Office Depot 2010 Annual Report Download - page 14

Download and view the complete annual report

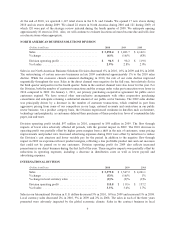

Please find page 14 of the 2010 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.$52.5 million at an effective interest rate of approximately 3.49%. The maximum month end amount outstanding

during 2010 occurred in November at approximately $73.4 million. There were also letters of credit outstanding

under the Facility at year end totaling approximately $119.0 million. An additional $0.2 million of letters of

credit were outstanding under separate agreements. Average borrowings under the Facility in the fourth quarter

of 2010 were approximately $33.9 million at an average interest rate of 3.56%. The maximum monthly average

in 2010 occurred in December at approximately $67.3 million. We did not borrow under the Facility during the

first three quarters of 2010.

In addition to our borrowings under the Facility, we had short-term borrowings of $1.2 million at 2010 year end.

These borrowings primarily represent outstanding balances under various local currency credit facilities for our

international subsidiaries that had an effective interest rate at the end of the year of approximately 6%. The

maximum month end and monthly average amounts were $53.5 million and $52.1 respectively, both occurring in

the month of August. The maximum month end and monthly average amounts includes debt related to two

operating subsidiaries in the International Division that were sold during the fourth quarter of 2010. The majority

of these short-term borrowings represent outstanding balances on uncommitted lines of credit, which do not

contain financial covenants.

The company’s arrangement with a third party financial services company for our private label credit cards is

scheduled for renewal during 2011. We anticipate successfully renewing or replacing this arrangement. See our

discussion under “Off-Balance Sheet Arrangements” for additional information.

Redeemable Preferred Stock

On June 23, 2009, we issued 274,596 shares of 10.00% Series A Redeemable Convertible Participating Perpetual

Preferred Stock (“Series A Preferred Stock”), and 75,404 shares of 10.00% Series B Redeemable Conditional

Convertible Participating Perpetual Preferred Stock (“Series B Preferred Stock” and, together with Series A

Preferred Stock the “Preferred Stock”) for net proceeds of approximately $325 million. Each share of Preferred

Stock has an initial liquidation preference of $1,000 and the conversion rate of $5.00 per common share allow the

two series of preferred stock to be initially convertible into 70 million shares of common stock. The conversion

rate is subject to anti-dilution adjustments. The conversion and voting rights features of these shares were

approved by the shareholders in 2009.

Dividends on the Preferred Stock are payable quarterly and will be paid in-kind or, in cash, only to the extent that

the company has funds legally available for such payment and a cash dividend is declared by the company’s

board of directors and allowed by credit facilities. If not paid in cash, an amount equal to the cash dividend due

will be added to the liquidation preference and measured for accounting purposes at fair value. The dividend rate

will be reduced to (a) 7.87% if, at any time after June 23, 2012, the closing price of the company’s common stock

is greater than or equal to $6.62 per share for a period of 20 consecutive trading days, or (b) 5.75% if, at any time

after June 23, 2012, the closing price of the company’s common stock is greater than or equal to $8.50 per share

for a period of 20 consecutive trading days.

The quarterly dividends of $9.2 million were paid in cash on April 1, 2010, July 1, 2010 and October 1, 2010.

The dividend of $9.2 million for the fourth quarter of 2010 was paid in cash on January 3, 2011. Dividends

accrued during 2009 were paid in-kind, with the stated-rate dividend added to the liquidation preference of the

respective Series A and Series B Preferred Stock. For accounting purposes, the company measured the in-kind

dividend at fair value using a binomial simulation model. The increase in fair value over the stated rate was

charged against additional paid-in capital and added to the Preferred Stock carrying value of the Preferred Stock

but provides no additional benefit to the Preferred Stock holders.

After the third anniversary of issuance the Preferred Stock is redeemable, in whole or in part, at the option of the

company, subject to the right of the holder to first convert the Preferred Stock the company proposes to redeem.

The redemption price is initially 107% of the liquidation preference amount and decreases by 1% each year until

13