Prudential 2012 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2012 Prudential annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TABLE OF CONTENTS

Page

Number

Selected Financial Data .................................................................................... 9

Management’s Discussion and Analysis of Financial Condition and Results of Operations ............................... 11

Quantitative and Qualitative Disclosures About Market Risk ....................................................... 100

Consolidated Financial Statements:

Management’s Annual Report on Internal Control Over Financial Reporting ...................................... 104

Report of Independent Registered Public Accounting Firm .................................................... 105

Consolidated Statements of Financial Position as of December 31, 2012 and 2011 .................................. 106

Consolidated Statements of Operations for the years ended December 31, 2012, 2011 and 2010 ....................... 107

Consolidated Statements of Comprehensive Income for the years ended December 31, 2012, 2011 and 2010 ............. 108

Consolidated Statements of Equity for the years ended December 31, 2012, 2011 and 2010 .......................... 109

Consolidated Statements of Cash Flows for the years ended December 31, 2012, 2011 and 2010 ...................... 110

Notes to Consolidated Financial Statements ................................................................ 111

Supplemental Combining Financial Information ............................................................ 223

Market Price of and Dividends on Common Equity and Related Stockholder Matters ................................... 226

Performance Graph ....................................................................................... 227

Forward-Looking Statements ............................................................................... 228

Throughout this Annual Report, “Prudential Financial” refers to Prudential Financial, Inc., the ultimate holding company for all

of our companies. “Prudential Insurance” refers to The Prudential Insurance Company of America. “Prudential,” the “Company,”

“we” and “our” refer to our consolidated operations.

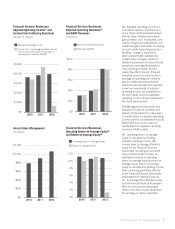

Financial Services Businesses and Closed Block Business

Effective with the date of demutualization, December 18, 2001, we established the Financial Services Businesses and the Closed Block

Business. The Financial Services Businesses refer to the businesses in our three operating divisions and our Corporate and Other operations. The

U.S. Retirement Solutions and Investment Management division consists of our Individual Annuities, Retirement and Asset Management

segments. The U.S. Individual Life and Group Insurance division consists of our Individual Life and Group Insurance segments. The

International Insurance division consists of our International Insurance segment. The Common Stock reflects the performance of the Financial

Services Businesses, but there can be no assurance that the market value of the Common Stock will reflect solely the financial performance of

these businesses. The Class B Stock, which was issued in a private placement on the date of the demutualization, reflects the financial

performance of the Closed Block Business, as defined in Note 22 to the Consolidated Financial Statements.

We allocate all of our assets, liabilities and earnings between the Financial Services Businesses and Closed Block Business as if they were

separate legal entities, but there is no legal separation between these two businesses. Holders of both the Common Stock and the Class B Stock are

common stockholders of Prudential Financial and, as such, are subject to all the risks associated with an investment in Prudential Financial and all

of its businesses. The Common Stock and the Class B Stock will be entitled to dividends, if and when declared by Prudential Financial’s Board of

Directors from funds legally available to pay them, as if the businesses were separate legal entities. See Note 15 to the Consolidated Financial

Statements for a discussion of liquidation rights of the Common Stock and the Class B Stock, dividend restrictions on the Common Stock if we do

not pay dividends on the Class B Stock when there are funds legally available to pay them and conversion rights of the Class B Stock.

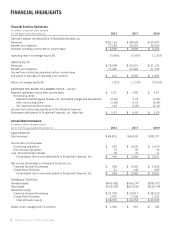

SELECTED FINANCIAL DATA

We derived the selected consolidated income statement data for the years ended December 31, 2012, 2011 and 2010 and the selected

consolidated balance sheet data as of December 31, 2012 and 2011 from our Consolidated Financial Statements included elsewhere herein.

We derived the selected consolidated income statement data for the years ended December 31, 2009 and 2008 and the selected consolidated

balance sheet data as of December 31, 2010, 2009 and 2008 from consolidated financial statements not included herein.

Results for the year ended December 31, 2012 include approximately $32 billion of premiums reflecting two recently completed

significant pension risk transfer transactions. On November 1, 2012, we issued a non-participating group annuity contract to the General

Motors Salaried Employees Pension Trust, and assumed responsibility for providing specified benefits to certain participants. On

December 10, 2012, we issued a non-participating group annuity contract to the Verizon Management Pension Plan and assumed

responsibility for providing specified benefits to certain participants. The premiums from these transactions were largely offset by a

corresponding increase in policyholders’ benefits, including the change in policy reserves.

On February 1, 2011, we acquired the Star and Edison Businesses from American International Group, Inc. The results of these

companies are reported with the Gibraltar Life operations and are included in the results presented below from the date of acquisition. The

Star and Edison companies were merged into Gibraltar Life on January 1, 2012.

On December 31, 2009, we completed the sale of our minority joint venture interest in Wachovia Securities. In 2009, “Equity in

earnings of operating joint ventures, net of taxes” includes a pre-tax gain on the sale of $2.247 billion. In addition, “General and

administrative expenses” includes certain one-time costs related to the sale of the joint venture interest of $104 million for pre-tax

compensation costs and costs related to increased contributions to the Company’s charitable foundation. The total of these items is an after-

tax gain of $1.389 billion, or $2.95 per share of Common Stock.

On May 1, 2009, we acquired Yamato Life, a Japanese life insurance company that declared bankruptcy in October 2008, and

renamed The Prudential Gibraltar Financial Life Insurance Company, Ltd. Results presented below include the results of this company

from the date of acquisition.

The 2009 income tax provision includes a benefit of $272 million from a reduction to the liability for unrecognized tax benefits and

related interest, primarily related to tax years prior to 2002 as a result of the expiration of the statute of limitations for the 2002 and 2003

tax years.

Prudential Financial, Inc. 2012 Annual Report 9