Office Depot 2010 Annual Report Download - page 21

Download and view the complete annual report

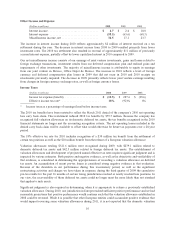

Please find page 21 of the 2010 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.future stock price performance, whether the company would issue a notice to call the preferred shares and

whether the holders would convert their preferred stock into common stock. While the fair value of preferred

stock dividends paid in-kind has no standing in the contractual rights to liquidation preference of the preferred

shareholders nor any cash impact on the company, it impacts the measurement of net income available to

common shareholders and reduces earnings per share. Changes in the valuation assumptions such as the risk

adjusted rate, stock price volatility and time to call or convert can impact the estimated fair value and therefore

the amount reported as net income available to common shareholders and earnings per share. However, the

valuation is most sensitive to changes in the underlying common stock price. The company believes the model

used to estimate fair value is reasonable and appropriate, but the reported dividend amount could change

significantly in future periods based on changes in the underlying common stock price and the model inputs. The

company paid all Preferred Stock dividends accrued for 2010 in cash.

SIGNIFICANT TRENDS, DEVELOPMENTS AND UNCERTAINTIES

Competitive Factors — Over the years, we have seen continued development and growth of competitors in all

segments of our business. In particular, mass merchandisers and warehouse clubs, as well as grocery and

drugstore chains, have increased their assortment of home office merchandise, attracting additional

back-to-school customers and year-round casual shoppers. Warehouse clubs have expanded beyond their in-store

assortment by adding catalogs and web sites from which a much broader assortment of products may be ordered.

We also face competition from other office supply stores that compete directly with us in numerous markets.

This competition is likely to result in increased competitive pressures on pricing, product selection and services

provided. Many of these retail competitors, including discounters, warehouse clubs, and drug stores and grocery

chains, carry basic office supply products. Some of them also feature technology products. Many of them may

price certain of these offerings lower than we do, but they have not shown an indication of greatly expanding

their somewhat limited product offerings at this time. This trend towards a proliferation of retailers offering a

limited assortment of office products is a potentially serious trend in our industry that could impact our results.

We have also seen growth in competitors that offer office products over the internet, featuring special purchase

incentives and one-time deals (such as close-outs). Through our own successful internet and business-to-business

web sites, we believe that we have positioned ourselves competitively in the e-commerce arena.

Another trend in our industry has been consolidation, as competitors in office supply stores and the copy/print

channel have been acquired and consolidated into larger, well-capitalized corporations. This trend towards

consolidation, coupled with acquisitions by financially strong organizations, is potentially a significant trend in

our industry that could impact our results.

We regularly consider these and other competitive factors when we establish both offensive and defensive

aspects of our overall business strategy and operating plans.

Economic Factors — Our customers in the North American Retail Division and the International Division and

many of our customers in the North American Business Solutions Division are predominantly small and home

office businesses. Accordingly, these customers may continue to curtail their spending in reaction to

macroeconomic conditions, such as changes in the housing market and commodity costs, higher credit costs,

credit availability and other factors. The downturn in the global economy experienced over the past two years

negatively impacted our sales and profits.

Liquidity Factors — Historically, we have generated positive cash flow from operating activities and have had

access to broad financial markets that provide the liquidity we need to operate our business. Together, these

sources have been used to fund operating and working capital needs, as well as invest in business expansion

through new store openings, capital improvements and acquisitions. However, due to the downturn in the global

economy our operating results have diminished. In June 2009, we issued $350 million of redeemable preferred

stock and in September 2008, we entered into a $1.25 billion asset based credit facility to provide liquidity. There

20