Nordstrom 1999 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 1999 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45NORDSTROM, INC. AND SUBSIDIARIES

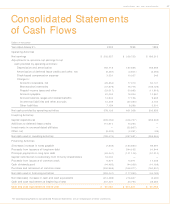

Note 13: Supplementary Cash Flow Information

Supplementary cash flow information includes the

following:

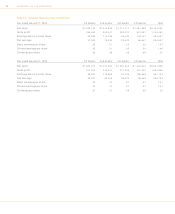

Year ended January 31 , 2000 1999 1998

Cash paid during

the year for:

Interest (net

of capitalized

interest) $ 54,195 $ 44,418 $ 35,351

Income taxes 129,566 126,157 126,606

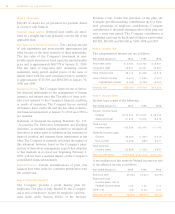

Note 14: Segment Reporting

The Company has three reportable segments which have

been identified based on differences in products and

services offered and regulatory conditions: the R etail

Stores, Credit Operations, and Catalog/ Internet seg-

ments. The R etail Stores segment derives its sales from

high-quality apparel, shoes and accessories for women,

men and children, sold through retail store locations. It

includes the Company’s Product Development Group

which coordinates the design and production of private

label merchandise sold in the Company’s retail stores.

Credit Operations segment revenues consist primarily of

finance charges earned through issuance of the Nordstrom

proprietary and VISA credit cards. The Catalog/ Internet

segment generates revenues from direct mail catalogs and

the NORD STRO M .com and N ORD STRO Mshoes.com Web sites.

The Company’s senior management utilizes various

measurements to assess segment performance and to

allocate resources to segments. The measurements used

to compute net earnings for reportable segments are

consistent with those used to compute net earnings for

the Company.

The accounting policies of the operating segments are

the same as those described in the summary of significant

accounting policies in Note 1. Corporate and Other

includes certain expenses and a portion of interest

expense which are not allocated to the operating seg-

ments. Intersegment revenues primarily consist of fees for

credit card services and are based on fees charged by third

party cards.

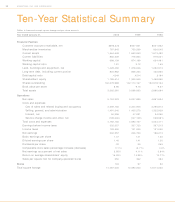

The following tables set forth the information for the Company’s reportable segments and a reconciliation to the

consolidated totals:

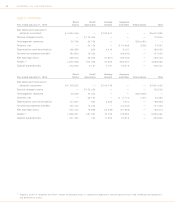

Retail Credit Catalog/ Corporate

Year ended January 31 , 2000 Stores Operations Internet and Other Eliminations Total

Net sales and revenues to

external customers $4,914,293 — $209,930 — — $5,124,223

Service charge income — $117,974 — — — 117,974

Intersegment revenues 20,285 25,963 — — $(46,248) —

Interest, net 728 26,933 (167) $ 22,902 — 50,396

Depreciation and amortization 170,765 1,424 6,313 15,216 — 193,718

Income tax expense (benefit) 191,790 19,450 — (81,740) — 129,500

Net earnings (loss) 300,009 30,417 (35,685) (92,184) — 202,557

Assets(a) 2,051,327 601,320 95,241 314,193 — 3,062,081

Capital expenditures 263,352 2,792 5,206 33,702 — 305,052

(a) Segment assets in Corporate and Other include unallocated assets in corporate headquarters, consisting primarily of land, buildings and equipment,

and deferred tax assets.