Nordstrom 1999 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 1999 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

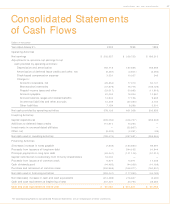

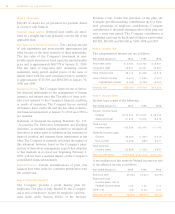

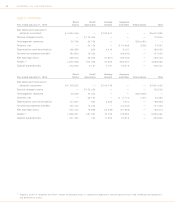

37NORDSTROM, INC. AND SUBSIDIARIES

Consolidated Statements

of Cash Flows

Dollars in thousands

Year ended January 31 , 2000 1999 1998

Operating Activities

Net earnings $ 202,557 $ 206,723 $ 186,213

Adjustments to reconcile net earnings to net

cash provided by operating activities:

Depreciation and amortization 193,718 180,655 158,969

Amortization of deferred lease credits and other, net (6,387) (3,501) (2,092)

Stock-based compensation expense 3,331 10,037 246

Change in:

Accounts receivable, net (29,854) 77,313 50,141

Merchandise inventories (47,576) 75,776 (106,126)

Prepaid income taxes and other (23,017) 30,983 (11,616)

Accounts payable 51,053 18,324 10,881

Accrued salaries, wages and related benefits 14,942 17,156 9,635

Income tax liabilities and other accruals 12,205 (20,454) 2,104

Other liabilities 7,154 8,296 2,301

Net cash provided by operating activities 378,126 601,308 300,656

Investing Activities

Capital expenditures (305,052) (306,737) (259,935)

Additions to deferred lease credits 114,910 74,264 —

Investments in unconsolidated affiliates — (32,857) —

Other, net (9,332) (2,251) (49)

Net cash used in investing activities (199,474) (267,581) (259,984)

Financing Activities

(Decrease) increase in notes payable (7,849) (184,984) 99,997

Proceeds from issuance of long-term debt — 544,165 91,644

Principal payments on long-term debt (63,341) (101,106) (51,210)

Capital contribution to subsidiary from minority shareholders 16,000 — —

Proceeds from issuance of common stock 9,577 14,971 17,406

Cash dividends paid (44,463) (44,059) (41,168)

Purchase and retirement of common stock (302,965) (346,077) (160,831)

Net cash used in financing activities (393,041) (117,090) (44,162)

Net (decrease) increase in cash and cash equivalents (214,389) 216,637 (3,490)

Cash and cash equivalents at beginning of year 241,431 24,794 28,284

Cash and cash equivalents at end of year $ 27,042 $ 241,431 $ 24,794

The accompanying Notes to Consolidated Financial Statements are an integral part of these statements.