Prudential 2012 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2012 Prudential annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In July 2012, we announced our decision to cease sales of group long-term care insurance reflecting the challenging economics of the

long-term care market including the continued low interest rate environment as well as our desire to focus our resources on our core group

life and disability businesses. In March 2012, we also discontinued sales of our individual long-term care products. As a result of our

decision to wind down this business, we have reflected the results of the long-term care insurance business, previously reported within the

Group Insurance segment, as a divested business for all periods presented.

On September 27, 2012, we announced that Prudential Insurance agreed to acquire The Hartford’s individual life insurance business

through a reinsurance transaction. This transaction closed on January 2, 2013. The total cash consideration was $615 million consisting

primarily of a ceding commission to provide reinsurance for approximately 700,000 life insurance policies with net retained face amount in

force of approximately $135 billion.

On October 19, 2012, Prudential Financial received notice that it is under consideration by the Council for a proposed determination

that it should be subject to stricter prudential regulatory standards and supervision by the Board of Governors of the Federal Reserve

System pursuant to the Dodd-Frank Act (as a “Covered Company”). The notice of consideration indicates that Prudential Financial is being

reviewed in stage 3 of the three-stage process described in the Council’s interpretative guidance for Covered Company determinations and

does not constitute a notice of a proposed determination. The Company is entitled, under the applicable regulations, to contest such

consideration. Nevertheless, the Council may determine to issue to Prudential Financial a written notice of determination that it is a

Covered Company, in which event we would be entitled to request a nonpublic evidentiary hearing before the Council. The prudential

standards under the Dodd-Frank Act include requirements regarding risk-based capital and leverage, liquidity, stress-testing, overall risk

management, resolution plans, early remediation, and credit concentration; and may also include additional standards regarding capital,

public disclosure, short-term debt limits, and other related subjects as appropriate. See “Business—Regulation” and “Risk Factors”

included in Prudential Financial’s 2012 Annual Report on Form 10-K for more information regarding the potential impact of the Dodd-

Frank Act on the Company, including as a result of these stricter prudential standards.

Prudential Bank & Trust, FSB has limited its operations to trust services. On October 31, 2012, the Board of Governors of the Federal

Reserve System approved Prudential Financial’s application to deregister as a savings and loan holding company, effective as of that date.

On November 7, 2012, Prudential Financial declared an annual dividend for 2012 of $1.60 per share of Common Stock, reflecting an

increase of approximately 10% from the 2011 Common Stock dividend. On February 12, 2013, Prudential Financial declared a dividend

for the first quarter of 2013 of $0.40 per share of Common Stock reflecting our previously announced plan to move to a quarterly Common

Stock dividend schedule in 2013.

Outlook

Management expects that results in 2013 will continue to reflect the quality of our individual businesses and their prospects, as well as

our overall business mix and effective capital management. In 2013, we continue to focus on long-term strategic positioning and growth

opportunities, including the following:

•U.S. Retirement and Investment Management Market. We seek to capitalize on the growing need of baby boomers for products

that provide guaranteed income for longer retirement periods. In addition, we continue to focus on our clients’ increasing needs for

retirement income security given volatility in the financial markets. We also seek to provide products that respond to the needs of

plan sponsors to manage risk and control their benefit costs.

•U.S. Insurance Market. We continue to focus on writing high-quality business and expect to continue to benefit from expansion of

our distribution channels and deepening our relationships with third-party distributors. We also seek to capitalize on opportunities

for additional voluntary life purchases in the group insurance market, as institutional clients are focused on controlling their benefit

costs.

•International Markets. We continue to concentrate on deepening our presence in the markets in which we currently operate, such

as Japan, and expanding our distribution capabilities, including through the integration of the acquired Star and Edison Businesses.

We seek to capitalize on opportunities arising in international markets as changing demographics and public policy have resulted in

a growing demand for retirement income products.

Results of Operations

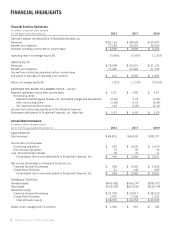

Net income of our Financial Services Businesses attributable to Prudential Financial, Inc. for the year ended December 31, 2012 was

$428 million compared to $3,420 million for 2011.

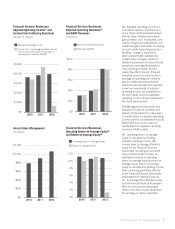

We analyze performance of the segments and Corporate and Other operations of the Financial Services Businesses using a measure

called adjusted operating income. See “—Consolidated Results of Operations—Segment Measures” for a discussion of adjusted operating

income and its use as a measure of segment operating performance.

Prudential Financial, Inc. 2012 Annual Report 15