aggregate notional values of $5.8 million.

The fair value of these contracts was a net gain of $0.1 million

at May 25, 2008 and is expected to be reclassified from accu-

mulated other comprehensive income (loss) into restaurant

expenses during fiscal 2009. To the extent that these derivatives

are no longer highly effective in offsetting changes in cash

flows related to our purchases of natural gas, hedge accounting

would be discontinued and future changes in their fair value

would be immediately recognized in current earnings.

The fair value of outstanding derivatives is included in

other current assets or other current liabilities. At May 25,

2008, the fair value of our outstanding commodity swaps was

$0.2 million and is included in other current assets in our

accompanying consolidated balance sheets. As of May 25,

2008, the maximum length of time over which we are hedging

our exposure to the variability in future cash flows related to

the purchase of natural gas and butter is six months.

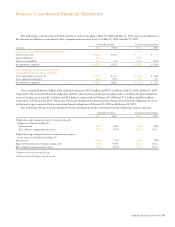

INTEREST RATE LOCK AGREEMENT

During the second quarter of fiscal 2008, we entered into

treasury-lock derivative instruments with $550.0 million of

notional value to hedge a portion of the risk of changes in

the benchmark interest rate prior to the issuance of the New

Senior Notes, as changes in the benchmark interest rate

would cause variability in our forecasted interest payments.

These instruments were all settled at the issuance of the

New Senior Notes for a cumulative gain of $6.2 million. This

amount was recorded in accumulated other comprehensive

income (loss) and will be reclassified into earnings as an

adjustment to interest expense as interest on the New Senior

Notes or similar debt is incurred. A gain of $0.5 million was

recognized in earnings during fiscal 2008 as an adjustment to

interest expense.