Nordstrom 1999 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 1999 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41NORDSTROM, INC. AND SUBSIDIARIES

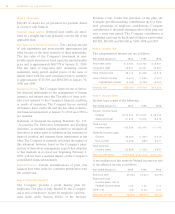

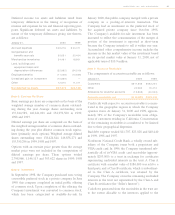

Deferred income tax assets and liabilities result from

temporary differences in the timing of recognition of

revenue and expenses for tax and financial reporting pur-

poses. Significant deferred tax assets and liabilities, by

nature of the temporary differences giving rise thereto,

are as follows:

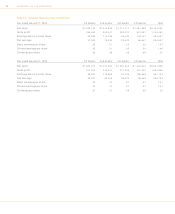

January 31, 2000 1999

Accrued expenses $ 29,276 $ 30,071

Compensation and

benefits accruals 35,651 30,404

Merchandise inventories 24,461 18,801

Land, buildings and

equipment basis and

depreciation differences (22,982) (34,519)

Employee benefits (11,008) (10,659)

Unrealized gain on investment (10,889) —

Other 12,570 11,011

Net deferred tax assets $57,079 $45,109

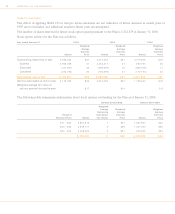

Note 5: Earnings Per Share

Basic earnings per share are computed on the basis of the

weighted average number of common shares outstand-

ing during the year. Average shares outstanding were

137,814,589, 146,241,091 and 154,972,560 in 1999,

1998 and 1997.

Diluted earnings per share are computed on the basis of

the weighted average number of common shares outstand-

ing during the year plus dilutive common stock equiva-

lents (primarily stock options). Weighted average diluted

shares outstanding were 138,424,844, 146,858,271 and

155,350,296 in 1999, 1998 and 1997.

Options with an exercise price greater than the average

market price were not included in the computation of

diluted earnings per share. These options totaled

2,798,966, 1,146,113 and 303,622 shares in 1999, 1998

and 1997.

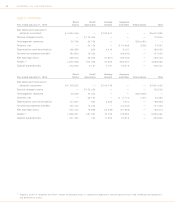

Note 6: Investment

In September 1998, the Company purchased non-voting

convertible preferred stock in a private company. In June

1999, this company completed an initial public offering

of common stock. Upon completion of the offering, the

Company’s investment was converted to common stock,

which has been categorized as available-for-sale. In

January 2000, this public company merged with a private

company in a pooling-of-interests transaction. The

Company had an investment in the preferred stock of

the acquired private company since O ctober 1998.

The Company’s available-for-sale investment has been

increased to reflect the consummation of the merger. A

portion of the investment is reported as short-term

because the Company intends to sell it within one year.

Accumulated other comprehensive income includes the

increase in the fair market value of the investment based

on its quoted market value at January 31, 2000, net of

applicable taxes of $10.9 million.

Note 7: Accounts Receivable

The components of accounts receivable are as follows:

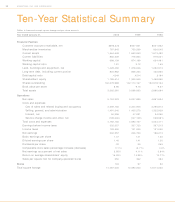

January 31, 2000 1999

Customers $611,858 $592,204

Other 20,969 19,474

Allowance for doubtful accounts (15,838) (24,543)

Accounts receivable, net $ 616,989 $5 87,135

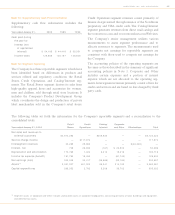

Credit risk with respect to accounts receivable is concen-

trated in the geographic regions in which the Company

operates stores. At January 31, 2000 and 1999, approxi-

mately 38% of the Company’s receivables were obliga-

tions of customers residing in California. Concentration

of the remaining receivables is considered to be limited

due to their geographical dispersion.

Bad debt expense totaled $11,707, $23,828 and $40,440

in 1999, 1998 and 1997.

Nordstrom National Credit Bank, a wholly owned sub-

sidiary of the Company, issues both a proprietary and

VISA credit card. In 1996, the Company transferred sub-

stantially all of its VISA credit card receivables (approxi-

mately $203,000) to a trust in exchange for certificates

representing undivided interests in the trust. A Class A

certificate with a market value of $186,600 was sold to a

third party, and a Class B certificate, which is subordinat-

ed to the Class A certificate, was retained by the

Company. The Company owns the remaining undivided

interests in the trust not represented by the Class A and

Class B certificates (the “Seller’s Interest”).

Cash flows generated from the receivables in the trust are,

to the extent allocable to the investors, applied to the