Red Lobster 2008 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2008 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DARDEN RESTAURANTS, INC. 47

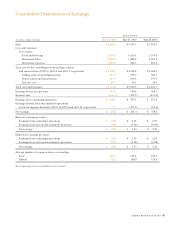

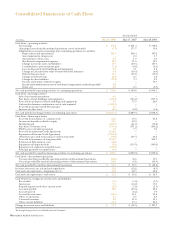

Consolidated Statements of Changes in Stockholders’ Equity and

Accumulated Other Comprehensive Income (Loss)

Common Accumulated Other Total

Stock and Retained Treasury Comprehensive Unearned Officer Notes Stockholders’

(In millions, except per share data)

Surplus Earnings Stock Income (Loss) Compensation Receivable Equity

Balances at May 29, 2005 $1,703.3 $1,405.7 $(1,784.8) $ (8.9) $(41.6) $(0.7) $1,273.0

Comprehensive income:

Net earnings – 338.2 – – – – 338.2

Other comprehensive income (loss):

Foreign currency adjustment – – – 3.9 – – 3.9

Change in fair value of derivatives,

net of tax of $0.4 – – – (0.5) – – (0.5)

Total comprehensive income 341.6

Cash dividends declared ($0.40 per share) – (59.2) – – – – (59.2)

Stock option exercises (3.9 shares) 49.3 – 6.3 – – – 55.6

Issuance of restricted stock (0.4 shares), net

of forfeiture adjustments 13.5 – – – (13.5) – –

Stock-based compensation – – – – 7.4 – 7.4

ESOP note receivable repayments – – – – 3.5 – 3.5

Income tax benefits credited to equity 34.3 – – – – – 34.3

Purchases of common stock for treasury (11.9 shares) – – (434.2) – – – (434.2)

Issuance of treasury stock under Employee Stock

Purchase Plan and other plans (0.2 shares) 6.0 – 1.5 – – – 7.5

Repayment of officer notes – – – – – 0.3 0.3

Balances at May 28, 2006 $1,806.4 $1,684.7 $(2,211.2) $ (5.5) $(44.2) $(0.4) $1,229.8

Comprehensive income:

Net earnings – 201.4 – – – – 201.4

Other comprehensive income (loss):

Foreign currency adjustment – – – 0.5 – – 0.5

Change in fair value of derivatives,

net of tax of 1.9 – – – 4.0 – – 4.0

Total comprehensive income 205.9

Adjustment related to adoption of SFAS No. 158,

net of tax of $19.6 – – – (31.8) – – (31.8)

Cash dividends declared ($0.46 per share) – (65.7) – – – – (65.7)

Stock option exercises (3.6 shares) 46.1 – 4.8 – – – 50.9

Reclassification of unearned compensation

(transition of SFAS 123(R)) (20.2) – – – 20.2 – –

Stock-based compensation 26.2 – – – – – 26.2

ESOP note receivable repayments – – – – 3.3 – 3.3

Income tax benefits credited to equity 40.0 – – – – – 40.0

Purchases of common stock for treasury (9.4 shares) – – (371.2) – – – (371.2)

Issuance of treasury stock under Employee Stock

Purchase Plan and other plans (0.2 shares) 5.8 – 1.1 – 0.1 – 7.0

Repayment of officer notes – – – – – 0.1 0.1

Balances at May 27, 2007 $1,904.3 $1,820.4 $(2,576.5) $(32.8) $(20.6) $(0.3) $1,094.5

Comprehensive income:

Net earnings – 377.2 – – – – 377.2

Other comprehensive income (loss):

Foreign currency adjustment – – – 3.3 – – 3.3

Change in fair value of derivatives,

net of tax of $2.6 – – – 0.7 – – 0.7

Benefit plans, net of tax of $5.0 – – – 8.1 – – 8.1

Total comprehensive income 389.3

Adjustment related to adoption of FIN 48,

net of tax of $0.4 – (0.7) – – – – (0.7)

Cash dividends declared ($0.72 per share) – (100.9) – – – – (100.9)

Stock option exercises (3.3 shares) 53.6 – 7.9 – – – 61.5

Stock-based compensation 46.6 – – – – – 46.6

Stock-based awards included in cost of

RARE acquisition 40.5 – – – – – 40.5

ESOP note receivable repayments – – – – 3.6 – 3.6

Income tax benefits credited to equity 23.5 – – – – – 23.5

Purchases of common stock for treasury (5.0 shares) – – (159.4) – – – (159.4)

Issuance of treasury stock under Employee

Stock Purchase Plan and other plans (0.2 shares) 6.4 – 4.0 – – – 10.4

Repayment of officer notes – – – – – 0.2 0.2

Balances at May 25, 2008 $2,074.9 $2,096.0 $(2,724.0) $(20.7) $(17.0) $(0.1) $1,409.1

See accompanying notes to consolidated financial statements.