Office Depot 2010 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2010 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

fiscal year. In addition, at the current ownership percentage level, the Investors are entitled to nominate up to

three members of the board of directors. Declining ownership percentages reduce the Investors’ board

representation rights. Three directors designated by the Investors are current members of the company’s board of

directors.

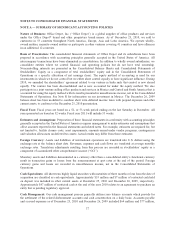

NOTE D — ASSET IMPAIRMENTS, EXIT COSTS AND OTHER CHARGES

Each of our three operating segments has been adversely affected by the downturn in the global economy in

recent years. The company has taken actions to adapt to the changing and increasingly competitive conditions

including closing stores and distribution centers (“DCs”), consolidating functional activities and disposing of

businesses and assets. During 2010, 2009 and 2008, we have recognized significant charges from reorganization

efforts and asset impairments. The charges recognized in 2009 and 2008 that related to a strategic review (the

“Charges”) were managed at the corporate level and were excluded from measurement of Division operating

profit.

In the fourth quarter of 2010, the company initiated additional activities to increase future operating performance,

change the ownership structure of certain international investments and eliminate non-productive corporate

assets. The 2010 charges included termination benefits and lease obligations accrued in Europe of approximately

$6 million and $5 million respectively, a pre-tax loss on the sale of two operating subsidiaries in the International

Division of approximately $11 million, a $51 million charge for the abandonment of software under development

that will not be implemented and approximately $13 million associated with severance, accelerated vesting of

share-based awards and compensation-related costs following the departure of the former CEO. The operations

of the two subsidiaries sold were not material to the operations of the company. The loss on subsidiary sales and

the severance and lease obligation accruals recognized in 2010 are included in Store and warehouse operating

and selling expenses on the Consolidated Statements of Operations and are included in the measurement of

segment operating profit for the International Division. The software impairment charge is presented on a

separate line and the executive compensation costs are included in unallocated general and administrative

expenses.

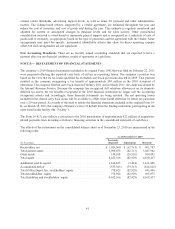

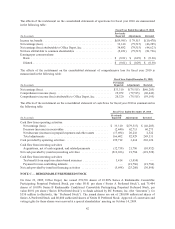

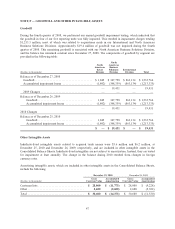

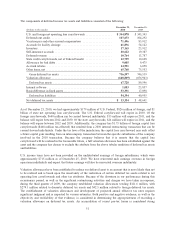

A summary of the Charges recognized during 2009 and 2008 and the line item presentation of these amounts in

our accompanying Consolidated Statements of Operations is as follows.

(Dollars in millions, except per share amounts) 2009 2008

Cost of goods sold and occupancy costs .................................... $ 13 $ 16

Store and warehouse operating and selling expenses .......................... 188 52

Goodwill and trade name impairments ..................................... — 1,270

Other asset impairments ................................................. 26 114

General and administrative expenses ....................................... 26 17

Total pre-tax Charges ................................................. $253 $1,469

The primary components of Charges include:

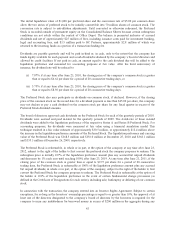

•Retail Store Initiatives — We closed 126 stores in North America (six of which were closed in the fourth

quarter of 2008, the remainder in 2009) and 27 stores in Japan. The stores closed were underperforming or

stores that were no longer a strategic fit for the company. The Charges totaled $122 million and $104 million

in 2009 and 2008, respectively. The 2009 Charges were primarily related to lease accruals, inventory write

downs, severance expenses and other facility closure costs. The 2008 Charges related primarily to asset

impairments, inventory write downs and lease accruals.

•Supply Chain Initiatives — During 2009, we closed five DCs and six crossdock facilities in North America

and consolidated our DCs in Europe. Charges related to these actions totaled approximately $57 million in

2009 and related primarily to lease accruals, inventory write downs, severance expenses and other facility

closure costs. The 2008 Charges totaled approximately $22 million and consisted primarily of accelerated

depreciation, severance related costs and lease accruals.

44