Prudential 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 Prudential annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PRUDENTIAL FINANCIAL, INC.

2012 ANNUAL REPORT

Table of contents

-

Page 1

PRUDENTIAL FINANCIAL, INC. 2012 ANNUAL REPORT -

Page 2

.... We measure our long-term success by our ability to deliver value for shareholders, meet customer needs, attract and develop the best talent in our industry, offer an inclusive work environment where employees can develop to their full potential and support the communities where we live and... -

Page 3

... sales, net ï¬,ows and market momentum. On an after-tax adjusted operating income basis,* our Financial Services Businesses earned $2.958 billion, or $6.27 per share of Common Stock, compared to $2.845 billion, or $5.83 per share of Common Stock in 2011. Our Financial Services Businesses reported... -

Page 4

...operations in the United States, based on new premium sales. We also now hold leadership positions in key product areas, including universal, variable and term life insurance. In addition, we have gained distribution strength in the banking and wirehouse channels, as well as a deep bench of talented... -

Page 5

... our shareholders; customers; employees; state, federal and international regulators; and our neighbors in the communities in which we operate. To truly abide by our values and meet our objectives as a company, we must fulï¬ll our obligations to all of them. Prudential Financial, Inc. 2012 Annual... -

Page 6

... again named Prudential one of the world's most admired companies in the life and health insurance category. Prudential's people remain our most important point of strategic differentiation and our greatest source of pride. Building on our momentum We are proud of our performance in 2012, and we... -

Page 7

.... Life insurance and annuities issued by The Prudential Insurance Company of America, Newark, NJ, and its insurance affiliates. FORTUNE® and "The World's Most Admired Companies®" are registered trademarks of Time Inc. 2013 ranking as of 3/1/2013. Prudential Financial, Inc. 2012 Annual Report 5 -

Page 8

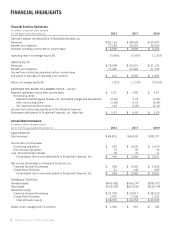

..., Inc. Financial Services Businesses Closed Block Business Consolidated net income attributable to Prudential Financial, Inc. FINANCIAL POSITION Invested assets Total assets Attributed equity: Financial Services Businesses Closed Block Business Total attributed equity Assets under management (in... -

Page 9

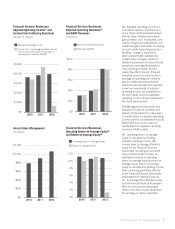

... Financial Services Businesses attributable to Prudential Financial, Inc. by average total attributed equity for the Financial Services Businesses. Both income amounts above give effect to the direct equity adjustment for earnings per share calculation. $0 2010 2011 2012 $0 2010 2011 2012 Assets... -

Page 10

... Securities Reform Act of 1995. Please see page 228 for a description of certain risks and uncertainties that could cause actual results to differ, possibly materially, from expectations or estimates reflected in such forward-looking statements. 8 Prudential Financial, Inc. 2012 Annual Report -

Page 11

... premiums from these transactions were largely offset by a corresponding increase in policyholders' benefits, including the change in policy reserves. On February 1, 2011, we acquired the Star and Edison Businesses from American International Group, Inc. The results of these companies are reported... -

Page 12

...- 2012 Balance Sheet Data: Total investments excluding policy loans ...Separate account assets ...Total assets ...Future policy benefits and policyholders' account balances ...Separate account liabilities ...Short-term debt ...Long-term debt ...Total liabilities ...Prudential Financial, Inc. equity... -

Page 13

... used exclusively for payment of benefits, including policyholder dividends, expenses and taxes with respect to these products. See Note 12 to the Consolidated Financial Statements and "Business-Demutualization and Separation of Business" included in Prudential Financial's 2012 Annual Report on Form... -

Page 14

...federal and state tax laws. Insurance regulators have begun to implement significant changes in the way in which industry participants must determine statutory reserves and statutory capital, particularly for products with embedded options and guarantees such as variable annuities and universal life... -

Page 15

... effective date of the tax law change and reduced sales thereafter. The Financial Services Agency, the insurance regulator in Japan, has implemented revisions to the solvency margin requirements for certain assets and has changed the manner in which an insurance company's core capital is calculated... -

Page 16

... market interest rates. Current Developments Effective January 1, 2012, the Company adopted, retrospectively, the amended authoritative guidance issued by the Financial Accounting Standards Board ("FASB") to address which costs relating to the acquisition of new or renewal insurance contracts... -

Page 17

...31, 2012, the Board of Governors of the Federal Reserve System approved Prudential Financial's application to deregister as a savings and loan holding company, effective as of that date. On November 7, 2012, Prudential Financial declared an annual dividend for 2012 of $1.60 per share of Common Stock... -

Page 18

... with our acquisition of The Hartford's individual life insurance business. Group Insurance. Segment results declined in 2012 in comparison to 2011 primarily due to less favorable group life and disability underwriting results and higher expenses. 16 Prudential Financial, Inc. 2012 Annual Report -

Page 19

... of our Closed Block Business is amortized over the expected lives of those contracts in proportion to estimated gross margins. Gross margins consider premiums, investment returns, benefit claims, costs for policy administration, changes in reserves, and dividends to policyholders. We evaluate our... -

Page 20

... reflect a near-term mean reversion blended rate of return of 5.9%. As of December 31, 2012, all contract groups within our variable life insurance business utilize these rates, as the near-term equity rate of return was less than our 13% maximum. 18 Prudential Financial, Inc. 2012 Annual Report -

Page 21

... International Group, Inc., or AIG, of AIG Star Life Insurance Co. Ltd, AIG Edison Life Insurance Company, and related entities (collectively, the "Star and Edison Businesses") on February 1, 2011. See Note 3 to the Consolidated Financial Statements for additional information on the acquisition... -

Page 22

...consists of public and private fixed maturity securities, commercial mortgage and other loans, equity securities, other invested assets, and derivative financial instruments. Derivatives are financial instruments whose values are derived from interest rates, foreign exchange rates, financial indices... -

Page 23

... and Financial Services Businesses. The future policy benefit reserves for the traditional participating life insurance products of our Closed Block Business, which as of December 31, 2012, represented 24% of our total future policy benefit reserves are determined using the net level premium method... -

Page 24

...of $2.9 billion as of December 31, 2012 is reported as a component of "Future policy benefits" and relates primarily to the group long-term disability products of our Group Insurance segment. This liability represents our estimate of future disability claim payments and expenses as well as estimates... -

Page 25

... costs associated with these plans. We determine our expected rate of return on plan assets based upon a building block approach that considers inflation, real return, term premium, credit spreads, equity risk premium and capital appreciation as well as expenses, expected asset manager performance... -

Page 26

... upon ultimate settlement using the facts, circumstances, and information available at the reporting date. The Company's liability for income taxes includes the liability for unrecognized tax benefits and interest that relate to tax years still subject to review by the Internal Revenue Service ("IRS... -

Page 27

... deferred policy acquisition and other costs as well as market value changes associated with certain derivatives under our capital hedge program (see "-Results of Operations for Financial Services Businesses by Segment-U.S. Retirement Solutions and Investment Management Division-Individual Annuities... -

Page 28

...deferred policy acquisition and other costs and the reserves for guaranteed minimum death and income benefit features of our variable annuity products, reflecting updates to the estimated profitability of the business primarily resulting from market performance and the impact of an annual review and... -

Page 29

... Annuities(1): Beginning total account value ...Sales ...Surrenders and withdrawals ...Net sales ...Benefit payments ...Net flows ...Change in market value, interest credited and other activity ...Policy charges ...Ending total account value(2) ... Prudential Financial, Inc. 2012 Annual Report... -

