Office Depot 2010 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2010 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

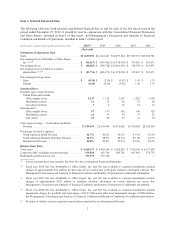

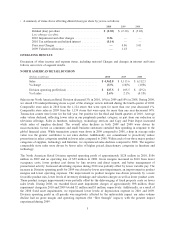

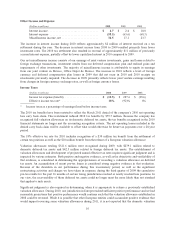

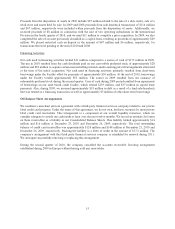

Other Income and Expense

(Dollars in millions) 2010 2009 2008

Interest income .................................. $ 4.7 $ 2.4 $ 10.0

Interest expense ................................. (58.5) (65.6) (68.3)

Miscellaneous income, net ......................... 34.5 17.1 23.7

The increase in interest income during 2010 reflects approximately $2 million of interest received on a tax

settlement during the year. The decrease in interest income from 2008 to 2009 resulted primarily from lower

investment rates. The 2010 tax settlement also resulted in reversal of approximately $11 million of previously

accrued interest expense, partially offset by lower capitalized interest in 2010 compared to 2009.

Our net miscellaneous income consists of our earnings of joint venture investments, gains and losses related to

foreign exchange transactions, investment results from our deferred compensation plan and realized gains and

impairments of other investments. The majority of miscellaneous income is attributable to equity in earnings

from our joint venture in Mexico, Office Depot de Mexico. The increase in 2010 reflects a level of foreign

currency and deferred compensation plan losses in 2009 that did not recur in 2010 and 2010 receipts on

investments previously impaired. The decrease in 2009 primarily reflects lower joint venture earnings resulting

from changes in foreign currency exchange rates, as well as foreign currency losses.

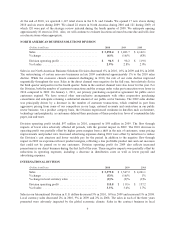

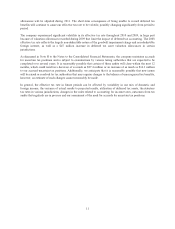

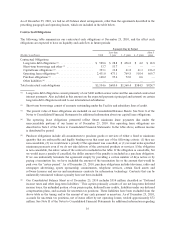

Income Taxes

(Dollars in millions) 2010 2009 2008

Income tax expense (benefit) ....................... $ (10.5) $ 287.6 $ (98.6)

Effective income tax rate* ......................... 18% (92)% 6%

* Income taxes as a percentage of earnings (loss) before income taxes.

The 2010 tax benefits have been restated to reflect the March 2011 denial of the company’s 2010 net operating

loss carry back claim. This restatement reduced 2010 tax benefits by $79.5 million. Because the company has

recognized full valuation allowances on its domestic deferred tax assets, the tax benefits recognized in the 2010

financial statements no longer met the accounting recognition criteria. The net operating losses included in the

denied carry back claim will be available to offset what would otherwise be future tax payments over a 20-year

period.

The 18% effective tax rate for 2010 includes recognition of a $30 million tax benefit from the settlement of

certain tax positions as well as the $10 million benefit from the release of a European valuation allowance.

Valuation allowances totaling $321.6 million were recognized during 2009, with $279.1 million related to

domestic deferred tax assets and $42.5 million related to foreign deferred tax assets. The establishment of

valuation allowances and development of projected annual effective tax rates requires significant judgment and is

impacted by various estimates. Both positive and negative evidence, as well as the objectivity and verifiability of

that evidence, is considered in determining the appropriateness of recording a valuation allowance on deferred

tax assets. An accumulation of recent pre-tax losses is considered strong negative evidence in that evaluation.

Because of the downturn in our performance during this recessionary period, as well as the significant

restructuring activities and charges we have taken in response, during the third quarter of 2009 the cumulative

pre-tax results for the past 36 months of certain taxing jurisdictions reached or nearly reached loss positions. In

our view, the recoverability of those deferred tax assets could no longer meet the more likely than not standard

that applies to such assets.

Significant judgment is also required in determining when it is appropriate to release a previously established

valuation allowance. During 2010, one jurisdiction in Europe reached sufficient positive performance and we had

reasonable projections that positive performance would continue such that the valuation allowance established in

2008 could be reversed. While it is possible that other European entities could accumulate positive evidence that

would support reversing some valuation allowances during 2011, it is not expected that the domestic valuation

10