Red Lobster 2008 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2008 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DARDEN RESTAURANTS, INC. 27

Management’s Discussion and Analysis of Financial Condition

and Results of Operations

Our net earnings (losses) from discontinued operations

were $7.7 million and ($175.7) million for fiscal 2008 and 2007,

respectively. Our diluted net earnings (losses) per share from

discontinued operations were $0.05 and ($1.18) for fiscal 2008

and 2007, respectively. The gain on the sale of Smokey Bones

contributed approximately $0.08 to diluted net earnings per

share from discontinued operations in fiscal 2008. When

combined with results from continuing operations, our diluted

net earnings per share were $2.60 and $1.35 for fiscal 2008

and 2007, respectively.

In fiscal 2009, we expect a net increase of approximately

75 to 80 restaurants. We expect combined U.S. same-restaurant

sales growth in fiscal 2009 of approximately 2 percent for Red

Lobster, Olive Garden and LongHorn Steakhouse. We expect

total sales growth of between 14 percent and 15 percent compared

to sales from continuing operations of $6.63 billion in fiscal

2008. This sales growth includes the impact of a 53rd week

in fiscal 2009, which we estimate will be 2 percentage points.

Diluted net earnings per share growth from continuing opera-

tions is expected to be between 14 percent and 15 percent

including the impact of the 53rd week of approximately two

percentage points. Transaction and integration-related costs

and purchase accounting adjustments are expected to favorably

impact diluted net earnings per share growth from fiscal 2008

to fiscal 2009 by approximately 5 percentage points.

In June 2008, we announced that we would pay a quarterly

dividend of 20 cents per share on August 1, 2008. Previously,

we had paid a quarterly dividend of 18 cents per share or

72 cents per share on an annual basis. Based on the 20 cent

quarterly dividend declaration, our indicated annual dividend

is 80 cents per share, an 11 percent increase.

Our mission is to be the best in full-service dining, now

and for generations. We believe we can achieve this goal

by continuing to build on our strategy to be a multi-brand

restaurant growth company, which is grounded in:

• Competitively superior leadership;

• Strong brand building that reflects brand management

and restaurant operating excellence; and

• Brand support excellence.

We seek to increase profits by leveraging our fixed and

semi-fixed costs with sales from new restaurants and increased

guest traffic and sales at existing restaurants. To evaluate our

operations and assess our financial performance, we monitor

a number of operating measures, with a special focus on two

key factors:

• Same-restaurant sales – which is a year-over-year

comparison of each period’s sales volumes for restaurants

open at least 16 months, including recently acquired

restaurants, absent consideration of when the restaurants

were acquired; and

• Restaurant earnings – which is restaurant-level

profitability (restaurant sales, less restaurant-level

cost of sales, marketing and depreciation).

Increasing same-restaurant sales can improve restaurant

earnings because these incremental sales provide better leverage

of our fixed and semi-fixed restaurant-level costs. A restaurant

concept can generate same-restaurant sales increases through

increases in guest traffic, increases in the average guest check,

or a combination of the two. The average guest check can

be impacted by menu price changes and by the mix of menu

items sold. For each restaurant concept, we gather daily sales

data and regularly analyze the guest traffic counts and the

mix of menu items sold to aid in developing menu pricing,

product offerings and promotional strategies. We view same-

restaurant guest counts as a measure of the long-term health

of a restaurant concept, while increases in average check and

menu mix may contribute more significantly to near-term

profitability. We focus on balancing our pricing and product

offerings with other initiatives to produce sustainable same-

restaurant sales growth.

We compute same-restaurant sales using restaurants open

at least 16 months because new restaurants experience a period

of time before sales levels normalize. Sales at newly opened

restaurants generally do not make a significant contribution to

profitability in their initial months of operation due to operating

inefficiencies. Our sales and expenses can be impacted significantly

by the number and timing of the opening of new restaurants

and the closing, relocation and remodeling of existing

restaurants. Pre-opening expenses each period reflect the

costs associated with opening new restaurants in current and

future periods.

There are significant risks and challenges that could

impact our operations and ability to increase sales and earn-

ings. The full-service dining restaurant industry is intensely

competitive and sensitive to economic cycles and other

business factors, including changes in consumer tastes and

dietary habits. Other risks and uncertainties are discussed in

Forward-Looking Statements found elsewhere in this report.

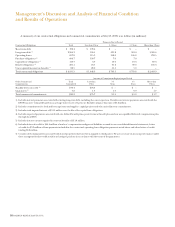

RESULTS OF OPERATIONS FOR

FISCAL 2008, 2007 AND 2006

The following table sets forth selected operating data as a

percentage of sales from continuing operations for the

52-week periods ended May 25, 2008, May 27, 2007 and May 28,

2006. This information is derived from the consolidated state-

ments of earnings, found elsewhere in this report. Additionally,

this information and the following analysis have been presented

with the results of operations, gains and losses on disposition,

impairment charges and closing costs for the Smokey Bones and

Rocky River Grillhouse restaurants and the nine closed Bahama

Breeze restaurants classified as discontinued operations for all