Page 30

.... During 2012, we suspended additional customer deposits for variable annuities with certain optional living benefit riders that were no longer being offered and implemented variable annuity product modifications for new sales to scale back benefits, increase pricing and close a share class in the... -

Page 31

... in our best estimate of total gross profits used to determine amortization rates. 2011 to 2010 Annual Comparison. Revenues increased $443 million. Policy charges and fees and asset management fees and other income increased $576 million driven by growth in average variable annuity account values... -

Page 32

... returns within those funds. 3. The equity volatility assumption is adjusted to remove certain risk margins required under U.S. GAAP valuation which are used in the projection of customer account values, as we believe the impact of these margins is highly sensitive to short-term market conditions... -

Page 33

... additional information on the liquidity needs associated with our hedging program, see "-Liquidity and Capital Resources-Liquidity associated with other activities-Hedging activities associated with living benefit guarantees." While we actively manage our hedge positions, changes in the fair value... -

Page 34

... primarily related to our annual review and update of assumptions performed in the third quarter, driven by a reduction to long-term interest and equity rate of return assumptions in 2012, and driven by changes to expense and net cash flow assumptions in 2011. Partially offsetting these increases in... -

Page 35

... bank deposits in 2012, partially offset by the impact of higher full service general account stable value account values and an increase related to a refinement associated with certain structured settlements recorded in 2011. 2011 to 2010 Annual Comparison. Revenues decreased $312 million. Premiums... -

Page 36

... the Retirement segment. For more information on internally-managed balances see "- Asset Management." Year ended December 31, 2012 Full Service(1): Beginning total account value ...Deposits and sales ...Withdrawals and benefits ...Change in market value, interest credited, interest income and other... -

Page 37

...costs. These decreases were partially offset by an increase in asset management fees, before associated expenses, primarily from institutional and retail customer assets as a result of higher asset values due to positive net asset flows and market appreciation in 2012. 2011 to 2010 Annual Comparison... -

Page 38

... related to new fund launches and increased compensation costs. 2011 to 2010 Annual Comparison. Revenues increased $526 million including a $215 million increase in asset management fees primarily from institutional and retail customer assets as a result of higher asset values. Service, distribution... -

Page 39

... ...Loans Secured by Investor Equity Commitments or Fund Assets: Real estate secured by investor equity ...Private equity secured by investor equity ...Real estate secured by fund assets ...Total ... In addition to the strategic investments above, the Asset Management segment's commercial mortgage... -

Page 40

...2011 to 2010 Annual Comparison. Revenues increased $83 million driven by higher net investment income of $75 million reflecting higher asset balances resulting from increased policyholder deposits and higher regulatory capital requirements associated with our universal life insurance product. Policy... -

Page 41

...and costs of strategic initiatives. This increase also reflects a $54 million increase in policyholders' benefits, including the change in policy reserves. Our group disability business reflects an increase in policyholders' benefits primarily from an increase in the number and severity of long-term... -

Page 42

...' Group Life Insurance contract and from excess premiums on group universal life insurance that build cash value but do not purchase face amounts, and include premiums from the takeover of claim liabilities. (2) Includes dental products. 2012 to 2011 Annual Comparison. Total annualized new... -

Page 43

...decrease the value of these U.S. dollar-denominated investments on the local books of our yen-based Japanese insurance entities and therefore negatively impact their equity and regulatory solvency margins by employing internal hedging strategies between a subsidiary of Prudential Financial and these... -

Page 44

... liabilities are remeasured for foreign currency exchange rate movements, and the related changes in value are recorded in earnings within "Asset management fees and other income." Investments designated as held-to-maturity under U.S. GAAP are recorded at amortized cost on the balance sheet, but are... -

Page 45

... from changes in value of certain assets and liabilities relating to foreign currency exchange movements that are economically matched, as discussed above. Acquisition and Integration of the former Star and Edison Businesses On February 1, 2011, Prudential Financial completed the acquisition from... -

Page 46

...of deferred policy acquisition costs. Partially offsetting these favorable variances were higher development costs supporting bank and agency distribution channel growth and unfavorable results from our insurance joint venture in India. Revenues, Benefits and Expenses 2012 to 2011 Annual Comparison... -

Page 47

..., changes in tax laws, changes in life insurance regulations or changes in the competitive environment. Sales volume may increase or decrease prior to such changes becoming effective, and then fluctuate in the other direction following such changes. Prudential Financial, Inc. 2012 Annual Report 45 -

Page 48

... products prior to a tax law change in April 2012 as well as increased demand for U.S. dollar-denominated retirement income products prior to pricing changes in April 2012. The table below present annualized new business premiums on a constant exchange rate basis, by product and distribution channel... -

Page 49

...additional information on the change in accounting method for the Company's pension plans, see Notes 2 and 18 to our Consolidated Financial Statements. 2012 to 2011 Annual Comparison. The loss from Corporate and Other operations, on an adjusted operating income basis, increased $225 million. Capital... -

Page 50

... as of the date of demutualization. The Closed Block Business includes our in force traditional domestic participating life insurance and annuity products and assets that are used for the payment of benefits and policyholder dividends on these policies, as well as other assets and equity and related... -

Page 51

... the expected in force decline, partially offset by an increase in reserves for estimated payments arising from use of new Social Security Master Death File matching criteria to identify deceased policy and contract holders, as discussed above. Prudential Financial, Inc. 2012 Annual Report 49 -

Page 52

... 6 3 (3) $(597) $101 $ 18 Long-Term Care ...Real Estate and Relocation Services ...Property and Casualty Insurance ...Individual Health Insurance ...Financial Advisory ...Other ...Total divested businesses excluded from adjusted operating income ... 50 Prudential Financial, Inc. 2012 Annual Report -

Page 53

... information on the sale of our real estate brokerage franchise and relocation services business, see Note 3 to the Consolidated Financial Statements. Experience-Rated Contractholder Liabilities, Trading Account Assets Supporting Insurance Liabilities and Other Related Investments Certain products... -

Page 54

.... For certain private fixed maturity and equity securities, the internally-developed valuation model uses significant unobservable inputs and, accordingly, such securities are included in Level 3 in our fair value hierarchy. Level 3 fixed maturity 52 Prudential Financial, Inc. 2012 Annual Report -

Page 55

..., 2011 of private fixed maturities, with values primarily based on internally-developed models. Significant unobservable inputs used included: issue specific credit adjustments, material non-public financial information, management judgment, estimation of future earnings and cash flows, default rate... -

Page 56

...annuity products. Derivative contracts also include forward purchases and sales of to-be-announced mortgage-backed securities primarily related to our dollar roll program. Many of these derivative contracts do not qualify for hedge accounting, and consequently, we recognize the changes in fair value... -

Page 57

...trading losses in 2011 were primarily due to public equity sales within our International Insurance operations. See below for additional information regarding the other-than-temporary impairments of equity securities in 2012 and 2011. Net realized gains on commercial mortgage and other loans in 2012... -

Page 58

...Ended December 31, 2012 2011 (in millions) Other-than-temporary impairments recorded in earnings-Financial Services Businesses(1) Public fixed maturity securities ...Private fixed maturity securities ...Total fixed maturity securities ...Equity securities ...Other invested assets(2) ...Total ...$219... -

Page 59

... or where we intend to sell the security. Other invested assets other-than-temporary impairments in 2012 and 2011 were mainly driven by a decline in value on certain real estate, joint ventures and partnership investments. For a further discussion of our policies regarding other-than-temporary... -

Page 60

... Equity Securities" below. 2011 to 2010 Annual Comparison Financial Services Businesses The Financial Services Businesses' net realized investment gains in 2011 were $1,986 million, compared to net realized investment gains of $256 million in 2010. 58 Prudential Financial, Inc. 2012 Annual Report -

