Nordstrom 1999 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 1999 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s

Discussion and Analysis

NORDSTROM, INC. AND SUBSIDIARIES

30

The following discussion and analysis reviews the past

three years, as well as additional information on future

expectations and trends. Some of the information in this

annual report, including anticipated store openings,

planned capital expenditures and trends in company

operations, are forward-looking statements, which are

subject to risks and uncertainties. Actual future results

and trends may differ materially depending upon a vari-

ety of factors, including, but not limited to, the

Company’s ability to predict fashion trends, consumer

apparel buying patterns, the Company’s ability to control

costs and expenses, trends in personal bankruptcies and

bad debt write-offs, employee relations, adverse weather

conditions and other hazards of nature such as earth-

quakes and floods, the Company’s ability to continue its

expansion plans, and the impact of ongoing competitive

market factors. This discussion and analysis should be

read in conjunction with the basic consolidated financial

statements and the Ten-Year Statistical Summary.

Overview

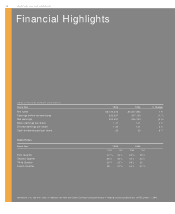

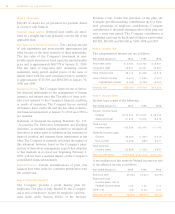

During 1999 (the fiscal year ended January 31, 2000),

Nordstrom, Inc. and its subsidiaries (collectively, the

“Company”) achieved record sales and an improvement

in gross margin.These improvements were offset by third

quarter 1999 charges of approximately $10 million (pre-

tax), primarily associated with the restructuring of the

Company’s information technology services area in order

to improve efficiency and effectiveness. The Company

also experienced substantially increased operating ex-

penses associated with the accelerated development of

N O RD STRO M .com and N O RD ST ROM shoes.com.

On November 1, 1999, the Company established a new

subsidiary, N O RD ST ROM .com, to promote the rapid expan-

sion of both its Internet commerce and catalog businesses.

The Company contributed the assets and certain liabili-

ties associated with its Internet commerce and catalog

businesses and $10 million in cash to the subsidiary.

Affiliates of Benchmark Capital and Madrona Investment

Group, collectively, contributed $16 million in cash to the

new entity. The Company owns approximately 81.4% of

N ORD ST ROM .com, with Benchmark Capital and Madrona

Investment Group holding the remaining interest.

The first major endeavor in November 1999 by

N ORD ST RO M .com was the launching of the Internet site

N ORD ST RO M shoes.com, which offers online access to mil-

lions of pairs of shoes.The launch was supported by a mul-

timedia national advertising campaign.

Also during 1999, the Company opened four new full-

line stores in Providence, R hode Island; Mission Viejo,

California; Columbia, Maryland; and Norfolk, Virginia.

The Company also opened three new Rack stores in

Sacramento, California; Brea, California; and Gaithersburg,

Maryland.