Red Lobster 2008 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2008 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DARDEN RESTAURANTS, INC. 39

Management’s Discussion and Analysis of Financial Condition

and Results of Operations

OFF-BALANCE SHEET ARRANGEMENTS

We are not a party to any off-balance sheet arrangements that

have, or are reasonably likely to have, a current or future

material effect on our financial condition, changes in financial

condition, sales or expenses, results of operations, liquidity,

capital expenditures or capital resources.

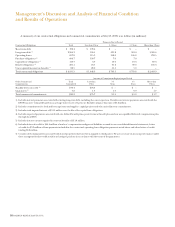

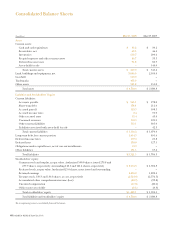

FINANCIAL CONDITION

Our total current assets were $467.9 million at May 25, 2008,

compared with $545.4 million at May 27, 2007. The decrease

resulted primarily from a decrease in assets held for sale

related primarily to the sale of Smokey Bones to BII, partially

offset by increases in current liabilities related to the addition

of RARE.

Our total current liabilities were $1.14 billion at May 25,

2008, compared with $1.07 billion at May 27, 2007. The increase

in current liabilities resulted primarily from an increase in our

level of operations due to the acquisition of RARE, partially

offset by the effects of the adoption of FIN 48 and the related

reclassification of reserves for uncertain tax positions to non-

current liabilities, and a reduction in liabilities associated with

assets held for sale related to the sale of Smokey Bones to BII.

QUANTITATIVE AND QUALITATIVE DISCLOSURES

ABOUT MARKET RISK

We are exposed to a variety of market risks, including fluctuations

in interest rates, foreign currency exchange rates, compensa-

tion and commodity prices. To manage this exposure, we

periodically enter into interest rate, foreign currency exchange,

equity forwards and commodity instruments for other than

trading purposes (see Notes 1 and 11 of the Notes to Consolidated

Financial Statements, included elsewhere in this report).

We use the variance/covariance method to measure value

at risk, over time horizons ranging from one week to one

year, at the 95 percent confidence level. At May 25, 2008, our

potential losses in future net earnings resulting from changes

in foreign currency exchange rate instruments, commodity

instruments, equity forwards and floating rate debt interest

rate exposures were approximately $12.5 million over a

period of one year (including the impact of the interest

rate swap agreements discussed in Note 11 of the Notes to

Consolidated Financial Statements, included elsewhere in this

report). The value at risk from an increase in the fair value of

all of our long-term fixed rate debt, over a period of one year,

was approximately $159.4 million. The fair value of our long-

term fixed rate debt during fiscal 2008 averaged $1.22 billion,

with a high of $1.69 billion and a low of $468.4 million. Our

interest rate risk management objective is to limit the impact

of interest rate changes on earnings and cash flows by target-

ing an appropriate mix of variable and fixed rate debt.

APPLICATION OF NEW ACCOUNTING STANDARDS

In September 2006, the FASB issued SFAS No. 157, “Fair Value

Measures.” SFAS No. 157 defines fair value, establishes a

framework for measuring fair value and enhances disclosures

about fair value measures required under other accounting

pronouncements, but does not change existing guidance as

to whether or not an instrument is carried at fair value. For

financial assets and liabilities, SFAS No. 157 is effective for fiscal

years beginning after November 15, 2007, which will require

us to adopt these provisions in fiscal 2009. For nonfinancial

assets and liabilities, SFAS No. 157 is effective for fiscal years

beginning after November 15, 2008, which will require us to

adopt these provisions in fiscal 2010. We do not believe the

adoption of SFAS No. 157 will have a significant impact on

our consolidated financial statements.

In February 2007, the FASB issued SFAS No. 159 “The

Fair Value Option for Financial Assets and Financial Liabilities.”

SFAS No. 159 provides companies with an option to report

selected financial assets and financial liabilities at fair value.

Unrealized gains and losses on items for which the fair value

option has been elected are reported in earnings at each

subsequent reporting date. SFAS No. 159 is effective for fiscal

years beginning after November 15, 2007, which will require

us to adopt these provisions in fiscal 2009. We do not believe

the adoption of SFAS No. 159 will have a significant impact on

our consolidated financial statements.

In December 2007, the FASB issued SFAS No. 141R,

“Business Combinations.” SFAS No. 141R provides

companies with principles and requirements on how an

acquirer recognizes and measures in its financial statements

the identifiable assets acquired, liabilities assumed, and any

noncontrolling interest in the acquiree as well as the recogni-

tion and measurement of goodwill acquired in a business

combination. SFAS No. 141R also requires certain disclosures

to enable users of the financial statements to evaluate the

nature and financial effects of the business combination.

Acquisition costs associated with the business combination

will generally be expensed as incurred. SFAS No. 141R is

effective for business combinations occurring in fiscal years

beginning after December 15, 2008, which will require us to

adopt these provisions for business combinations occurring

in fiscal 2010 and thereafter. Early adoption of SFAS No.

141R is not permitted. We do not believe the adoption of

SFAS No. 141R will have a significant impact on our consoli-

dated financial statements; however, the application of this

standard will significantly change how we account for future

business combinations.