Page 61

... private equity sales within our Corporate and Other business and sales within our International Insurance operations. See below for additional information regarding the other-than-temporary impairments of equity securities in 2011 and 2010. Net realized gains on commercial mortgage and other loans... -

Page 62

... finance, consumer cyclical, and communications sectors of our corporate securities, asset-backed securities collateralized by sub-prime mortgages that reflect adverse financial conditions of the respective issuers, the impact of the rising forward 60 Prudential Financial, Inc. 2012 Annual Report -

Page 63

... used to hedge foreign denominated investments. Also, contributing to the net derivative gains in 2010 were net realized gains of $17 million on embedded derivatives associated with certain externally-managed investments in the European market. Prudential Financial, Inc. 2012 Annual Report... -

Page 64

... "Separate account assets" on our balance sheet. The general account portfolios are managed pursuant to the distinct objectives and investment policy statements of the Financial Services Businesses and the Closed Block Business. The primary investment objectives of the Financial Services Businesses... -

Page 65

... through investment in a broad range of fixed income assets, including government and agency securities, public and private corporate bonds and structured securities, and commercial mortgage loans. In addition, we hold small allocations to alternative assets and other equities. We manage our public... -

Page 66

...value ...Private, held-to-maturity, at amortized cost ...Trading account assets supporting insurance liabilities, at fair value ...Other trading account assets, at fair value ...Equity securities, available-for-sale, at fair value ...Commercial mortgage and other loans, at book value ...Policy loans... -

Page 67

...value ...Private, held-to-maturity, at amortized cost ...Trading account assets supporting insurance liabilities, at fair value ...Other trading account assets, at fair value ...Equity securities, available-for-sale, at fair value ...Commercial mortgage and other loans, at book value ...Policy loans... -

Page 68

... consumer and diversified finance, health insurance, life insurance, property and casualty insurance, other finance and real estate investment trusts. Our gross direct exposure to the Eurozone region attributable to the Closed Block Business was $4,241 million of amortized cost (fair value, $4,688... -

Page 69

... management swaps that are included in adjusted operating income. Year Ended December 31, 2012 Yield(1) Amount Fixed maturities ...Trading account assets supporting insurance liabilities ...Equity securities ...Commercial mortgage and other loans ...Policy loans ...Short-term investments and cash... -

Page 70

...074 2012 Yield(1) Amount Fixed maturities ...Trading account assets supporting insurance liabilities ...Equity securities ...Commercial mortgage and other loans ...Policy loans ...Short-term investments and cash equivalents ...Other investments ...Gross investment income before investment expenses... -

Page 71

... amortized cost of our fixed maturity securities portfolio in total by contractual maturity as of December 31, 2012. December 31, 2012 Financial Services Businesses Closed Block Business Amortized Amortized Cost % of Total Cost % of Total ($ in millions) Corporate & government securities: Maturing... -

Page 72

... interest rates. Asset-Backed Securities Included within asset-backed securities attributable to both the Financial Services Businesses and the Closed Block Business are securities collateralized by sub-prime mortgages. While there is no market standard definition, we define sub-prime mortgages as... -

Page 73

... mortgages, by year of issuance (vintage). Asset-Backed Securities at Amortized Cost-Financial Services Businesses December 31, 2012 Lowest Rating Agency Rating BB and BBB below (in millions) $ 0 0 49 17 50 116 108 0 142 22 23 $ 411 $ 0 429 725 265 583 Total Total Amortized December 31, Cost 2011... -

Page 74

... Financial Statements. The weighted average estimated subordination percentage of our asset-backed securities collateralized by sub-prime mortgages attributable to the Financial Services Businesses, excluding those supported by guarantees from monoline bond insurers, was 28% as of December 31, 2012... -

Page 75

... Consolidated Financial Statements. The weighted average estimated subordination percentage of asset-backed securities collateralized by sub-prime mortgages attributable to the Closed Block Business, excluding those supported by guarantees from monoline bond insurers, was 32% as of December 31, 2012... -

Page 76

... (vintage). Commercial Mortgage-Backed Securities at Amortized Cost-Financial Services Businesses December 31, 2012 Lowest Rating Agency Rating(1) Total BB and Amortized BBB below Cost (in millions) $ 3 $17 $ 566 0 1 1,196 4 0 2,781 0 0 2,113 12 7 757 $19 $25 $7,413 Total December 31, 2011 $ 418... -

Page 77

... with amortized cost of $568 million, all rated AA. Commercial Mortgage-Backed Securities at Fair Value-Closed Block Business December 31, 2012 Lowest Rating Agency Rating(1) BB and Total below Fair Value (in millions) $ 0 $ 869 13 579 0 1,375 0 1,141 3 242 $16 $4,206 Total December 31, 2011 66 860... -

Page 78

... securities by NAIC Designation is based on the expected ratings indicated by internal analysis. Investments of our international insurance companies are not subject to NAIC guidelines. Investments of our Japanese insurance operations are regulated locally by the Financial Services Agency, an agency... -

Page 79

...to selling credit protection, we have purchased credit protection using credit derivatives in order to hedge specific credit exposures in our investment portfolio, including exposures relating to certain guarantees from monoline bond insurers. As of December 31, 2012 and 2011, the Financial Services... -

Page 80

... and obligations of U.S. states ...Total fixed maturities ...Equity securities ...Total trading account assets supporting insurance liabilities ...(1) Prior period's amounts are presented on a basis consistent with the current period presentation. 78 Prudential Financial, Inc. 2012 Annual Report -

Page 81

...As of December 31, 2012, on an amortized cost basis, 100% of asset-backed securities classified as "Other trading account assets" attributable to the Closed Block Business have credit ratings of A or above. Commercial Mortgage and Other Loans Investment Mix As of December 31, 2012 and 2011, we held... -

Page 82

... gross carrying values of our general account investments in commercial and agricultural mortgage loans by geographic region and property type as of the dates indicated. December 31, 2012 December 31, 2011 Financial Services Closed Block Financial Services Closed Block Businesses Business Businesses... -

Page 83

... account investments in commercial and agricultural mortgage loans attributable to the Financial Services Businesses and the Closed Block Business as of the dates indicated by loan-to-value and debt service coverage ratios. Commercial and Agricultural Mortgage Loans by Loan-to-Value and Debt Service... -

Page 84

... the assets were current for both periods. The following table sets forth the change in valuation allowances for our commercial mortgage and other loan portfolio as of the dates indicated: December 31, 2011 December 31, 2012 Financial Closed Financial Closed Services Block Services Block Businesses... -

Page 85

... consist principally of investments in common and preferred stock of publicly-traded companies, as well as mutual fund shares. The following table sets forth the composition of our equity securities portfolio attributable to the Financial Services Businesses and the associated gross unrealized gains... -

Page 86

... regarding our holdings in the Federal Home Loan Banks of New York and Boston, see Note 14 to the Consolidated Financial Statements. The increase in non-real estate-related joint venture and limited partnership assets is due to private equity partnership assets acquired from the two pension risk... -

Page 87

... requiring the use of capital, including all mergers and acquisitions, as well as new products, initiatives and transactions that present substantial reputational, legal, regulatory, operating, accounting or tax risk. The CFCC also evaluates the Company's Annual Capital and Financing Plan... -

Page 88

... 31, 2012 Prudential of Japan ...Gibraltar Life consolidated(1) ...>800% >800% March 31, 2012 721% 810% (1) Reflects the merger of the acquired Star and Edison entities with Gibraltar, which became effective January 1, 2012, and includes Prudential Gibraltar Financial Life Insurance Company, Ltd... -

Page 89

... with the statutory reserves required for other individual life insurance policies with similar guarantees. Many market participants believe that these levels of reserves are non-economic. We use captive reinsurance companies to implement reinsurance and capital management actions to satisfy these... -

