Office Depot 2010 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2010 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

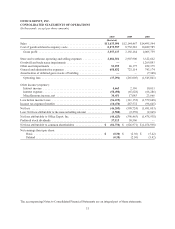

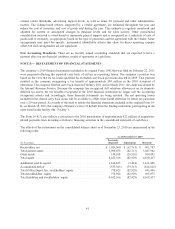

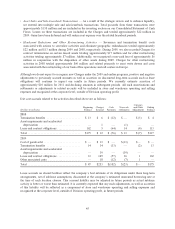

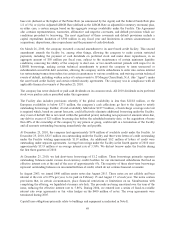

The effects of the restatement on the consolidated statements of operations for fiscal year 2010 are summarized

in the following table:

Fiscal Year Ended December 25, 2010

(In thousands)

Previously

Reported Adjustments Restated

Income tax benefit ............................................... $(89,985) $ 79,515 $(10,470)

Net earnings (loss) ............................................... 33,310 (79,515) (46,205)

Net earnings (loss) attributable to Office Depot, Inc. .................... 34,892 (79,515) (44,623)

Net loss attributable to common shareholders ......................... (2,221) (79,515) (81,736)

Earnings per common share:

Basic ....................................................... $ (0.01) $ (0.29) $ (0.30)

Diluted ...................................................... $ (0.01) $ (0.29) $ (0.30)

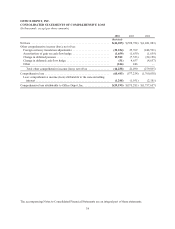

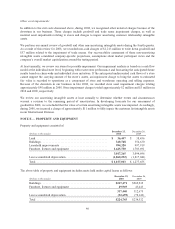

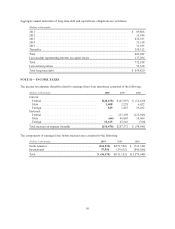

The effects of the restatement on the consolidated statement of comprehensive loss for fiscal year 2010 is

summarized in the following table:

Fiscal Year Ended December 25, 2010

(In thousands)

Previously

Reported Adjustments Restated

Net earnings (loss) .............................................. $33,310 $(79,515) $(46,205)

Comprehensive income (loss) ..................................... 19,072 (79,515) (60,443)

Comprehensive income (loss) attributable to Office Depot, Inc. .......... 20,320 (79,515) (59,195)

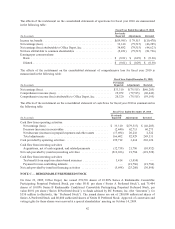

The effects of the restatement on the consolidated statement of cash flows for fiscal year 2010 is summarized in

the following table:

Fiscal Year Ended December 25, 2010

(In thousands)

Previously

Reported Adjustments Restated

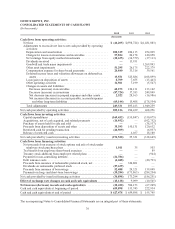

Cash flow from operating activities:

Net earnings (loss) .......................................... $ 33,310 $(79,515) $ (46,205)

Decrease (increase) in receivables ............................. (2,440) 62,713 60,273

Net decrease (increase) in prepaid expenses and other assets ........ (17,694) 20,216 2,522

Total adjustments .......................................... 166,402 82,929 249,331

Cash provided by operating activities ............................. 199,712 3,414 203,126

Cash flow from investing activities

Acquisitions, net of cash acquired, and related payments ........... (32,738) 21,786 (10,952)

Net cash provided by (used in) investing activities .................. (213,306) 21,786 (191,520)

Cash flow from investing activities

Tax benefit from employee share-based exercises ................. 3,414 (3,414) —

Payment for non-controlling interests ........................... — (21,786) (21,786)

Net cash provided by (used in) financing activities .................. (5,698) (25,200) (30,898)

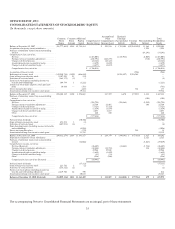

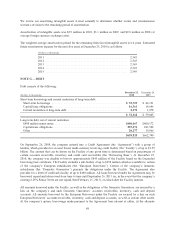

NOTE C — REDEEMABLE PREFERRED STOCK

On June 23, 2009, Office Depot, Inc. issued 274,596 shares of 10.00% Series A Redeemable Convertible

Participating Perpetual Preferred Stock, par value $0.01 per share (“Series A Preferred Stock”), and 75,404

shares of 10.00% Series B Redeemable Conditional Convertible Participating Perpetual Preferred Stock, par

value $0.01 per share (“Series B Preferred Stock”), to funds advised by BC Partners, Inc. (the “Investors”), for

$350 million (collectively, the “Preferred Stock”). The issued shares are out of 280,000 authorized shares of

Series A Preferred Stock and 80,000 authorized shares of Series B Preferred Stock. Approval of conversion and

voting rights for these shares was received at a special shareholders’ meeting on October 14, 2009.

42