Office Depot 2010 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2010 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

can be no assurance that our liquidity will not be adversely impacted by changes in the financial markets and the

global economy. In addition, deterioration in our financial results could negatively impact our credit ratings. The

tightening of the credit markets or a downgrade in our credit ratings could make it more difficult for us to access

funds, to refinance our existing indebtedness, to enter into agreements for new indebtedness or to obtain funding

through the issuance of securities.

MARKET SENSITIVE RISKS AND POSITIONS

The company has adopted an enterprise risk management process patterned after the principles set out by the

Committee of Sponsoring Organizations (COSO) in 2004. Management utilizes a common view of exposure

identification and risk management. A process is in place for periodic risk reviews and identification of

appropriate mitigation strategies.

We have market risk exposure related to interest rates, foreign currency exchange rates, and commodities.

Market risk is measured as the potential negative impact on earnings, cash flows or fair values resulting from a

hypothetical change in interest rates or foreign currency exchange rates over the next year. Interest rate changes

on obligations may result from external market factors, as well as changes in our credit rating. We manage our

exposure to market risks at the corporate level. The portfolio of interest-sensitive assets and liabilities is

monitored and adjusted to provide liquidity necessary to satisfy anticipated short-term needs. Our risk

management policies allow the use of specified financial instruments for hedging purposes only; speculation on

interest rates, foreign currency rates, or commodities is not permitted.

Interest Rate Risk

We are exposed to the impact of interest rate changes on cash, cash equivalents and debt obligations. The impact

on cash and short-term investments held at the end of 2010 from a hypothetical 10% decrease in interest rates

would be a decrease in interest income of less than $1 million.

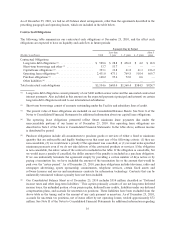

Market risk associated with our debt portfolio is summarized below:

2010 2009

(Dollars in thousands)

Carrying

Value

Fair

Value

Risk

Sensitivity

Carrying

Value

Fair

Value

Risk

Sensitivity

$400 million senior notes ......... $ 400,067 $ 398,000 $ 4,800 $ 400,172 $ 345,966 $ 5,420

Asset based credit facility ......... $ 52,488 $ 52,488 $ — $—$—$—

The risk sensitivity of fixed rate debt reflects the estimated increase in fair value from a 50 basis point decrease

in interest rates, calculated on a discounted cash flow basis. The sensitivity of variable rate debt reflects the

possible increase in interest expense during the next period from a 50 basis point change in interest rates

prevailing at year-end.

Foreign Exchange Rate Risk

We conduct business in various countries outside the United States where the functional currency of the country

is not the U.S. dollar. While our company sells directly or indirectly to customers in 53 countries, the principal

operations of our International Division are in countries with Euro, British Pound and Mexican Peso functional

currencies. We continue to assess our exposure to foreign currency fluctuation against the U.S. dollar. As of

December 25, 2010, a 10% change in the applicable foreign exchange rates would result in an increase or

decrease in our pretax earnings of approximately $18 million.

Although operations generally are conducted in the relevant local currency, we also are subject to foreign

exchange transaction exposure when our subsidiaries transact business in a currency other than their own

21