Page 90

... to Prudential Financial, the parent holding company, are dividends and returns of capital from its subsidiaries, repayments of operating loans from subsidiaries and cash and short-term investments. These sources of funds may be supplemented by Prudential Financial's access to the capital markets as... -

Page 91

... Securities Group (previously supporting the global commodities business), $282 million by Prudential Real Estate and Relocation, $175 million by Prudential Annuities Life Assurance Corporation, $169 million by our asset management subsidiaries and $100 million by Prudential Arizona Reinsurance Term... -

Page 92

... and fee income, and investment maturities and sales associated with our insurance and annuity operations, as well as internal and external borrowings. The principal uses of that liquidity include benefits, claims, dividends paid to policyholders, and payments to policyholders and contractholders in... -

Page 93

...the fair value of our international insurance operations' portfolio of liquid assets, including cash and short-term investments, fixed maturity investments other than those designated as held-to-maturity, by NAIC or equivalent rating, and public equity securities, as of the dates indicated. December... -

Page 94

... interest rates, equity markets, mortality and policyholder behavior. Currently, we fund these liquidity needs with a combination of capital contributions and loans from Prudential Financial and affiliates. Additionally, for certain of our domestic insurance companies to claim statutory reinsurance... -

Page 95

... inability to sell assets in a timely manner, declines in the value of assets and credit defaults. In support of our real estate business, certain real estate funds under management are held for the benefit of clients in insurance company separate accounts sponsored by Prudential Insurance. In the... -

Page 96

... mortgage-related assets or U.S. Treasury securities. Prudential Retirement Insurance and Annuity Company, or PRIAC, is a member of the Federal Home Loan Bank of Boston, or FHLBB, which provides PRIAC access to collateralized advances. Based on regulatory limitations, as of December 31, 2012... -

Page 97

... to the Federal Home Loan Bank of New York as of December 31, 2012 and 2011, respectively. These notes and funding agreements are included in "Policyholders' account balances." For additional information on these obligations, see Notes 10 and 14 to the Consolidated Financial Statements (4) Includes... -

Page 98

... in the credit or financial strength ratings of Prudential Financial or its rated subsidiaries could potentially, among other things, limit our ability to market products, reduce our competitiveness, increase the number or value of policy surrenders and withdrawals, increase our borrowing costs and... -

Page 99

... ...Prudential Annuities Life Assurance Corporation ...Prudential Retirement Insurance and Annuity Company ...The Prudential Life Insurance Company Ltd. (Prudential of Japan) ...Gibraltar Life Insurance Company, Ltd...Credit Ratings: Prudential Financial, Inc.: Short-term borrowings ...Long-term... -

Page 100

... date of the expiration in exchange for a fee. (5) The estimated payments due by period for insurance liabilities reflect future estimated cash payments to be made to policyholders and others for future policy benefits, policyholders' account balances, policyholder's dividends, reinsurance payables... -

Page 101

... have relationships with any unconsolidated entities that are contractually limited to narrow activities that facilitate our transfer of or access to associated assets. See Note 5 to the Consolidated Financial Statements for additional information. Prudential Financial, Inc. 2012 Annual Report 99 -

Page 102

... and other loans and policy loans. Liabilities that subject us to interest rate risk primarily include policyholder account balances relating to interest-sensitive life insurance, annuity and other investment-type contracts, as well as through outstanding short-term and long-term debt. Changes in... -

Page 103

...liabilities relating to the underlying or hedged products. Additionally, changes in equity prices may impact other items including, but not limited to, the following: • Asset-based fees earned on assets under management or contractholder account value Prudential Financial, Inc. 2012 Annual Report... -

Page 104

... total gross profits and the amortization of deferred policy acquisition and other costs • Net exposure to the guarantees provided under certain products We actively manage investment equity price risk against benchmarks in respective markets. We benchmark our return on equity holdings against... -

Page 105

... 2012. The increase was related to sales of investment-only stable value synthetic GIC products, our variable annuity hedging activities, and our capital hedge program. For additional information on our derivative activities, see Note 21 to the Consolidated Financial Statements. Market Risk Related... -

Page 106

... acquisition, use, or disposition of the Company's assets that could have a material effect on our financial statements. Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness... -

Page 107

...retrospectively, i) a change to the method of accounting for the deferral of acquisition costs for new or renewed insurance contracts and ii) a change in the method of applying an accounting principle for pension plans, respectively. A company's internal control over financial reporting is a process... -

Page 108

...268 5,107 Trading account assets supporting insurance liabilities, at fair value(1) ...20,590 19,481 Other trading account assets, at fair value ...6,328 5,545 Equity securities, available-for-sale, at fair value (cost: 2012 - $6,759; 2011 - $6,922) ...8,277 7,535 Commercial mortgage and other loans... -

Page 109

... operations, net of taxes ...(1.00) 0.00 0.50 Net income attributable to Prudential Financial, Inc...$ 10.50 $ 61.00 $229.50 Dividends declared per share of Class B Stock ...$ 9.625 $ 9.625 $ 9.625 See Notes to Consolidated Financial Statements Prudential Financial, Inc. 2012 Annual Report 107 -

Page 110

... changes and other ...Amortization of transition obligation, prior service cost and actuarial gain (loss) included in net income ...Total ...Other comprehensive income, before tax ...Less: Income tax expense (benefit) related to: Foreign currency translation adjustments ...Net unrealized investment... -

Page 111

PRUDENTIAL FINANCIAL, INC. Consolidated Statements of Equity(1) Years Ended December 31, 2012, 2011 and 2010 (in millions) Common Accumulated Total Additional Stock Other Prudential Common Paid-in Retained Held in Comprehensive Financial, Inc. Noncontrolling Total Stock Capital Earnings Treasury ... -

Page 112

... assets supporting insurance liabilities and other trading account assets ...Equity securities, available-for-sale ...Commercial mortgage and other loans ...Policy loans ...Other long-term investments ...Short-term investments ...Acquisitions, net of cash acquired...Other, net ...Cash flows used... -

Page 113

...is managed separately from the Financial Services Businesses. The Closed Block Business was established on the date of demutualization and includes the Company's in force participating insurance and annuity products and assets that are used for the payment of benefits and policyholders' dividends on... -

Page 114

...excess tax benefits that would be recognized in additional paid-in capital upon exercise or release of the award. Investments and Investment-Related Liabilities The Company's principal investments are fixed maturities; equity securities; commercial mortgage and other loans; policy loans; other long... -

Page 115

... internal credit rating include debt service coverage ratios, amortization, loan term, estimated market value growth rate and volatility for the property type and region. See Note 4 for additional information related to the loan-to-value ratios and debt service coverage ratios related to the Company... -

Page 116

... net investment income at the contract interest rate when earned. Policy loans are fully collateralized by the cash surrender value of the associated insurance policies. Securities repurchase and resale agreements and securities loaned transactions are used to earn spread income, to borrow funds, or... -

Page 117

...of the Company's International Insurance businesses' portfolios, where the average cost method is used. Realized investment gains and losses are generated from numerous sources, including the sale of fixed maturity securities, equity securities, investments in joint ventures and limited partnerships... -

Page 118

...due from banks, certain money market investments and other debt instruments with maturities of three months or less when purchased, other than cash equivalents that are included in "Trading account assets supporting insurance liabilities, at fair value." Deferred Policy Acquisition Costs Costs that... -

Page 119

...life of the contracts using the interest method. For other group life and disability insurance contracts and guaranteed investment contracts, acquisition costs are expensed as incurred. For some products, policyholders can elect to modify product benefits, features, rights or coverages by exchanging... -

