Nordstrom 1999 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 1999 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NORDSTROM, INC. AND SUBSIDIARIES

40

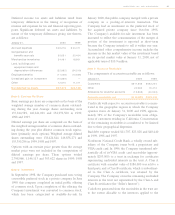

(Note 1 continued)

$10,189 of checks not yet presented for payment drawn

in excess of cash balances.

Deferred Lease Credits: Deferred lease credits are amor-

tized on a straight-line basis primarily over the life of the

applicable lease.

Fair Value of Financial Instruments: The carrying amount

of cash equivalents and notes payable approximates fair

value because of the short maturity of these instruments.

The fair value of the Company’s investment in mar-

ketable equity securities is based upon the quoted market

price and is approximately $60,778 at January 31, 2000.

The fair value of long-term debt (including current

maturities), using quoted market prices of the same or

similar issues with the same remaining term to maturity,

is approximately $715,500 and $894,000 at January 31,

2000 and 1999.

Derivatives Policy: The Company limits its use of deriva-

tive financial instruments to the management of foreign

currency and interest rate risks.The effect of these activ-

ities is not material to the Company’s financial condition

or results of operations. The Company has no material

off-balance sheet credit risk, and the fair value of deriva-

tive financial instruments at January 31, 2000 and 1999 is

not material.

Statement of Financial Accounting Standards No. 133,

“Accounting For Derivative Instruments and Hedging

Activities,” as amended, requires an entity to recognize all

derivatives as either assets or liabilities in the statement of

financial position and measure those instruments at fair

value.The Company is currently reviewing the impact of

this statement; however, based on the Company’s mini-

mal use of derivatives, management expects that adoption

of this standard, in its fiscal year beginning February 1,

2001, will not have a material impact on the Company’s

consolidated financial statements.

Reclassifications: Certain reclassifications of prior year

balances have been made for consistent presentation with

the current year.

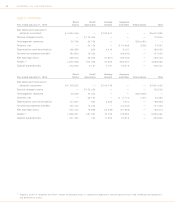

Note 2: Employee Benefits

The Company provides a profit sharing plan for

employees. The plan is fully funded by the Company

and is non-contributory except for employee contribu-

tions made under Section 401(k) of the Internal

R evenue Code. Under this provision of the plan, the

Company provides matching contributions up to a stipu-

lated percentage of employee contributions. Company

contributions to the profit sharing portion of the plan vest

over a seven-year period. The Company contribution is

established each year by the Board of Directors and totaled

$47,500, $50,000 and $45,000 in 1999, 1998 and 1997.

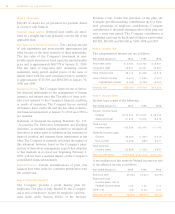

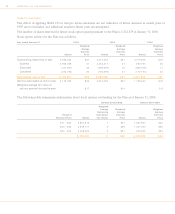

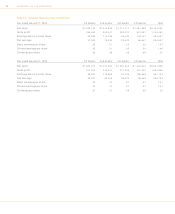

Note 3: Interest, Net

The components of interest, net are as follows:

Year ended January 31 , 2000 1999 1998

Short-term debt $ 2,584 $10,707 $ 10,931

Long-term debt 56,831 43,601 32,887

Total interest cost 59,415 54,308 43,818

Less: Interest income (3,521) (1,883) (1,221)

Capitalized interest (5,498) (5,334) (8,347)

Interest, net $50,396 $47,091 $3 4,250

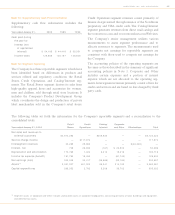

Note 4: Income Taxes

Income taxes consist of the following:

Year ended January 31 , 2000 1999 1998

Current income taxes:

Federal $130,524 $113,270 $ 98,464

State and local 21,835 19,672 18,679

Total current

income taxes 152,359 132,942 117,143

Deferred income taxes:

Current (18,367) (1,357) (4,614)

Non-current (4,492) (585) 8,471

Total deferred

income taxes (22,859) (1,942) 3,857

Total income taxes $129,500 $1 31,000 $121,000

A reconciliation of the statutory Federal income tax rate

to the effective tax rate is as follows:

Year ended January 31 , 2000 1999 1998

Statutory rate 35.00% 35.00% 35.00%

State and local

income taxes, net of

Federal income taxes 4.06 4.03 4.17

Other, net (.06) (0.24) 0.21

Effective tax rate 39.00% 38.79 % 39 .38%