Office Depot 2010 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2010 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

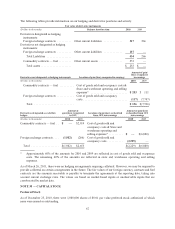

Internal Revenue Code to modify distribution elections previously elected for plans years 2005 through 2008. In

October 2009, the compensation and benefits committee amended the plan to no longer accept new deferrals.

During 2010, 2009, and 2008, $80.2 thousand, $1.1 million, $12.6 million, respectively, was recorded as compensation

expense for company contributions to these programs and certain international retirement savings plans.

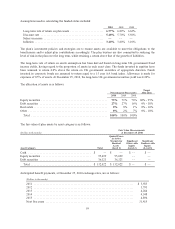

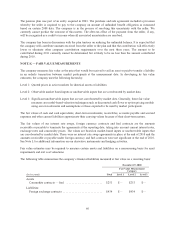

Pension Plan

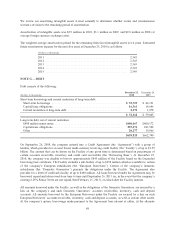

The company has a defined benefit pension plan covering a limited number of employees in Europe. During

2008, curtailment of that plan was approved by the trustees and future service benefits ceased for the remaining

employees, resulting in a curtailment gain of $11.4 million. The following table provides a reconciliation of

changes in the projected benefit obligation, the fair value of plan assets and the funded status of the plan to

amounts recognized on our balance sheets:

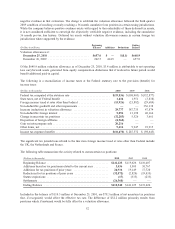

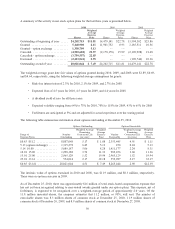

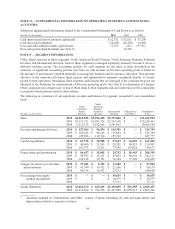

(Dollars in thousands) December 25, 2010 December 26, 2009

Changes in projected benefit obligation:

Obligation at beginning of period .................................. $ 192,131 $ 154,840

Service cost ................................................... ——

Interest cost ................................................... 10,466 9,006

Member contributions ........................................... ——

Benefits paid ................................................... (4,426) (5,041)

Actuarial loss (gain) ............................................. (14,651) 18,107

Curtailment (gain) .............................................. ——

Currency translation ............................................. (6,325) 15,219

Obligation at valuation date ....................................... 177,195 192,131

Changes in plan assets:

Fair value at beginning of period ................................... 120,383 84,454

Actual return on plan assets ....................................... 14,959 22,898

Company contributions .......................................... 5,105 5,166

Member contributions ........................................... ——

Benefits paid ................................................... (4,426) (5,041)

Currency translation ............................................. (3,999) 12,906

Plan assets at valuation date ....................................... 132,022 120,383

Benefit obligation in excess of plan assets ............................ (45,173) (71,748)

Net liability recognized at end of period ............................. $ (45,173) $ (71,748)

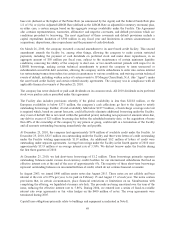

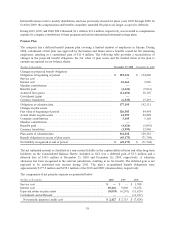

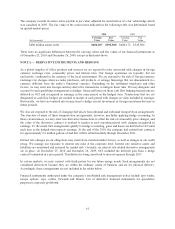

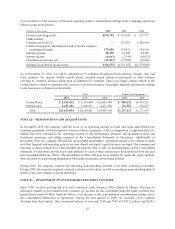

The net unfunded amount is classified as a non-current liability in the caption deferred taxes and other long-term

liabilities on the Consolidated Balance Sheets. Included in OCI was a deferred gain of $5.5 million and a

deferred loss of $14.5 million at December 25, 2010 and December 26, 2009, respectively. A valuation

allowance has been recognized in the relevant jurisdiction, resulting in no tax benefit. The deferred gain is not

expected to be amortized into income during 2011. The plan’s accumulated benefit obligations were

approximately $177.2 million and $192.1 million at the 2010 and 2009 valuation dates, respectively.

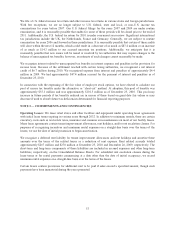

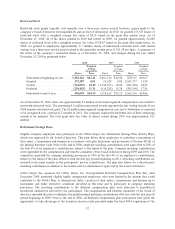

The components of net periodic expense are presented below:

(Dollars in thousands) 2010 2009 2008

Service cost .............................................. $—$ — $ 1,708

Interest cost .............................................. 10,466 9,006 13,434

Expected return on plan assets ............................... (8,039) (6,291) (11,629)

Curtailment and settlement .................................. —— (11,437)

Net periodic pension (credit) cost ........................... $ 2,427 $ 2,715 $ (7,924)

58