Page 120

... pension benefit costs, certain restricted assets, trade receivables, value of business acquired, goodwill and other intangible assets, deferred sales inducements, the Company's investments in operating joint ventures, which include the Company's indirect investment in China Pacific Insurance (Group... -

Page 121

... interest rate assumptions applied are those used to calculate the policies' guaranteed cash surrender values. For life insurance, other than individual traditional participating life insurance, and annuity and disability products, expected mortality and morbidity is generally based on the Company... -

Page 122

... in a derivative broker-dealer capacity in the Company's global commodities group to meet the needs of clients by structuring transactions that allow clients to manage their exposure to interest rates, foreign exchange rates, indices and prices of 120 Prudential Financial, Inc. 2012 Annual Report -

Page 123

... an embedded derivative that otherwise would need to be bifurcated and reported at fair value, the Company may elect to classify the entire instrument as a trading account asset and report it within "Other trading account assets, at fair value." Prudential Financial, Inc. 2012 Annual Report 121 -

Page 124

... relates to the calculation of market related value of pension plan assets, used to determine net periodic pension cost. The impact of this change in accounting method on net income for the year ended December 31, 2012 was an increase of $96 million ($0.21 diluted earnings per share of Common stock... -

Page 125

...As Previously Reported Deferred policy acquisition costs ...Other assets ...TOTAL ASSETS ...Future policy benefits ...Policyholders' account balances ...Income taxes ...Total liabilities ...Accumulated other comprehensive income (loss) ...Retained earnings ...Total Prudential Financial, Inc. equity... -

Page 126

...2010 Effect of As Effect of Pension As Previously DAC Accounting Currently Reported Change Change Reported (in millions) REVENUES Premiums ...Policy charges and fee income ...Asset management fees and other income ...Total revenues ...BENEFITS AND EXPENSES Amortization of deferred policy acquisition... -

Page 127

... The updated guidance clarifies existing guidance related to the application of fair value measurement methods and requires expanded disclosures. This new guidance is effective for the first interim or annual reporting period beginning after December 15, 2011 and should be applied prospectively. The... -

Page 128

... scale in the U.S. individual life insurance market, particularly universal life products, and provides complementary distribution opportunities through expanded wirehouse and bank distribution channels. Acquisition of AIG Star Life Insurance Co., Ltd., AIG Edison Life Insurance Company and Related... -

Page 129

...Financial Statements 3. ACQUISITIONS AND DISPOSITIONS (continued) Net Assets Acquired The following table presents an allocation of the purchase price to assets acquired and liabilities assumed at February 1, 2011 (the "Acquisition Date"): (in millions) Total invested assets at fair value(1) ...Cash... -

Page 130

... 6, 2011, the Company sold its real estate brokerage franchise and relocation services business ("PRERS") to Brookfield Asset Management, Inc. The Prudential Real Estate Financial Services Company of America Inc. ("PREFSA"), a finance subsidiary of the Company with investments in a limited number of... -

Page 131

...real estate investments. (2) In 2011, the Company completed the sale of all the issued and outstanding shares of capital stock of the subsidiaries that conduct its global commodities business (the "Global Commodities Business") and certain assets that are primarily used in connection with the Global... -

Page 132

... subdivisions ...Foreign government bonds ...Corporate securities ...Asset-backed securities(1) ...Commercial mortgage-backed securities ...Residential mortgage-backed securities(2) ...Total fixed maturities, available-for-sale ...Equity securities, available-for-sale ... Fair Value $ 12,270 2,410... -

Page 133

... of its projected future cash flows discounted at the effective interest rate implicit in the debt security prior to impairment. Any remaining difference between the fair value and amortized cost is recognized in OCI. The following table sets forth the amount of pre-tax credit loss impairments on... -

Page 134

.... Concentrations of Financial Instruments The Company monitors its concentrations of financial instruments on an on-going basis, and mitigates credit risk by maintaining a diversified investment portfolio which limits exposure to any one issuer. 132 Prudential Financial, Inc. 2012 Annual Report -

Page 135

... Value Cost Value (in millions) Investments in Japanese government and government agency securities: Fixed maturities, available-for-sale ...Fixed maturities, held-to-maturity ...Trading account assets supporting insurance liabilities ...Other trading account assets ...Short-term investments ...Cash... -

Page 136

... year, 2011 ...Addition to / (release of) allowance of losses ...Charge-offs, net of recoveries ...Change in foreign exchange ...Total Ending Balance, 2012 ... Commercial Agricultural Residential Other Mortgage Property Property Collateralized Uncollateralized Loans Loans Loans Loans Loans Total (in... -

Page 137

... Financial Statements 4. INVESTMENTS (continued) Impaired loans include those loans for which it is probable that all amounts due will not be collected according to the contractual terms of the loan agreement. Impaired commercial mortgage and other loans identified in management's specific review... -

Page 138

... that it will sell the loan to an investor. As of December 31, 2012 and 2011, all of the Company's commercial and other loans held for sale were collateralized, with collateral primarily consisting of office buildings, retail properties, apartment complexes and industrial buildings. The following... -

Page 139

...INC. Notes to Consolidated Financial Statements 4. INVESTMENTS (continued) The following tables set forth the credit quality indicators as of December 31, 2011, based upon the recorded investment gross of allowance for credit losses. Commercial mortgage loans Debt Service Coverage Ratio-December 31... -

Page 140

... ...Real estate held through direct ownership ...Other ...Total other long-term investments ...2011 (in millions) $1,182 3,304 4,486 2,460 874 $7,820 $ 1,250 5,623 6,873 2,108 1,047 $10,028 In certain investment structures, the Company's asset management business invests with other co-investors in... -

Page 141

... as changes in the Company's level of investment in such entities. At December 31, 2012 2011 (in millions) STATEMENT OF FINANCIAL POSITION Investments in real estate ...Investments in securities ...Cash and cash equivalents ...Receivables ...Property and equipment ...Other assets(1) ...Total assets... -

Page 142

... following sources: 2011 2010 (in millions) $ (37) $ 230 $ (244) 24 145 185 94 122 53 (20) (20) 1 (2) 26 (41) (1,500) 2,294 1,090 0 34 6 $(1,441) $2,831 $1,050 2012 Fixed maturities ...Equity securities ...Commercial mortgage and other loans ...Investment real estate ...Joint ventures and limited... -

Page 143

...Policy Acquisition Costs, Accumulated Deferred Other Sales Comprehensive Inducements, Deferred Income (Loss) and Income Related To Net Net Unrealized Value of Future Tax Unrealized Gains (Losses) Business Policy Policyholders' (Liability) Investment on Investments Acquired Benefits Dividends Benefit... -

Page 144

... Policy Acquisition Costs, Accumulated Deferred Other Sales Comprehensive Inducements, Deferred Income (Loss) and Income Related To Net Net Unrealized Value of Future Tax Unrealized Gains (Losses) Business Policy Policyholders' (Liability) Investment on Investments(1) Acquired Benefits Dividends... -

Page 145

... discounts. At December 31, 2012, the Company does not intend to sell the securities and it is not more likely than not that the Company will be required to sell the securities before the anticipated recovery of its remaining amortized cost basis. Prudential Financial, Inc. 2012 Annual Report... -

Page 146

... certain employee benefits. Securities restricted as to sale amounted to $183 million and $191 million at December 31, 2012 and 2011, respectively. These amounts include member and activity-based stock associated with memberships in the Federal Home Loan Bank of New York and Boston. Restricted cash... -

Page 147

...-for-sale ...Fixed maturities, held-to-maturity ...Trading account assets supporting insurance liabilities ...Other long-term investments ...Accrued investment income ...Total assets of consolidated VIEs ...Total liabilities of consolidated VIEs ... Prudential Financial, Inc. 2012 Annual Report 145 -

