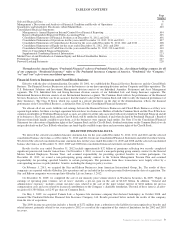

Prudential 2012 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2012 Prudential annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Sensitivity

For the variable and universal life policies of our Individual Life segment, a significant portion of our gross profits is derived from

mortality margins. As a result, our estimates of future gross profits are significantly influenced by our mortality assumptions. Our mortality

assumptions represent our expected claims experience over the life of these policies and are developed based on Company experience or

standard industry tables. Unless a material change in mortality experience that we feel is indicative of a long term trend is observed in an

interim period, we generally update our mortality assumptions annually in the third quarter. Updates to our mortality assumptions in future

periods could have a significant adverse or favorable effect on the results of our operations in the Individual Life segment.

The DAC balance associated with the variable and universal life policies of our Individual Life segment as of December 31, 2012 was

$1.7 billion. The following table provides a demonstration of the sensitivity of that DAC balance relative to our future mortality

assumptions by quantifying the adjustments that would be required, assuming both an increase and decrease in our future mortality rate by

1%. While the information below is for illustrative purposes only and does not reflect our expectations regarding future mortality

assumptions, it is a near-term, reasonably likely hypothetical change that illustrates the potential impact of such a change. This information

considers only the direct effect of changes in our mortality assumptions on the DAC balance, with no changes in any other assumptions

such as persistency, future rate of return, or expenses included in our evaluation of DAC, and does not reflect changes in reserves, such as

the unearned revenue reserve, which would partially offset the adjustments to the DAC balance reflected below. The impact of the

unearned revenue reserve is discussed in more detail below in “—Policyholder Liabilities.”

December 31, 2012

Increase/(Reduction) in DAC

(in millions)

Decrease in future mortality by 1% ...................................................................... $38

Increase in future mortality by 1% ....................................................................... $(38)

For a discussion of DAC adjustments related to our Individual Life segment for the years ended December 31, 2012, 2011 and 2010, see

“—Results of Operations for Financial Services Businesses by Segment—U.S. Individual Life and Group Insurance Division—Individual

Life.”

For variable annuity contracts, DAC and DSI are more sensitive to changes in our future rate of return assumptions due primarily to

the significant portion of our gross profits that is dependent upon the total rate of return on assets held in separate account investment

options, and the shorter average life of the contracts. The DAC and DSI balances associated with our domestic variable annuity contracts

were $3.8 billion and $1.4 billion, respectively, as of December 31, 2012. The following table provides a demonstration of the sensitivity of

each of these balances relative to our future rate of return assumptions by quantifying the adjustments to each balance that would be

required assuming both an increase and decrease in our future rate of return by 100 basis points. The sensitivity includes an increase and

decrease of 100 basis points to both the near-term future rate of return assumptions used over the next four years, and the long-term

expected rate of return used thereafter. While the information below is for illustrative purposes only and does not reflect our expectations

regarding future rate of return assumptions, it is a near-term, reasonably likely hypothetical change that illustrates the potential impact of

such a change. This information considers only the direct effect of changes in our future rate of return on the DAC and DSI balances and

not changes in any other assumptions such as persistency, mortality, or expenses included in our evaluation of DAC and DSI. Further, this

information does not reflect changes in reserves, such as the reserves for the guaranteed minimum death and optional living benefit features

of our variable annuity products, or the impact that changes in such reserves may have on the DAC and DSI balances.

December 31, 2012

Increase/

(Reduction) in DAC

Increase/

(Reduction) in DSI

(in millions)

Decrease in future rate of return by 100 basis points .............................................. $(189) $(80)

Increase in future rate of return by 100 basis points ............................................... $153 $66

For a discussion of DAC and DSI adjustments related to our Individual Annuities segment for the years ended December 31, 2012,

2011 and 2010, see “—Results of Operations for Financial Services Businesses by Segment—U.S. Retirement Solutions and Investment

Management Division—Individual Annuities.”

Value of Business Acquired

In addition to DAC and DSI, we also recognize an asset for value of business acquired, or VOBA. VOBA includes an explicit

adjustment to reflect the cost of capital attributable to the acquired insurance contracts, and represents an adjustment to the stated value of

inforce insurance contract liabilities to present them at fair value, determined as of the acquisition date. As of December 31, 2012, VOBA

was $3,248 million, and included $2,865 million related to the acquisition from American International Group, Inc., or AIG, of AIG Star

Life Insurance Co. Ltd, AIG Edison Life Insurance Company, and related entities (collectively, the “Star and Edison Businesses”) on

February 1, 2011. See Note 3 to the Consolidated Financial Statements for additional information on the acquisition from AIG of the Star

and Edison Businesses. The remaining $383 million relates to previously-acquired traditional life, deferred annuity, defined contribution

and defined benefit businesses. VOBA is amortized over the expected life of the acquired contracts. For additional information about

VOBA including details on items included in our estimates of future cash flows for the various acquired businesses and its bases for

amortization, see Note 2 and Note 8 to the Consolidated Financial Statements. VOBA is also subject to recoverability testing at the end of

each reporting period to ensure that the balance does not exceed the present value of anticipated gross profits.

Goodwill

As of December 31, 2012, our goodwill balance of $873 million is reflected in the following four reporting units: $444 million related

to our Retirement Full Service business, $238 million related to our Asset Management business, $171 million related to our Gibraltar Life

and Other operations and $20 million related to our International Insurance Life Planner business.

Prudential Financial, Inc. 2012 Annual Report 19