Office Depot 2010 Annual Report Download - page 12

Download and view the complete annual report

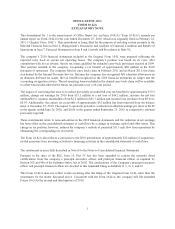

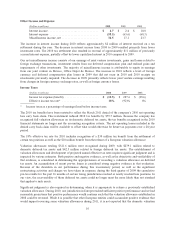

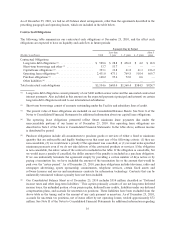

Please find page 12 of the 2010 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.allowances will be adjusted during 2011. The short-term consequence of being unable to record deferred tax

benefits will continue to cause our effective tax rate to be volatile, possibly changing significantly from period to

period.

The company experienced significant volatility in its effective tax rate throughout 2010 and 2009, in large part

because of valuation allowances recorded during 2009 that limit the impact of deferred tax accounting. The 2008

effective tax rate reflects the largely non-deductible nature of the goodwill impairment charge and non-deductible

foreign interest, as well as a $47 million increase in deferred tax asset valuation allowances in certain

jurisdictions.

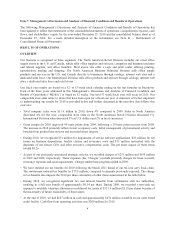

As discussed in Note H to the Notes to the Consolidated Financial Statements, the company maintains accruals

for uncertain tax positions and is subject to examinations by various taxing authorities that are expected to be

completed over several years. It is reasonably possible that certain of these audits will close within the next 12

months, which could result in a decrease of as much as $87.4 million or an increase of as much as $14.3 million

to our accrued uncertain tax positions. Additionally, we anticipate that it is reasonably possible that new issues

will be raised or resolved by tax authorities that may require changes to the balance of unrecognized tax benefits,

however, an estimate of such changes cannot reasonably be made.

In general, the effective tax rate in future periods can be affected by variability in our mix of domestic and

foreign income, the variance of actual results to projected results, utilization of deferred tax assets, the statutory

tax rates in various jurisdictions, changes in the rules related to accounting for income taxes, outcomes from tax

audits that regularly are in process and our assessment of the need for accruals for uncertain tax positions.

11