Page 148

... 31, 2012 and 2011, respectively, is classified within "Policyholders' account balances." Creditors of the trust have recourse to Prudential Insurance if the trust fails to make contractual payments on the medium-term notes. The Company has not provided material financial or other support that was... -

Page 149

... changes in market value, which are included in accumulated other comprehensive income and relate to the market price of China Pacific Group's publicly traded shares. The consortium of investors including the Company sold portions of its holdings during the years ended December 31, 2012, 2011... -

Page 150

... amounts listed above for 2012, 2011 and 2010 do not include impairments recorded for mortgage servicing rights or other intangibles. See the non-recurring fair value measurements section of Note 20 for more information regarding these impairments. 148 Prudential Financial, Inc. 2012 Annual Report -

Page 151

... future disability claim payments and expenses as well as estimates of claims incurred but not yet reported as of the balance sheet dates related to group disability products. Unpaid claim liabilities that are discounted use interest rates ranging from 3.5% to 6.4%. Policyholders' Account Balances... -

Page 152

... death benefit in excess of the current account balance at the balance sheet date. The Company's primary risk exposures for these contracts relates to actual deviations from, or changes to, the assumptions used in the original pricing of these products, including equity market returns, contract... -

Page 153

... invested in general account investment options. For the years ended December 31, 2012, 2011, and 2010, there were no transfers of assets, other than cash, from the general account to any separate account, and accordingly no gains or losses recorded. Prudential Financial, Inc. 2012 Annual Report... -

Page 154

... balance to the then-current account value, if greater. The GMWB liability is calculated as the present value of future expected payments to customers less the present value of assessed rider fees attributable to the embedded derivative feature. 152 Prudential Financial, Inc. 2012 Annual Report -

Page 155

... life insurance policies and annuities issued by Prudential Insurance in the U.S. The recorded assets and liabilities were allocated to the Closed Block at their historical carrying amounts. The Closed Block forms the principal component of the Closed Block Business. Prudential Financial, Inc. 2012... -

Page 156

...Block Assets Fixed maturities, available-for-sale, at fair value ...Other trading account assets, at fair value ...Equity securities, available-for-sale, at fair value ...Commercial mortgage and other loans ...Policy loans ...Other long-term investments ...Short-term investments ...Total investments... -

Page 157

... obligations to the Company under the terms of the reinsurance agreements. Reinsurance premiums, commissions, expense reimbursements, benefits and reserves related to reinsured long-duration contracts are accounted for over the life of the underlying reinsured contracts using assumptions consistent... -

Page 158

... borrowings from the Federal Home Loan Bank of New York of $100 million and $199 million at December 31, 2012 and 2011, respectively, discussed in more detail below. (2) Includes limited and non-recourse borrowings of Prudential Holdings, LLC attributable to the Closed Block Business of $75... -

Page 159

... long term debt. The fair value of qualifying assets that were available to Prudential Insurance but not pledged amounted to $3.1 billion as of December 31, 2012. Federal Home Loan Bank of Boston Prudential Retirement Insurance and Annuity Company ("PRIAC") is a member of the Federal Home Loan Bank... -

Page 160

... of credit at December 31, 2012, of which $815 million was for the sole use of certain real estate separate accounts. The separate account facilities include loan-to-value ratio requirements and other financial covenants and recourse on obligations under these facilities is limited to the assets of... -

Page 161

... Prudential Financial or a continuing payment default. The initial exchange rate for the surplus notes is 10.1235 shares of Common Stock per each $1,000 principal amount of surplus notes, which represents an initial exchange price per share of Common Stock of $98.78; however, the exchange rate... -

Page 162

...dividend on the date of demutualization for use in the Financial Services Businesses. In addition, $72 million was used to purchase a guaranteed investment contract to fund a portion of the financial guarantee insurance premium related to the IHC debt. The remainder of the net proceeds was deposited... -

Page 163

PRUDENTIAL FINANCIAL, INC. Notes to Consolidated Financial Statements 14. SHORT-TERM AND LONG-TERM DEBT (continued) As of December 31, 2012 2011 (in millions) Consolidated Statements of Financial Position: Total assets ...Total liabilities ...Total member's equity ...Noncontrolling interests ...... -

Page 164

... increased capital needs of the Company due to opportunities for growth and acquisitions, as well as the effect of adverse market conditions on the segments. Stock Conversion Rights of the Class B Stock Prudential Financial may, at its option, at any time, exchange all outstanding shares of Class... -

Page 165

... holding company. The principal sources of funds available to Prudential Financial are dividends and returns of capital from its subsidiaries, repayments of operating loans from its subsidiaries and cash and short-term investments. The primary uses of funds at Prudential Financial include servicing... -

Page 166

... policy benefit liabilities using different actuarial assumptions, as well as valuing investments and certain assets and accounting for deferred taxes on a different basis. The FSA utilizes a solvency margin ratio to evaluate the capital adequacy of Japanese insurance companies. The solvency margin... -

Page 167

... additional information on changes in accounting for deferred acquisition costs and pension plans. 16. EARNINGS PER SHARE The Company has outstanding two separate classes of common stock. The Common Stock reflects the performance of the Financial Services Businesses and the Class B Stock reflects... -

Page 168

... Compensation cost for restricted stock units, performance shares and performance units granted to employees is measured by the share price of the underlying Common Stock at the date of grant. The fair value of each stock option award is estimated using a binomial option-pricing model on the date of... -

Page 169

... plans capitalized in deferred acquisition costs for the years ended December 31, 2012, 2011 and 2010 were de minimis. Stock Options Each stock option granted has an exercise price no less than the fair market value of the Company's Common Stock on the date of grant and has a maximum term... -

Page 170

... value is estimated using the 15% discount off of the grant date share price, plus the value of three month call and put options on shares at the grant date share price, less the value of forgone interest. Compensation costs recognized for employees under the Company's Employee Stock Purchase Plan... -

Page 171

...the funded status of the plans. The Company previously calculated market related value for pensions by recognizing changes in fair value of plan assets over a period of five years on all classes of assets (U.S Equities, International Equities, Fixed Maturities (including short term investments) Real... -

Page 172

... Financial Statements 18. EMPLOYEE BENEFIT PLANS (continued) Other Postretirement Pension Benefits Benefits 2012 2011 2012 2011 (in millions) Change in plan assets Fair value of plan assets at beginning of period ...Actual return on plan assets ...Annuity purchase ...Employer contributions ...Plan... -

Page 173

... Financial Statements 18. EMPLOYEE BENEFIT PLANS (continued) In 2012 the pension plans purchased annuity contracts from Prudential Insurance for $1 million. There were no purchases of annuity contracts in 2011 from Prudential Insurance. The approximate future annual benefit payment payable... -

Page 174

... the value of the Aa portfolio to the cash flows for the benefit obligation. The result is rounded to the nearest 5 basis points and the benefit obligation is recalculated using the rounded discount rate. The pension and postretirement expected long-term rates of return on plan assets for 2012 were... -

Page 175

... investor owns a "unit of account." Single client trusts hold assets for only one investor, the domestic qualified pension plan and each security in the fund is treated as individually owned. There were no investments in Prudential Financial Common Stock as of December 31, 2012 and December 31, 2011... -

Page 176

PRUDENTIAL FINANCIAL, INC. Notes to Consolidated Financial Statements 18. EMPLOYEE BENEFIT PLANS (continued) Partnerships-The value of interests owned in partnerships is based on valuations of the underlying investments that include private placements, structured debt, real estate, equities, fixed ... -

