Nordstrom 1999 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 1999 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

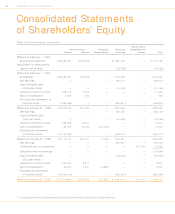

33NORDSTROM, INC. AND SUBSIDIARIES

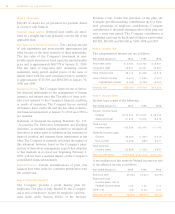

The Board of Directors has authorized an aggregate of

$1.1 billion of share repurchases since May 1995. As of

January 31, 2000, the Company had purchased approxi-

mately 35 million shares of its common stock for approx-

imately $931 million pursuant to these authorizations, and

had remaining share repurchase authority of $169 million.

Share repurchases have been financed, in part, through

additional borrowings, resulting in a planned increase in

the Company’s debt to capital (debt plus shareholders’

equity) ratio. At January 31, 2000, the Company’s debt to

capital ratio was .42.

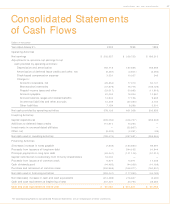

In March 1998, the Company issued $300 million of

6.95% Senior Debentures due in 2028. The proceeds

were used to repay commercial paper and current matu-

rities of long-term debt. In January 1999, the Company

issued $250 million of 5.625% Senior Notes due in 2009,

the proceeds of which were used to repay short-term

debt and for general corporate purposes. A substantial

portion of the Company’s total debt of $876 million at

January 31, 2000, finances the Company’s credit card

portfolio, which aggregated $612 million at that date.

Year 2000

The Company transitioned into the Year 2000 without

any material negative effects on its business, operations or

financial condition. The Company’s accumulative Year

2000 expenses, through January 31, 2000, were $17 mil-

lion. Approximately $4 million of expense was incurred

in 1999, $7 million in 1998 and $5 million in 1997.

Recent Accounting Pronouncements

In June 1998, the Financial Accounting Standards Board

issued Statement of Financial Accounting Standards

No. 133, “Accounting for Derivative Instruments and

Hedging Activities,” which will require an entity to

recognize all derivatives as either assets or liabilities in the

statement of financial position and measure those instru-

ments at fair value. Adoption of this standard, as amended

by the Company, beginning February 1, 2001, is not

expected to have a material impact on the Company’s

consolidated financial statements.

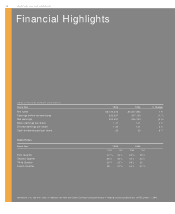

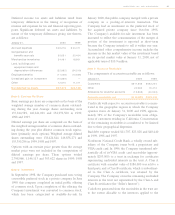

Southwest 32.7%

4,729,000

East Coast 25.3%

3,671,000

Northwest 19.1%

2,770,000

Central States 14 .4%

2,086,000

Rack 8.1%

1,174,000

Other 0.4%

57,000

Square Footage by Market

Segment at January 31 , 2000