Page 177

PRUDENTIAL FINANCIAL, INC. Notes to Consolidated Financial Statements 18. EMPLOYEE BENEFIT PLANS (continued) As of December 31, 2011 Level 1 Level 2 Level 3 Total (in millions) U.S. Equities: Pooled separate accounts(1) ...Common/collective trusts(1) ...Subtotal ...International Equities: Pooled ... -

Page 178

PRUDENTIAL FINANCIAL, INC. Notes to Consolidated Financial Statements 18. EMPLOYEE BENEFIT PLANS (continued) Changes in Fair Value of Level 3 Pension Assets Year Ended December 31, 2012 Fixed Maturities- Corporate Real Estate- Debt- Fixed Pooled Corporate Maturities- Separate Bonds Other Accounts (... -

Page 179

... Financial Statements 18. EMPLOYEE BENEFIT PLANS (continued) Postretirement plan asset allocations in accordance with the investment guidelines are as follows: As of December 31, 2012 Level 1 Level 2 Level 3 Total (in millions) U.S. Equities: Variable Life Insurance Policies(1) ...Common trusts... -

Page 180

... ...International Equities ...Fixed Maturities ...Short-term Investments ...Real Estate ...Other ...Total ...10 % 4 69 3 4 10 100 % 8% 2 73 2 4 11 100 % Postretirement Percentage of Plan Assets 2012 2011 52 % 5 40 3 0 0 100 % 46 % 4 48 2 0 0 100 % 178 Prudential Financial, Inc. 2012 Annual Report -

Page 181

..., INC. Notes to Consolidated Financial Statements 18. EMPLOYEE BENEFIT PLANS (continued) The expected benefit payments for the Company's pension and postretirement plans, as well as the expected Medicare Part D subsidy receipts related to the Company's postretirement plan, for the years indicated... -

Page 182

... ... Total income tax expense includes additional tax expense related to the realization of deferred tax assets recorded in the Statement of Financial Position as of the acquisition date for Prudential Gibraltar Financial Life Insurance Company, Ltd. ("PGFL") and the Star and Edison Businesses. The... -

Page 183

... effective rate ... The Company classifies all interest and penalties related to tax uncertainties as income tax expense (benefit). The amounts recognized in the consolidated financial statements for tax-related interest and penalties for the years ended December 31, are as follows: 2011 2010 2012... -

Page 184

...of the difference between the Company's effective tax rate and the federal statutory tax rate of 35%. The DRD for the current period was estimated using information from 2011, current year results, and was adjusted to take into account the current year's equity market performance. The actual current... -

Page 185

... (corporate public and private bonds, most government securities, certain asset-backed and mortgage-backed securities, etc.), certain equity securities (mutual funds, which do not actively trade and are priced based on a net asset value), certain commercial mortgage loans, short-term investments and... -

Page 186

... ...Equity securities, available-for-sale ...Commercial mortgage and other loans ...Other long-term investments ...Short-term investments ...Cash equivalents ...Other assets ...Subtotal excluding separate account assets ...Separate account assets(4) ...Total assets ...Future policy benefits ...Other... -

Page 187

... of investments in common and preferred stock of publicly traded companies, perpetual preferred stock, privately traded securities, as well as mutual fund shares. The fair values of most publicly traded equity securities are based on quoted market prices in active markets for identical assets and... -

Page 188

... name credit default swaps, loan commitments held for sale and to-be-announced (or TBA) forward contracts on highly rated mortgage-backed securities issued by U.S. government sponsored entities are determined using discounted cash flow models. The fair values of European style option contracts are... -

Page 189

... information on significant internally-priced Level 3 assets and liabilities for which the investment risks associated with market value changes are borne by the Company. As of December 31, 2012 Impact of Increase in Input on Fair Value(1) Fair Value (in millions) Assets: Corporate securities... -

Page 190

...earned by the Company related to the management of most separate account assets classified as Level 3 do not change due to changes in the fair value of these investments. Quantitative information about significant internally-priced Level 3 separate account assets is as follows: Real Estate and Other... -

Page 191

... $124 $11 $ 0 $ 0 $ 0 $ (1) $ 9 $ 0 $ 0 Year Ended December 31, 2012 Trading Account Assets Commercial Residential All U.S Asset- Mortgage- MortgageOther Government Corporate Backed Backed Backed Equity Activity (in millions) Fair Value, beginning of period ...$9 $148 $ 416 $ 35 $4 $1,296... -

Page 192

..., INC. Notes to Consolidated Financial Statements 20. FAIR VALUE OF ASSETS AND LIABILITIES (continued) Year Ended December 31, 2012 Equity Commercial Securities Mortgage Other Availableand Other Long-term Short-term For-Sale Loans Investments Investments (in millions) $360 $ 86 $1,110 $0 Fair... -

Page 193

...$16 $ 0 $ 0 $ (39) $ 7 $ (55) $ 0 Year Ended December 31, 2011 Trading Account Assets Commercial Residential U.S. Asset- Mortgage- Mortgage- Equity All Other Government Corporate Backed Backed Backed Securities Activity (in millions) Fair Value, beginning of period ...$0 $117 $ 280 $ 24 $ 36... -

Page 194

... Financial Statements 20. FAIR VALUE OF ASSETS AND LIABILITIES (continued) Year Ended December 31, 2011 Other Equity Commercial Liabilities Securities Mortgage Other Separate Future and notes Available- and Other Long-term Other Account Policy of consolidated For-Sale Loans Investments Assets Assets... -

Page 195

...Value, end of period ...Unrealized gains (losses) for assets still held(3): Included in earnings: Realized investment gains (losses), net ...Asset management fees and other income ... Year Ended December 31, 2010 Equity Commercial Securities Mortgage Other Availableand Other Long-term For-Sale Loans... -

Page 196

... or accretion of premiums and discounts. (4) Separate account assets represent segregated funds that are invested for certain customers. Investment risks associated with market value changes are borne by the customers, except to the extent of minimum guarantees made by the Company with respect to... -

Page 197

... value on a recurring basis, as of the date indicated, by primary underlying. These tables exclude embedded derivatives which are recorded with the associated host contract. The derivative assets and liabilities shown below are included in "Other trading account assets," "Other long-term investments... -

Page 198

...December 31, 2012 and 2011, respectively, were recorded for real estate investments, some of which were classified as discontinued operations. The impairments were based primarily on appraisal values and were classified as Level 3 in the hierarchy. 196 Prudential Financial, Inc. 2012 Annual Report -

Page 199

..., INC. Notes to Consolidated Financial Statements 20. FAIR VALUE OF ASSETS AND LIABILITIES (continued) Fair Value Option-The following table presents information regarding changes in fair values recorded in earnings for commercial mortgage loans, other long-term investments and notes issued by... -

Page 200

...group corporate-, bank- and trust-owned life insurance contracts and group universal life contracts, the fair value of the policy loans is the amount due, excluding interest, as of the reporting date. Short-Term Investments, Cash & Equivalents, Accrued Investment Income and Other Assets The Company... -

Page 201

...of exercise and the strike price. The Company uses combinations of purchases and sales of equity index options to hedge the effects of adverse changes in equity indices within a predetermined range. These hedges do not qualify for hedge accounting. Prudential Financial, Inc. 2012 Annual Report 199 -

Page 202

... determined using valuation models. The Company maintains a portfolio of derivative instruments that is intended to economically hedge the risks related to the above products' features. The derivatives may include, but are not limited to equity options, total return swaps, interest rate swap options... -

Page 203

PRUDENTIAL FINANCIAL, INC. Notes to Consolidated Financial Statements 21. DERIVATIVE INSTRUMENTS (continued) Synthetic Guarantees. The Company sells synthetic guaranteed investment contracts, through both full service and investment-only sales channels, to qualified pension plans. The assets are ... -

Page 204

... the financial statement classification and impact of derivatives used in qualifying and non-qualifying hedge relationships, excluding the offset of the hedged item in an effective hedge relationship. Year Ended December 31, 2012 Interest Credited Accumulated Realized Net To Policyholders' Other... -

Page 205

... "Accumulated other comprehensive income (loss)." (2) Relates to the sale of equity method investments. For the years ended December 31, 2012, 2011 and 2010, the ineffective portion of derivatives accounted for using hedge accounting was not material to the Company's results of operations and there... -

Page 206

... of Prudential Insurance. The notional of this credit derivative is $500 million and the fair value as of December 31, 2012 and 2011 was a liability of $32 million and $77 million, respectively. No collateral was pledged in either period. The Company holds certain externally-managed investments in... -

Page 207

... fair value of the Company's derivative contracts used in a derivative dealer or broker capacity were reported on a net-bycounterparty basis in the Company's Consolidated Statements of Financial Position when management believes a legal right of setoff exists under an enforceable netting agreement... -

Page 208

... value products, guaranteed investment contracts, funding agreements, institutional and retail notes, structured settlement annuities and other group annuities. The Asset Management segment provides a broad array of investment management and advisory services by means of institutional portfolio... -

Page 209

... Company's Asset Management segment. For example, Asset Management's strategic investing business makes investments for sale or syndication to other investors or for placement or co-investment in the Company's managed funds and structured products. The realized investment gains and losses associated... -

Page 210

...-rated products are classified as trading and are carried at fair value, with realized and unrealized gains and losses reported in "Asset management fees and other income." To a lesser extent, these experience-rated products are also supported by derivatives and commercial mortgage and other loans... -

Page 211

... care insurance reflecting the challenging economics of the long-term care market including the continued low interest rate environment as well as its desire to focus resources on its core group life and disability businesses. The Company discontinued sales of group long-term care products effective... -

Page 212

...31, 2012 Interest Credited to Amortization of Net Policyholders' Deferred Policy Investment Policyholders' Account Dividends to Interest Acquisition Total Revenues Income Benefits Balances Policyholders Expense Costs Assets (in millions) Financial Services Businesses: Individual Annuities ...$ 3,983... -

Page 213

...31, 2011 Interest Amortization Credited to of Deferred Net Policyholders' Policy Investment Policyholders' Account Dividends to Interest Acquisition Total Revenues Income Benefits Balances Policyholders Expense Costs Assets (in millions) Financial Services Businesses: Individual Annuities ...$ 3,638... -

Page 214

... Amortization Credited to of Deferred Net Policyholders' Policy Investment Policyholders' Account Dividends to Interest Acquisition Revenues Income Benefits Balances Policyholders Expense Costs (in millions) Financial Services Businesses: Individual Annuities ...Retirement ...Asset Management... -

Page 215

... as derivatives and recorded at fair value. In certain of these transactions, the Company pre-arranges that it will sell the loan to an investor, including to governmental sponsored entities as discussed below, after the Company funds the loan. Prudential Financial, Inc. 2012 Annual Report 213 -

Page 216

... Written As discussed further in Note 21, the Company writes credit derivatives under which the Company is obligated to pay the counterparty the referenced amount of the contract and receive in return the defaulted security or similar security. 214 Prudential Financial, Inc. 2012 Annual Report -

Page 217

... 2012 2011 (in millions) $172 $221 215 290 0 0 Guarantees of credit enhancements of debt instruments associated with commercial real estate assets ...Fair value of properties and associated tax credits that secure the guarantee ...Accrued liability associated with guarantee ... The Company arranges... -

Page 218

... protect policyholders against the insolvency of life insurance companies in Japan through assessments to companies licensed to provide life insurance. Assets and liabilities held for insolvency assessments were as follows: As of December 31, 2012 2011 (in millions) Other assets: Premium tax offset... -

Page 219

... life insurance companies to take additional steps to identify unreported deceased policy and contract holders. These prospective changes and any escheatable property identified as a result of the audits and inquiries could result in: (1) additional Prudential Financial, Inc. 2012 Annual Report... -

Page 220

... actions were filed challenging the use of retained asset accounts to settle death benefit claims of beneficiaries of a group life insurance contract owned by the United States Department of Veterans Affairs that covers the lives of members and veterans of the U.S. armed forces. In 2011, the cases... -

Page 221

...In June 2012, the court granted summary judgment against an additional plaintiff reducing to 39 the number of plaintiffs asserting claims against the Company. Retirement Solutions and Investment Management In October 2007, Prudential Retirement Insurance and Annuity Co. ("PRIAC") filed an action in... -

Page 222

... class action lawsuit was filed in the United States District Court for the Southern District of California, Wang v. Prudential Financial, Inc. and Prudential Insurance, claiming that the Company failed to pay its agents overtime and provide other benefits in violation of California and federal law... -

Page 223

..., INC. Notes to Consolidated Financial Statements 23. COMMITMENTS AND GUARANTEES, CONTINGENT LIABILITIES AND LITIGATION AND REGULATORY MATTERS (continued) Prudential Insurance Company of America, et al. v. Barclays Bank PLC, et al,, The Prudential Insurance Company of America, et al. v. Goldman... -

Page 224

... of a change in method of applying an accounting principle for the Company's pension plans. The pension plan accounting change resulted in an increase in net income of $24 million for each quarter of 2012 ($0.05 diluted earnings per share of Common stock). For further information, see Notes... -

Page 225

...supporting insurance liabilities, at fair value ...20,590 Other trading account assets, at fair value ...6,053 Equity securities, available-for-sale, at fair value ...5,052 Commercial mortgage and other loans ...27,125 Policy loans ...6,455 Other long-term investments ...8,016 Short-term investments... -

Page 226

... Ended December 31, 2012 and 2011 (in millions) 2012 2011 Financial Financial Services Closed Block Services Closed Block Businesses Business Consolidated Businesses Business Consolidated REVENUES Premiums ...Policy charges and fee income ...Net investment income ...Asset management fees and other... -

Page 227

... interest rate swap related to the IHC debt; and certain other related assets and liabilities. The Financial Services Businesses consist of the U.S. Retirement Solutions and Investment Management, U.S. Individual Life and Group Insurance, and International Insurance divisions and Corporate and Other... -

Page 228

... to Section 4(2) of the Securities Act of 1933 on the date of demutualization. There is no established public trading market for the Class B Stock. During the fourth quarter of 2012 and 2011, Prudential Financial paid an annual dividend of $9.625 per share of Class B Stock. On January 31, 2013... -

Page 229

... into shares of common stock and an initial investment of $100 at the closing prices on December 31, 2007. ANNUAL RETURN PERCENTAGE Years Ending Dec09 Dec10 Dec11 66.75 26.46 22.98 20.66 15.06 15.17 -12.19 2.11 -25.37 Company / Index Prudential Financial, Inc ...S&P 500 Index ...Financial Services... -

Page 230

... related to deferred policy acquisition costs, value of business acquired or goodwill; (9) changes in assumptions for retirement expense; (10) changes in our financial strength or credit ratings; (11) statutory reserve requirements associated with term and universal life insurance policies... -

Page 231

...Capital Group, LLC * Robert M. Falzon replaces Richard J. Carbone as Chief Financial Ofï¬cer effective March 4, 2013 Shareholder information Corporate Ofï¬ce Prudential Financial, Inc. 751 Broad Street, Newark, NJ 07102 973-802-6000 Stock Exchange Listing The Common Stock of Prudential Financial... -

Page 232

PRINTED ON RECYCLED PAPER WITH 10% POST-CONSUMER WASTE. PAPERS PRODUCED UNDER A SUSTAINABLE FOREST MANAGEMENT PROGRAM. PRINTED USING VEGETABLE-BASED INKS AND RENEWABLE ENERGY.